- +1-315-215-1633

- sales@thebrainyinsights.com

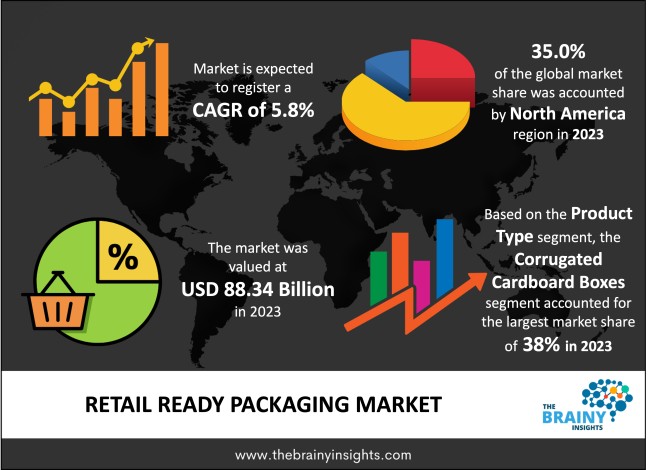

The global retail ready packaging market was valued at USD 88.34 billion in 2023 and is anticipated to grow at a CAGR of 5.8% from 2024 to 2033. The primary purpose of retail ready packaging (RRP) is to offer an efficient packaging solution that streamlines product distribution, improves brand recognition and facilitates the smooth transition of products from supply chains onto retail shelves. As consumer tastes change whilst competition becomes fiercer in the world of retailing, producers and store owners acknowledge how critical good packaging can be when it comes to influencing purchasing behaviors and boosting sales figures. RRP serves as a vital link between production lines and selling environments by encompassing several design elements customized for suppliers' requirements and retailers' needs.

Retail-ready packaging is a versatile solution that tackles the intricacies of contemporary retail logistics while accomplishing brands' marketing and promotional goals. Unlike conventional shipping containers or bulk packaging, RRP is designed to reduce handling time, increase shelf efficiency for optimal replenishment process flow, and lessen operational costs for retailers. This package format usually includes features like effortless opening mechanics, standardized measurement values, and eye-catching brand elements, ensuring swift recognition during restocking operations on store shelves.

Retail-ready packaging is distinguished by its capacity to heighten product visibility and brand recognition in a saturated retail market. By implementing intelligently designed features, such as striking graphics, lucid messaging regarding products and compelling displays that are easy on the eyes, brands can captivate customer attention while setting their merchandise apart from similar items across competing labels. Additionally, RRP presents prime marketing opportunities business enterprises may seize to convey advantages specific to their goods or service offerings.

Apart from its marketing and promotional roles, retail-ready packaging enhances supply chain efficiency and operational performance within the entire retail industry. RRP achieves this by implementing standardized packaging formats incorporating features like stickability, nesting, and easy handling. This leads to faster replenishment cycles, reducing stockouts while minimizing product damage during transit. These advantages provided by RRP across the supply chain process promote an excellent shopping experience for consumers, simultaneously empowering retailers to maximize sales potential while reducing waste levels throughout their operations.

Get an overview of this study by requesting a free sample

Consumer Convenience and Shopping Experience - The boost in the global retail ready packaging market can be attributed to the growing importance placed on consumer convenience and shopping experience. Modern-day shoppers prioritize ease and effectiveness when making purchases amidst speedy retail environments. Retail-ready packaging provides an array of characteristics that cater to these demands with its user-friendly opening mechanisms, compact configurations, and intuitive product showcases. By simplifying the buying process while elevating shelf display visibility, RRP solutions offer customers a more effortless and satisfying purchasing encounter, leading to increased sales potentiality and brand loyalty gains.

Cost Considerations – The primary obstacle to the widespread adoption of retail-ready packaging is its high cost, which poses a challenge for manufacturers and retailers. Although RRP formats present many benefits, such as improved product visibility on shelves, enhanced protection during transportation, and more streamlined logistics, significant expenses are associated with transitioning from traditional packaging methods to RRP solutions. These costs include redesigning packages themselves along with upgraded machinery. This aspect can be particularly difficult for smaller firms or those with limited resources than bigger competitors in well-established markets. The ongoing operational expenditures must also be considered - this includes sourcing specialized materials required by specific RRP types and maintaining the expensive equipment necessary for efficient production processes. These investments can further raise overall expenditure.

Technological Advancements and Smart Packaging Solutions - Innovations within the retail ready packaging market are fueled by technological advancements, resulting in the growth of smart packaging solutions offering additional features and functions. These include RFID tags, QR codes and near-field communication (NFC) technologies, which can be integrated into these solutions to provide real-time inventory tracking and product authentication presets while improving consumer interactions. These developments increase traceability and widen business information-gathering options to enhance marketing efforts or optimize supply chain visibility/traceability. The continued evolution of technology is expected to grow Smart Package usage across retail sectors globally - bringing increased sustainability whilst simultaneously bolstering operational efficiency and engagement strategies throughout the complete store experience ecosystem.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region emerged as the most prominent global retail ready packaging market, with a 37.0% market revenue share in 2023. The global retail ready packaging market sees North America as a dominant region due to its strong retail infrastructure, advanced packaging technologies and evolving consumer preferences. The United States and Canada feature mature markets with highly consolidated retail sectors, well-established supply chain networks and a significant focus on branding/presentation, contributing to this dominance. An increasing number of these retailers/CPG manufacturers in the region are adopting RRP solutions for better shelf visibility, greater operational efficiency, and increased sales within competitive environments. Major retailers in the United States, like Walmart, have quickly adopted RRP formats. These packaging solutions assist with maximizing shelf space utilization, minimizing labor costs and ultimately improving consumers' shopping experiences. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

North America Region Retail Ready Packaging Market Share in 2023 - 35.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The material type segment includes plastic, paper & paperboard and others. The paper & paperboard segment dominated, with a market share of around 45% in 2023. The global retail-ready packaging market benefits greatly from paper and paperboard materials that provide sustainable, recyclable, and renewable packaging solutions that cater to environmentally-conscious consumers and retailers. Multiple substrates are paper-based RRP formats such as kraft paper, corrugated board, folding cartons, or solid bleached sulfate (SBS) board– each with distinct features for varied retail sectors. The adaptability of these options makes them popular due to their printability and malleability while remaining biodegradable, being perfect for brand promotion needs and customization initiatives in an eco-friendly manner.

The product type segment includes die cut display containers, corrugated cardboard boxes, shrink-wrapped trays, folding cartons and others. The corrugated cardboard boxes segment dominated, with a market share of around 38% in 2023. Corrugated cardboard boxes are widely used in the global RRP market for their durability, versatility, and cost-effectiveness. These boxes are constructed from layers of fluted corrugated board sandwiched between liner board sheets, providing strength, cushioning, and protection for packaged goods during transportation and storage. Corrugated cardboard boxes come in various styles, such as regular slotted containers (RSC), half-slotted containers (HSC), and full-overlap containers (FOL), each offering specific advantages and applications within the retail supply chain.

The application segment is bifurcated into food & beverage, pharmaceuticals, electronics, personal care & cosmetics and others. The food & beverage segment dominated, with a market share of around 48% in 2023. Due to the substantial quantities of packaged goods and diverse packaging formats necessary for meeting consumer preferences, along with regulatory requirements, the food and beverage industry ranks among the top contributors to the global RRP market. The role played by RRP solutions in this sector is critical as they offer effective packaging options that enhance product visibility while extending shelf life and simultaneously ensuring optimal safety standards. RRP solutions are extensively employed within the food and beverage industry for several products, including dairy goods, fresh produce, snacks, convenience foods, and beverages. Retailers and manufacturers rely on RRP formats like shrink-wrapped multipack corrugated display trays and folding cartons to enhance shelf space optimization processes and streamline replenishment operations while creating visually appealing displays that entice impulse purchases. Furthermore, these solutions present numerous benefits, such as tamper-evident seal barrier properties plus portion control, making them perfect for preserving freshness, preventing contamination, and complying with stringent food safety regulations.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 88.34 Billion |

| Market size value in 2033 | USD 155.25 Billion |

| CAGR (2024 to 2033) | 5.8% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Material Type, Product Type, Application |

As per The Brainy Insights, the size of the global retail ready packaging market was valued at 88.34 billion in 2023 to USD 155.25 billion by 2033.

The global retail ready packaging market is growing at a CAGR of 5.8% during the forecast period 2024-2033.

North America region became the largest market for retail ready packaging.

The rising demand for retail ready packaging across end-user vertical is driving the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global retail ready packaging market based on below-mentioned segments:

Global Retail Ready Packaging Market by Material Type:

Global Retail Ready Packaging Market by Product Type:

Global Retail Ready Packaging Market by End-user:

Global Retail Ready Packaging Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date