- +1-315-215-1633

- sales@thebrainyinsights.com

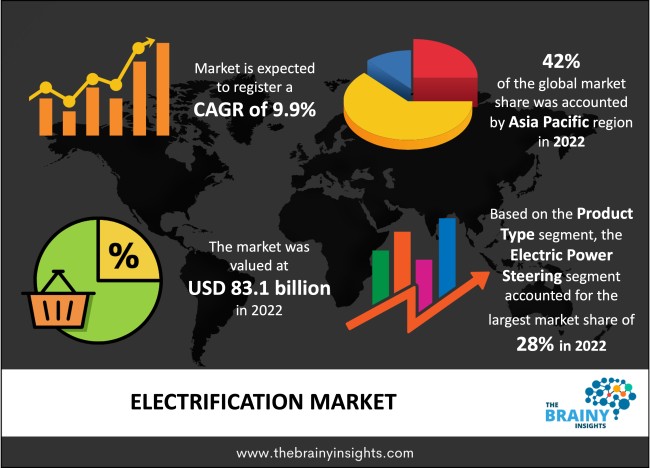

The global electrification market is expected to reach USD 213.5 billion by 2032, at a CAGR of 9.9% during the forecast period 2023 to 2032. North America is expected to grow the fastest during the forecast period.

The process of using electricity to power a vehicle and replace components that use a conventional energy source is known as vehicle electrification. It offers electronic power-assisted steering through an electric motor, auxiliary systems such as on-board and off-board charging systems, and wireless power transfer. It also has electronic stability control, an intelligent light system, traction control, all-wheel drive, innovative electromagnetic suspension, and an airbag deployment system. As a result, it is widely used in distribution, field services, and long-distance transportation worldwide. Electric vehicles (EVs) are becoming increasingly popular around the world. This, along with the increasing automotive market, is one of the primary drivers. Furthermore, there is a growing need to replace traditional hydraulic and mechanical systems. This, combined with rising environmental concerns among individuals as a result of rising CO2 emissions (CO2), is catalyzing demand for vehicle electrification. Furthermore, there is a strong emphasis on weight reduction in automotive components to reduce fuel consumption and improve vehicle operational efficiency. This, together with government measures in numerous countries to promote the adoption of fuel-efficient automobiles, is driving demand for vehicle electrification.

Get an overview of this study by requesting a free sample

Rising Automotive Industry- The rising automobile industry drive the electrification market. On the other hand, increased demand for cost-effective solutions and the expanding trend of electrification of commercial vehicles and fleets are likely to give profitable prospects for global electrification market advancement over the forecast period. The growing emphasis on products has resulted in considerable demand for automotive electrification and associated infrastructure in recent years. The expansion of charging stations, in conjunction with government financial incentives, is emerging as a significant factor driving demand for electric vehicles. Because electric vehicles have lower operating costs than conventional ICE-powered automobiles, the electrification market is expected to grow.

High Cost- Electric vehicles are not practicable in cities with insufficient power. Electric car batteries have a relatively short battery backup duration. These electric car restrictions are expected to stymie the electrification market. However, the replacement and maintenance expenses of vehicle electrification are significant. On the other hand, rising fuel prices and growing environmental concerns are projected to support the expansion of the electrification market over the forecast period.

Rising Public Transportation- Buses and trucks are used worldwide for public transport and logistics. In Europe and Asia-Pacific, public transportation outnumbers private transportation. On the other hand, private automobiles are the dominant form of transportation in North America. The growing population in metropolitan regions drives the need for public transportation, where existing transportation infrastructure needs to be improved. Each OEM promotes using electric vehicles to reduce the global carbon footprint as the trend towards mobility-on-demand rises, taxis and passenger cars focus more on greener technologies. The majority of attempts to electrify vehicles are focused on passenger cars.

Power-to-weight ratio Problem- The power-to-weight ratio is extensively utilized for engines and power sources to assist vehicle comparisons. A vehicle's kW/kg weight ratio is easily calculated by dividing its kW output by kilo weight. The lighter the vehicle, the more power, efficiency, and range it has. Advanced, lightweight components and materials are required to achieve the highest power-to-weight ratio. OEMs and Tier I companies are working hard to improve the power-to-weight ratio by combining lightweight materials and novel products like e-CVT and e-axles. However, they are still in the early phases of development.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia-Pacific emerged as the most significant global electrification market, with a 42% market revenue share in 2022.

Asia-Pacific dominates the electrification market with a 42% market revenue share in 2022. The government's attempts to encourage electric vehicles and provide subsidies for sales are fuelling demand in this region. The rising population in the countries, together with rising per capita income, drives demand for personal transportation automobiles that are environmentally friendly.

North America is expected to witness the fastest growth during the forecast period. The expansion of charging infrastructure and significant investments by OEMs in the development of vehicle electrification are driving this region's growth. Federal tax credits and rebate incentives have expedited the expansion of the car electrification sector, particularly in the United States. For example, General Motors, a prominent American carmaker, unveiled intentions in 2021 to produce electric autos suited for personal use in the coming years. The company intends to release 30 electrified vehicles worldwide by 2025, with around two-thirds available in North America. The market's lucrative nature is expected to entice more traditional car makers to enter the product market, driving the expansion of the electrification market.

Asia Pacific Region Electrification Market Share in 2022 - 42%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into starter motor, electric oil pump, electric fuel pump, alternator, electric car motors, electric vacuum pump, electric water pump, actuators, electric power steering, and start/stop system. The electric power steering segment dominated the market, with a market share of around 28% in 2022. The EPS sector has a higher preference among end-users than other steering methods. It has various advantages, including energy savings, fewer mechanical difficulties, and the possibility to customize a more straightforward interface. Because EPS is smaller and lighter than HPS, it is a more energy-efficient vehicle alternative. The need for more dependability in hydraulic power steering aids the market's expansion.

The vehicle type segment is divided into internal combustion engine vehicles, plug-in hybrid electric vehicles (PHEV), micro & full hybrid vehicles, and battery electric vehicles (BEVs). The plug-in hybrid electric vehicle (PHEV) segment dominated the market, with a share of around 42% in 2022. Collaborations between corporate and public sector organizations to construct smart cities across the country and expand charging infrastructure are projected to drive up demand for plug-in hybrid electric vehicles. Furthermore, plug-in hybrid electric vehicles have grown significantly in technologically advanced countries. Government agencies worldwide are encouraging integrated electrification systems for all types of transport vehicles, such as freight delivery vehicles, public transportation, and 2-wheelers, to minimize reliance on fossil fuels. All of these elements contribute to the market's expansion.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2022 | USD 83.1 billion |

| Market size value in 2032 | USD 213.5 billion |

| CAGR (2023 to 2032) | 9.9% |

| Historical data | 2019-2021 |

| Base Year | 2022 |

| Forecast | 2023-2032 |

| Regional Segments | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Segments | Product Type, Vehicle Type |

As per The Brainy Insights, the size of the electrification market was valued at USD 83.1 billion in 2022 to USD 213.5 billion by 2032.

The global electrification market is growing at a CAGR of 9.9% during the forecast period 2023-2032.

Asia-Pacific emerged as the largest electrification market.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis by Product Type

4.3.2. Market Attractiveness Analysis by Vehicle Type

4.3.3. Market Attractiveness Analysis by Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Rising Automotive Industry

5.3. Restraints

5.3.1. High Cost

5.4. Opportunities

5.4.1. Rising Public Transportation

5.5. Challenges

5.5.1. Power-to-weight ratio Problem

6. Global Electrification Market Analysis and Forecast, By Product Type

6.1. Segment Overview

6.2. Starter Motor

6.3. Electric Oil Pump

6.4. Electric Fuel Pump

6.5. Alternator

6.6. Electric Car Motors

6.7. Electric Vacuum Pump

6.8. Electric Water Pump

6.9. Actuators

6.10. Electric Power Steering

6.11. Start/Stop System

7. Global Electrification Market Analysis and Forecast, By Vehicle Type

7.1. Segment Overview

7.2. Internal Combustion Engine Vehicle

7.3. Plug-in Hybrid Electric Vehicle (PHEV)

7.4. Micro & Full Hybrid Vehicle

7.5. Battery Electric Vehicle (BEV)

8. Global Electrification Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Electrification Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in Global Electrification Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. AISIN SEIKI Co., Ltd.

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. CONTINENTAL AG

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. Delphi Technologies

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. Hitachi Automotive Systems, Ltd

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. Robert Bosch GmbH

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. FRIEDRICHSHAFEN AG

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. Denso Corporation

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. BorgWarner Inc

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. Magna International Inc

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

10.10. Johnson Electric Holdings Limited

10.10.1. Business Overview

10.10.2. Company Snapshot

10.10.3. Company Market Share Analysis

10.10.4. Company Product Portfolio

10.10.5. Recent Developments

10.10.6. SWOT Analysis

List of Table

1. Global Electrification Market, By Product Type, 2019-2032 (USD Billion)

2. Global Starter Motor, Electrification Market, By Region, 2019-2032 (USD Billion)

3. Global Electric Oil Pump, Electrification Market, By Region, 2019-2032 (USD Billion)

4. Global Electric Fuel Pump, Electrification Market, By Region, 2019-2032 (USD Billion)

5. Global Alternator, Electrification Market, By Region, 2019-2032 (USD Billion)

6. Global Electric Car Motors, Electrification Market, By Region, 2019-2032 (USD Billion)

7. Global Electric Vacuum Pump, Electrification Market, By Region, 2019-2032 (USD Billion)

8. Global Electric Water Pump, Electrification Market, By Region, 2019-2032 (USD Billion)

9. Global Actuators, Electrification Market, By Region, 2019-2032 (USD Billion)

10. Global Electric Power Steering, Electrification Market, By Region, 2019-2032 (USD Billion)

11. Global Start/Stop System, Electrification Market, By Region, 2019-2032 (USD Billion)

12. Global Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

13. Global Internal Combustion Engine Vehicle, Electrification Market, By Region, 2019-2032 (USD Billion)

14. Global Plug-in Hybrid Electric Vehicle (PHEV), Electrification Market, By Region, 2019-2032 (USD Billion)

15. Global Micro & Full Hybrid Vehicle, Electrification Market, By Region, 2019-2032 (USD Billion)

16. Global Battery Electric Vehicle (BEV), Electrification Market, By Region, 2019-2032 (USD Billion)

17. North America Electrification Market, By Product Type, 2019-2032 (USD Billion)

18. North America Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

19. U.S. Electrification Market, By Product Type, 2019-2032 (USD Billion)

20. U.S. Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

21. Canada Electrification Market, By Product Type, 2019-2032 (USD Billion)

22. Canada Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

23. Mexico Electrification Market, By Product Type, 2019-2032 (USD Billion)

24. Mexico Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

25. Europe Electrification Market, By Product Type, 2019-2032 (USD Billion)

26. Europe Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

27. Germany Electrification Market, By Product Type, 2019-2032 (USD Billion)

28. Germany Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

29. France Electrification Market, By Product Type, 2019-2032 (USD Billion)

30. France Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

31. U.K. Electrification Market, By Product Type, 2019-2032 (USD Billion)

32. U.K. Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

33. Italy Electrification Market, By Product Type, 2019-2032 (USD Billion)

34. Italy Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

35. Spain Electrification Market, By Product Type, 2019-2032 (USD Billion)

36. Spain Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

37. Asia Pacific Electrification Market, By Product Type, 2019-2032 (USD Billion)

38. Asia Pacific Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

39. Japan Electrification Market, By Product Type, 2019-2032 (USD Billion)

40. Japan Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

41. China Electrification Market, By Product Type, 2019-2032 (USD Billion)

42. China Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

43. India Electrification Market, By Product Type, 2019-2032 (USD Billion)

44. India Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

45. South America Electrification Market, By Product Type, 2019-2032 (USD Billion)

46. South America Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

47. Brazil Electrification Market, By Product Type, 2019-2032 (USD Billion)

48. Brazil Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

49. Middle East and Africa Electrification Market, By Product Type, 2019-2032 (USD Billion)

50. Middle East and Africa Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

51. UAE Electrification Market, By Product Type, 2019-2032 (USD Billion)

52. UAE Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

53. South Africa Electrification Market, By Product Type, 2019-2032 (USD Billion)

54. South Africa Electrification Market, By Vehicle Type, 2019-2032 (USD Billion)

List of Figures

1. Global Electrification Market Segmentation

2. Global Electrification Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Electrification Market Attractiveness Analysis by Product Type

9. Global Electrification Market Attractiveness Analysis by Vehicle Type

10. Global Electrification Market Attractiveness Analysis by Region

11. Global Electrification Market: Dynamics

12. Global Electrification Market Share by Product Type (2023 & 2032)

13. Global Electrification Market Share by Vehicle Type (2023 & 2032)

14. Global Electrification Market Share by Regions (2023 & 2032)

15. Global Electrification Market Share by Company (2022)

This study forecasts global, regional, and country revenue from 2019 to 2032. The Brainy Insights has segmented the global electrification market based on the below-mentioned segments:

Global Electrification Market By Product Type:

Global Electrification Market By Vehicle Type:

Global Electrification Market By Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date