- +1-315-215-1633

- sales@thebrainyinsights.com

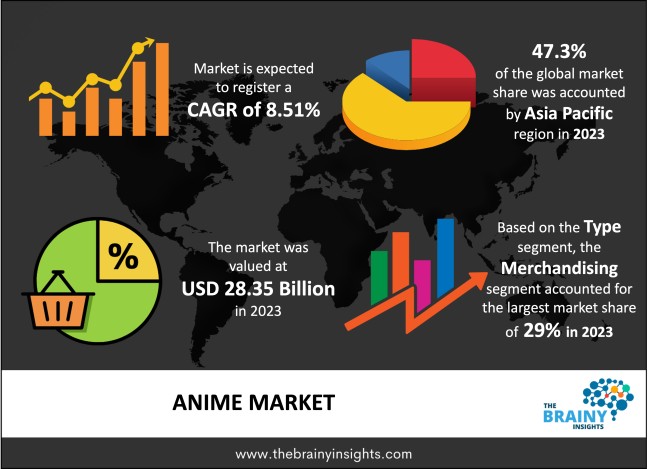

The global anime market is expected to grow from USD 28.35 billion in 2023 to USD 50.22 billion by 2033, at a CAGR of 8.51% during the forecast period 2022-2030. The Asia Pacific region will dominate the global anime market in 2023 with a market share of 47.3%. Anime is created through hand-drawn images and digital animations, renowned for their roots in Japan. Once it achieved remarkable success within its birthplace, anime quickly caught on in other markets. In the context of this rapid popularity gain, a surge of investments in technological advancements helped fuel the industry's growth exponentially. The wide-ranging involvement encompassing production companies alongside numerous talented creators and artists enabled outstanding global expansion; every release positively impacted the market with a distinguishable effect, subsequently generating significant growth opportunities in the upcoming years.

Anime is a form of animation used to define animation originating from Japan. The cultural distinction in portraying characters in the way they look and act resembles Japanese society, and culture becomes the defining feature of anime. Anime is the animation of everything and anything with the necessary characteristic of it originating from Japan. The origin of anime can be traced back 100 years. There is no difference in the technicalities of creating cartoons or anime. For instance, tom & jerry is a cartoon, whereas Pokemon is anime, even though they may have used the same software to create the shows. Therefore, it is said that all anime is a cartoon, but not all cartoons are anime. Anime is also defined by the features of characters like big endearing eyes or small noses etc. Bright lighting and sharp angles with swift camera movements add to the thrill of watching anime and is also defining feature of this animation. Anime is used as a tool to portray stories from all walks of life, be it supernatural, sci-fi, thriller or non-fiction. Anime has been popular in Japan; however, it held global attention after the popularity of Pokemon and Dragon Ball Z. anime was created for children and adults. Animation artists are exploring new storylines and digital technologies to expand the anime market. The advancement in technologies and software has enabled animation artists to improve characters' appearance, motion and aesthetics. However, generating a final anime show or movie still takes a long and arduous process. Artificial intelligence, machine learning, and augmented reality improve the anime market by making creation faster and easier. Fullmetal Alchemist Brotherhood, Steins; Gate, Clannad After Story, Your Name, and Code Geass: Lelouch of the Rebellion R2 are some of the most popular anime T.V. shows in the market.

Get an overview of this study by requesting a free sample

October 2022 - The second Atsumaru (come together in Japanese) Euphoria experiential festival debuted on October 29 at The Hub Bengaluru. Atsumaru Euphoria, a day-long festival run by I Know A Guy Productions (IKAG), is a celebration of all things anime, manga, Japanese pop culture, cosplay, and the best of Bangalore through music, food, gaming, merchandise, and other fun activities. The world's first metaverse-as-a-service (MaaS) platform, Metapolis, has joined as a technology partner. It offers various meta-services to simplify web2 companies, creators, and web3 initiatives to onboard into the metaverse. The fan base and niche communities are a ripple effect by making more people interested in Japanese culture.

October 2022 – By acquiring the Scottish company Anime Ltd., German distributor Plaion Pictures hopes to strengthen its position in the lucrative Japanese animation industry. The Munich-based Plaion, formerly Koch Films, has acquired all of the stock in Anime Ltd. Anime Ltd, a Glasgow-based company with headquarters in France, recently agreed to a contract with ITV to supply Cowboy Bebop episodes for the U.K. pubcaster's impending digital streaming service, ITVX. The action is a component of Plaion's plan to invest in the market for anime material, which has seen tremendous growth in recent years.

The growing popularity of anime – The increasing ownership of smart connected devices, given the growing affordability and accessibility to smartphones and internet services is one of the significant contributing factors driving anime consumption globally. Globalization in modern times has taken Japanese anime to the international market, contributing to its popularity. The globalization of Japanese animation is also spearheaded by digital streamers like Netflix and amazon prime partnering with Japanese animation studios, thereby driving the global anime market. The unique and distinctive features of anime that endear to the audience are different from western animation or cartoons, making them highly popular in the western world. The growing animation studios with technological advancements to produce more content to meet the rising market demand has also pushed the popularity of anime in the right direction. Creating customized content for the local geographical audience has facilitated the anime market's development. The growing fascination of millennials with anime, given the unique aesthetic and storytelling across genres, has garnered extensive attention to the anime market worldwide. Furthermore, the rising creation of anime content in various markets to exploit the lucrative anime industry has led to the market’s development in the 21st century.

Lack of anime artists – Despite technological advancements, anime creation includes multiple stages, from writing and storyboarding to animation and sound design. The numerous steps are time-consuming. The long working hours of anime artists, designers, programmers and creators are not justified by the kind of remuneration they receive. Given the long hours and low income, budding anime artists are discouraged from pursuing this career. With the ever-increasing animation market and the lack of anime artists and skilled animators, the market is likely to witness limited growth.

Integrating new technologies – The advent of industrialization 4.0 is defined by artificial intelligence, augmented reality, big data, internet-of-things and machine learning in every sphere of the economy. Integrating artificial intelligence and other technologies to create better animation with a faster process will facilitate exponential market growth in the forecast period. The use of new technologies by animation studios can offer lucrative opportunities to them by saving a significant amount of time and effort. Artificial intelligence can also help better the graphics and motion or angles of anime shows, furthering the global anime market.

Unlicensed streaming of anime shows is a widespread practice in the anime market when anime creators live stream their creations. The streaming of anime shows on digital streaming platforms is also popular. The live streaming and digital streaming platforms are licensed streamers partnered with the creators and are paid their due. However, streaming these shows via unlicensed media causes a loss of money to the creators and licensed streamers. The lack of regulations that crack down on the unlicensed streaming of anime also adds to the problem. Therefore, unlicensed anime show steaming will challenge the market's growth.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region emerged as the largest market for the global anime market, with a 47.3% market revenue share in 2023. The dominance of Asia Pacific can be attributed to the vast anime market of Japan. The origin of anime is Japan. Anime in the Japanese market carries historical significance. Japan is the largest anime production base in the whole world. The dominance of Japan is the primary reason for the large market share of Asia Pacific in the global anime market. Japan has a well-established anime market with hundreds of animation studios. Japan is also home to several anime artists modernizing the art to expand the market beyond its shores. Japan is also the highest consumer market as the consumption of anime content is driven by the popularity of Japanese-origin comic books. The increasing consumption of anime in the Indian and Korean markets has encouraged young artists and studios to build their anime, propelling the market's future growth. The increasing internet penetration with the growing ownership of smart connected devices in the Asia Pacific market is attributed to the skyrocketing popularity of anime. China is developing its anime to counter the Japanese influence and power in the market. Increased investments in developing animation studios and opportunities for budding anime artists in the Chinese market will bode well for the region's development. The competition between China and Japan to increase their market share will enhance the quality and quantity of anime content in the region, thereby contributing to its growth. The partnership of animation studios with OTT streamlining platforms will offer lucrative opportunities for the market players to expand their consumer base and develop in the global market.

Asia Pacific region Anime Market Share in 2023 - 47.3%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into television, movie, internet distribution, video, merchandising, music, pachinko, live entertainment, and others. The merchandising segment dominated the market with a revenue share of around 29% in 2023. Merchandising includes the sales of anime-based clothing, accessories and other items in retail stores. The growing popularity of anime in the western world is translated to the increasing demand for anime merchandise fans like to collect as a hobby, passion, or dedication towards a show. Creative merchandise in the form of t-shirts, cups, key chains, small figurines or other regular items used by consumers has gained popularity in the global market. The battles in the anime movies and shows also lead to the formation of groups supporting each character and showing this support by buying and owning merchandise based on these characters. The growing presence of retail outlets selling anime merchandise is also aiding in the segment's growth. The merchandise is often presented as affordable retail items or expensive collectables, which offer significant revenue streams for anime creators. The growing presence of anime merchandise on online sales channels or e-commerce is also expected to facilitate the growth of the segment.

The genre segment is divided into action & adventure, sci-fi & fantasy, romance & drama, sports, and others. The action & adventure segment dominated the market with a revenue share of around 36% in 2023. Anime belonging to the Action & Adventure genre has a substantial market share of consumers across the globe. This popularity can be attributed to their captivating plots, action-packed battle scenes, and multi-layered character-building. This anime genre usually revolves around heroes setting out on extraordinary quests where they confront daunting opponents and surmount great obstacles. The genre's ability offers excitement with an intriguing storyline, making it attractive to niche and mass audiences. The likes of "Naruto," "One Piece," "Death Note," and "Attack on Titan" have gained worldwide attention and boosted the genre's considerable market share. Apart from engaging audiences with their intricate storylines and well-crafted action scenes, these series generate significant income through merchandise sales, video games, and theatrical releases.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 28.35 Billion |

| Market size value in 2033 | USD 64.17 Billion |

| CAGR (2024 to 2033) | 8.51% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions examined for the market are Europe, Asia Pacific, North America, South America, and Middle East & Africa. |

| Segments | The research segment is based on type and genre. |

As per The Brainy Insights, the size of the anime market was valued at USD 28.35 billion in 2023 to USD 64.17 billion by 2033.

Global anime market is growing at a CAGR of 8.51% during the forecast period 2024-2033.

The market's growth will be influenced by the growing popularity of anime.

Lack of anime artists could hamper the market growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Type

4.3.2. Market Attractiveness Analysis By Genre

4.3.3. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. The growing popularity of anime

5.3. Restraints

5.3.1. Lack of anime artists

5.4. Opportunities

5.4.1. Integrating new technologies

5.5. Challenges

5.5.1. Unlicensed streaming of anime shows

6. Global Anime Market Analysis and Forecast, By Type

6.1. Segment Overview

6.2. Television

6.3. Movie

6.4. Internet Distribution

6.5. Video

6.6. Merchandising

6.7. Music

6.8. Pachinko

6.9. Live Entertainment

6.10. Others

7. Global Anime Market Analysis and Forecast, By Genre

7.1. Segment Overview

7.2. Action & Adventure

7.3. Sci-Fi & Fantasy

7.4. Romance & Drama

7.5. Sports

7.6. Others

8. Global Anime Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Anime Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in the Anime Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. STUDIO DURGA

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. Production I.G, Inc.

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. Pierrot Co., Ltd.

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. Toei Animation Co., Ltd.

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. Studio Ghibli, Inc.

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. Pierrot Co. Ltd.

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. Sunrise, Inc. (Bandai Namco Filmworks)

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. Kyoto Animation Co., Ltd.

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. Bones Inc.

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

10.10. Ufotable Co., Ltd.

10.10.1. Business Overview

10.10.2. Company Snapshot

10.10.3. Company Market Share Analysis

10.10.4. Company Component Portfolio

10.10.5. Recent Developments

10.10.6. SWOT Analysis

10.11. Ufotable Co., Ltd.

10.11.1. Business Overview

10.11.2. Company Snapshot

10.11.3. Company Market Share Analysis

10.11.4. Company Component Portfolio

10.11.5. Recent Developments

10.11.6. SWOT Analysis

10.12. MADHOUSE, Inc.

10.12.1. Business Overview

10.12.2. Company Snapshot

10.12.3. Company Market Share Analysis

10.12.4. Company Component Portfolio

10.12.5. Recent Developments

10.12.6. SWOT Analysis

10.13. Progressive Animation Works Co., Ltd. (PA Works)

10.13.1. Business Overview

10.13.2. Company Snapshot

10.13.3. Company Market Share Analysis

10.13.4. Company Component Portfolio

10.13.5. Recent Developments

10.13.6. SWOT Analysis

10.14. Good Smile Company, Inc.

10.14.1. Business Overview

10.14.2. Company Snapshot

10.14.3. Company Market Share Analysis

10.14.4. Company Component Portfolio

10.14.5. Recent Developments

10.14.6. SWOT Analysis

10.15. VIZ Media, LLC

10.15.1. Business Overview

10.15.2. Company Snapshot

10.15.3. Company Market Share Analysis

10.15.4. Company Component Portfolio

10.15.5. Recent Developments

10.15.6. SWOT Analysis

10.16. Sentai Holdings, LLC (AMC Networks)

10.16.1. Business Overview

10.16.2. Company Snapshot

10.16.3. Company Market Share Analysis

10.16.4. Company Component Portfolio

10.16.5. Recent Developments

10.16.6. SWOT Analysis

10.17. Atomic Flare

10.17.1. Business Overview

10.17.2. Company Snapshot

10.17.3. Company Market Share Analysis

10.17.4. Company Component Portfolio

10.17.5. Recent Developments

10.17.6. SWOT Analysis

List of Table

1. Global Anime Market, By Type, 2020-2033 (USD Billion)

2. Global Television Anime Market, By Region, 2020-2033 (USD Billion)

3. Global Movie Anime Market, By Region, 2020-2033 (USD Billion)

4. Global Internet Distribution Anime Market, By Region, 2020-2033 (USD Billion)

5. Global Video Anime Market, By Region, 2020-2033 (USD Billion)

6. Global Merchandising Anime Market, By Region, 2020-2033 (USD Billion)

7. Global Music Anime Market, By Region, 2020-2033 (USD Billion)

8. Global Pachinko Anime Market, By Region, 2020-2033 (USD Billion)

9. Global Live Entertainment Anime Market, By Region, 2020-2033 (USD Billion)

10. Global Others Anime Market, By Region, 2020-2033 (USD Billion)

11. Global Anime Market, By Genre, 2020-2033 (USD Billion)

12. Global Action & Adventure Anime Market, By Region, 2020-2033 (USD Billion)

13. Global Sports Anime Market, By Region, 2020-2033 (USD Billion)

14. Global Sci-Fi & Fantasy Anime Market, By Region, 2020-2033 (USD Billion)

15. Global Romance Anime Market, By Region, 2020-2033 (USD Billion)

16. Global Others Anime Market, By Region, 2020-2033 (USD Billion)

17. Global Anime Market, By Region, 2020-2033 (USD Billion)

18. North America Anime Market, By Type, 2020-2033 (USD Billion)

19. North America Anime Market, By Genre, 2020-2033 (USD Billion)

20. U.S. Anime Market, By Type, 2020-2033 (USD Billion)

21. U.S. Anime Market, By Genre, 2020-2033 (USD Billion)

22. Canada Anime Market, By Type, 2020-2033 (USD Billion)

23. Canada Anime Market, By Genre, 2020-2033 (USD Billion)

24. Mexico Anime Market, By Type, 2020-2033 (USD Billion)

25. Mexico Anime Market, By Genre, 2020-2033 (USD Billion)

26. Europe Anime Market, By Type, 2020-2033 (USD Billion)

27. Europe Anime Market, By Genre, 2020-2033 (USD Billion)

28. Germany Anime Market, By Type, 2020-2033 (USD Billion)

29. Germany Anime Market, By Genre, 2020-2033 (USD Billion)

30. France Anime Market, By Type, 2020-2033 (USD Billion)

31. France Anime Market, By Genre, 2020-2033 (USD Billion)

32. U.K. Anime Market, By Type, 2020-2033 (USD Billion)

33. UK Anime Market, By Genre, 2020-2033 (USD Billion)

34. Italy Anime Market, By Type, 2020-2033 (USD Billion)

35. Italy Anime Market, By Genre, 2020-2033 (USD Billion)

36. Spain Anime Market, By Type, 2020-2033 (USD Billion)

37. Spain Anime Market, By Genre, 2020-2033 (USD Billion)

38. Asia Pacific Anime Market, By Type, 2020-2033 (USD Billion)

39. Asia Pacific Anime Market, By Genre, 2020-2033 (USD Billion)

40. Japan Anime Market, By Type, 2020-2033 (USD Billion)

41. Japan Anime Market, By Genre, 2020-2033 (USD Billion)

42. China Anime Market, By Type, 2020-2033 (USD Billion)

43. China Anime Market, By Genre, 2020-2033 (USD Billion)

44. India Anime Market, By Type, 2020-2033 (USD Billion)

45. India Anime Market, By Genre, 2020-2033 (USD Billion)

46. South America Anime Market, By Type, 2020-2033 (USD Billion)

47. South America Anime Market, By Genre, 2020-2033 (USD Billion)

48. Brazil Anime Market, By Type, 2020-2033 (USD Billion)

49. Brazil Anime Market, By Genre, 2020-2033 (USD Billion)

50. Middle East and Africa Anime Market, By Type, 2020-2033 (USD Billion)

51. Middle East and Africa Anime Market, By Genre, 2020-2033 (USD Billion)

52. UAE Anime Market, By Type, 2020-2033 (USD Billion)

53. UAE Anime Market, By Genre, 2020-2033 (USD Billion)

54. South Africa Anime Market, By Type, 2020-2033 (USD Billion)

55. South Africa Anime Market, By Genre, 2020-2033 (USD Billion)

List of Figures

1. Global Anime Market Segmentation

2. Anime Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Anime Market Attractiveness Analysis By Type

9. Global Anime Market Attractiveness Analysis By Genre

10. Global Anime Market Attractiveness Analysis By Region

11. Global Anime Market: Dynamics

12. Global Anime Market Share by Type (2023 & 2033)

13. Global Anime Market Share by Genre (2023 & 2033)

14. Global Anime Market Share by Regions (2023 & 2033)

15. Global Anime Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the anime market based on below mentioned segments:

Anime Market by Type:

Anime Market by Genre:

Anime Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date