- +1-315-215-1633

- sales@thebrainyinsights.com

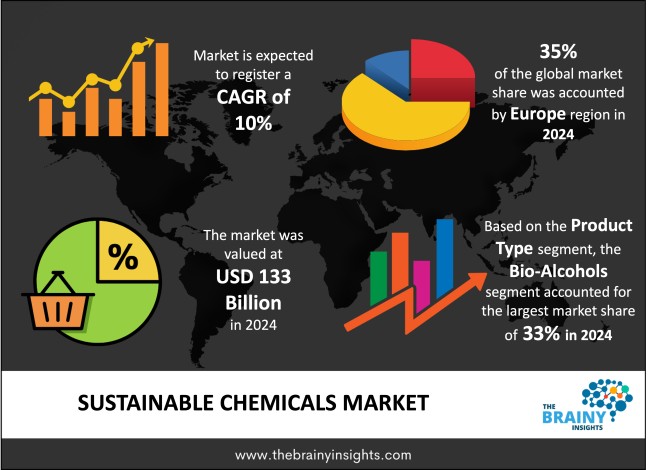

The global sustainable chemicals market was valued at USD 133 billion in 2024 and grew at a CAGR of 10% from 2025 to 2034. The market is expected to reach USD 344.96 billion by 2034. The growing emphasis on sustainability will drive the growth of the global sustainable chemicals market.

Green chemicals, environmentally friendly chemicals or sustainable chemicals, describe chemical substances which are designed, manufactured and utilized in a manner that limits adverse effects to human health and the environment during the life cycle of the chemical. The chemicals play a core role in the wider campaign of green chemistry that looks to minimize or abolish the use of dangerous materials in industrial procedures and consumer goods. Compared to traditional chemicals, which could be based on toxic feedstocks, have low energy intensities and produce byproducts that could cause significant harm to the environment, sustainable chemicals use renewable raw materials, energy efficient chemical synthesis, and produce low to no waste. Sustainable chemicals have been defined to have numerous aspects such as biodegradability, toxicity, energy consumption/production, resources efficiency and recyclability. They are frequently bio-based, i.e. of renewable biological origin, such as plants, algae, or microorganisms, rather than fossil fuels. Also, they could be produced with the employment of green technologies that decrease greenhouse gas emissions, water usage, and harmful reagents. Sustainable chemicals are also gaining importance in industries belonging to different sectors like agriculture, pharmaceuticals, personal care, textiles, and construction to meet tough environmental standards, minimize carbon footprints, and address the needs of eco-sensitive consumers. In addition, circular economy ambitions and corporates sustainability targets are spurring innovation in biodegradable solvents, bio-surfactants, green polymers and non-toxic dyes and coatings.

Get an overview of this study by requesting a free sample

The increasing emphasis on sustainability and environmental conservation – The increase in prominence of corporate sustainability goals is one of the most important drivers. The use of Environmental, Social, and Governance (ESG) frameworks and climate action plans are becoming popular, which is challenging the companies to shift to using sustainable chemicals rather than traditional ones. Not only is this change morally correct, but it also improves brand image and investor attractiveness. Sustainable chemicals can have increased initial cost associated with them; however, it can pay off in the long run through decreased operational costs like less energy usage, less waste, less money spent on regulation compliance. Innovation also has a very important role. Companies are also working hard to come up with new eco-friendly products that respond to the growing consumer needs of green and non-toxic products. These inventions provide an added advantage in the local and the global marketplace. Companies can reduce their liability to health and environmental hazards of dangerous chemicals through incorporation of sustainable chemicals thereby preventing regulatory penalties, product recall, or even reputational loss. Furthermore, a lot of organizations are moving towards the models of a circular economy, where the main focus is efficiency of resources, recyclability, and minimization of waste. In this regard, the sustainable chemicals would provide a feasible means of realizing closed-loop systems.

Significant upfront capital investments – Among the greatest obstacles, the high upfront price of switching to sustainable chemicals hampers the global sustainable chemicals market’s growth. These are associated with a high cost of raw materials, investment in R&D and redesigning of current processes. Such initial costs are sometimes regarded as financially straining, particularly to many companies especially the small and medium enterprises (SMEs), where the long-term advantages are overridden. Also, a lack of technical know-how and internal capacities to innovate or adopt sustainable chemistry exists. Most organizations do not have skilled human resource or specialized units to handle the intrigues of green transitions. Another big obstacle is resistance to change. The companies which have been using conventional chemical procedures over the decades are understandably hesitant to make any changes to their workflow in fear of affecting productivity or quality. The resistance is enhanced by the uncertainty regarding the performance of sustainable chemicals. The doubt of whether the green option can be as functional, long-lasting, or efficient as the conventional one, particularly on an industrial level, is usually the thing that postpones the introduction of sustainable chemicals.

Supportive regulatory environment – Among the most powerful impetuses is the introduction of stringent environmental standards among the leading economies. Regulations like the European REACH, the United States Toxic Substances Control Act (TSCA) and other local restrictions on hazardous chemicals are forcing industries to turn to greener alternatives of chemicals. The policies seek to reduce pollution, improve the health of the people and make industries safer. In addition to the regulation, the shift in consumer preferences is taking a central role. The current consumers are greener and are insisting on products that are non-toxic, biodegradable and ethically made and this directly drives the companies towards the use of sustainable chemicals in manufacturing. The market is also shaping due to government incentives and funding support. Tax breaks, subsidies and grants to develop and implement green technologies, such as sustainable chemicals, are being provided by many countries. This financial assistance makes it easier to implement greener solutions by businesses particularly small and medium enterprises. Moreover, the global climate initiatives like the Paris Agreement are driving the industries towards decarbonization, and sustainable chemicals can play an important role in that process by lowering the lifecycle emissions and environmental footprint.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe emerged as the most significant global sustainable chemicals market, with a 35% market revenue share in 2024.

Europe is currently holding a leading position in the worldwide sustainable chemicals market mostly because of its well-developed progressive regulatory system and policy support, as well as early implementation of green technologies. European Union has been leading in the world in coming up with strict environmental laws which promote the creation and utilization of more sustainable chemicals. It is important to note that the EU has presented tremendous goals on carbon reduction and implementing circular economy practices through its REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation and the European Green Deal. With such policies, there will be great urge among the industries to shift the use of conventional chemical substances to bio-based and eco-friendly chemicals. Furthermore, Europe boasts a well-developed chemical production ecosystem, placing a heavy focus on innovation and sustainability. The area is also well endowed with established biomass supply chain, and a friendly network of academic institutions, research centres and industry partnerships that help expedite the commercialization of sustainable solutions.

Europe Region Sustainable Chemicals Market Share in 2024 - 35%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into bio-alcohols, bio-organic acids, bio-ketones, biopolymers, platform chemicals, specialty chemicals and green solvents. The bio-alcohols segment dominated the market, with a market share of around 33% in 2024. Bio-alcohols, led by bioethanol, are the most important sustainable chemicals in the global market because of their wide range of applications, established production platform, and compatibility with international sustainability agenda. Bioethanol is obtained mainly via renewable biomass (e.g. corn, sugarcane, cellulosic feedstocks), and is commonly utilized as a biofuel (particularly in the transport industry) as a cleaner fuel than petroleum-derived products. This has been done through establishing mandatory blending mandates (e.g. E10 or E15) in many countries, wherein a specific proportion of ethanol is required to be blended with gasoline, effectively creating a large increase in demand. They have high environmental benefits compared to the traditional petrochemical counterparts because of their renewable nature, biodegradability and reduced toxicity. In addition to this, bio-alcohols are comparatively simpler to incorporate into existent fuel infrastructure in addition to industrial procedures, which further boosts their commercial attractiveness and minimizes the obstacle to adoption. This leadership of the bio-alcohols is also backed by robust policy environments globally.

The feedstock type segment is divided into biomass, agricultural waste, algae, forestry residues and animal waste. The biomass segment dominated the market, with a market share of around 36% in 2024. The most prevalent feedstock in the sustainable chemicals market is biomass, this is because of its availability, renewability, and applicability in numerous chemical production routes. Biomass is low-carbon and biodegradable, and unlike fossil-based raw materials, it can be produced again and again using organic feedstocks. Biomass also has the existing infrastructure in many countries to collect, process, and transport, making it cheaper and easier to scale than other emerging feedstocks such as algae or synthetic biology platforms. Government policies, subsidies and renewable energy targets also strongly favour biomass-based production, in particular in the EU, U.S., Brazil and India. Its carbon-neutral image, with sustainable management, also suits global climate ambitions. All in all, biomass flexibility, availability of supply, and compatibility of policy make it the most repeatedly used and economically attractive feedstock in the sustainable chemicals market.

The application segment is divided into packaging, agriculture, food & beverages, personal care & cosmetics, textiles, pharmaceuticals, construction and automotive. The packaging segment dominated the market, with a market share of around 32% in 2024. Single-use plastics, mainly used in the packaging of food, beverages, and consumer goods industries, are among the greatest contributors to plastic pollution around the world. Consequently, this has changed a lot as regards to the employment of sustainable chemicals in bioplastics, compostable films, bio-based adhesives, and coating in packaging applications. The increasing prohibition of single-use plastics in countries and regions is one of the major elements that make packaging dominance. The EU, India and a number of states in the U.S. have implemented or proposed rules and regulations to gradually ban conventional plastics, which provides a great impetus to plastic manufacturers to switch to using biodegradable or recyclable material that uses sustainable chemicals. Also, the growing consumer understanding of packaging waste and its consequences on the environment has connected with the heightened necessity of green-labelled and responsibly packaged commodities, pushing brands to redesign their packaging with bio-based content. It has also become technically possible to develop flexible, rigid and semi-rigid packaging solutions, which can equal the performance of the conventional materials. Large corporations in the FMCG are spending on sustainable packaging developments, to achieve ESG targets, and decrease carbon footprints.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 133 Billion |

| Market size value in 2034 | USD 344.96 Billion |

| CAGR (2025 to 2034) | 10% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Feedstock Type and Application |

As per The Brainy Insights, the size of the global sustainable chemicals market was valued at USD 133 billion in 2024 to USD 344.96 billion by 2034.

Global sustainable chemicals market is growing at a CAGR of 10% during the forecast period 2025-2034.

The market's growth will be influenced by the increasing emphasis on sustainability and environmental conservation.

Significant upfront capital investments could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global sustainable chemicals market based on below mentioned segments:

Global Sustainable Chemicals Market by Product Type:

Global Sustainable Chemicals Market by Feedstock Type:

Global Sustainable Chemicals Market by Application:

Global Sustainable Chemicals Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date