- +1-315-215-1633

- sales@thebrainyinsights.com

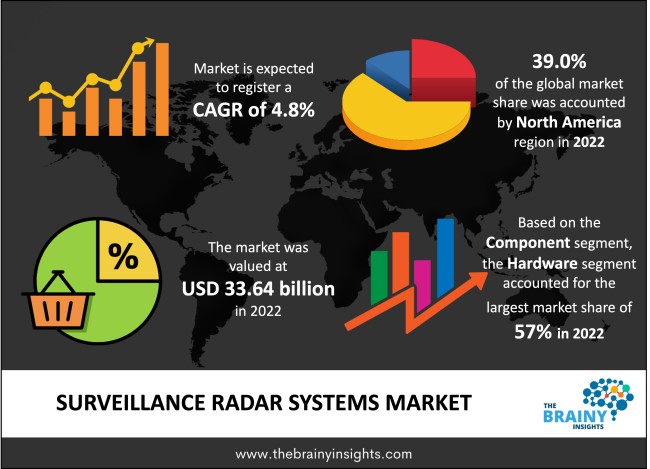

The global surveillance radar systems market was valued at USD 33.64 billion in 2022 and is anticipated to grow at a CAGR of 4.8% from 2023 to 2032. Radars are deployed to keep track of operations at significant infrastructure and establishments like airfields, bases, frontiers and harbors. The prime objective behind their usage is to safeguard national interests by identifying non-linear, moving targets that act collectively. Their utility extends towards strengthening boundary security in both commercial and defense segments. Radars can function on diverse platforms, viz., land-based stations, marine setups, aerial modules or even outer space installation, rendering them an indispensable aspect of border defense activities.

Sophisticated technological advancements known as surveillance radar systems are engineered to supervise and track objects within a specified region. These cutting-edge systems are essential to multiple domains, including the military, aviation, maritime operations, and meteorology. Surveillance radars offer up-to-the-minute data about target location presence and motions so authorized personnel can make informed decisions quickly. An expert sensor that uses radio waves to sense and trail items within its range is at the heart of a surveillance radar system. The mechanism functions by transmitting radio wave impulses and studying the reflections sent back following contact with objects. As suggested by its term "surveillance," this system's leading purpose is persistently observing and overseeing specific airspaces or geological areas.

Get an overview of this study by requesting a free sample

Growing Importance of Border and Maritime Security - The need for surveillance radar systems with tailored capabilities has increased globally due to heightened concerns about border and maritime security. Countries with vast coastlines have strongly emphasized coastal surveillance, which helps prevent smuggling, monitor maritime activities, and protect territorial waters using advanced radar technologies. Surveillance radar systems have become essential in defending borders and maritime zones. By providing real-time detection and tracking of objects like aircraft, vessels, and individuals, these systems play a crucial role in enabling authorities to monitor potential threats such as illegal or terrorist activities. They are competent at identifying targeted subjects and informing officials with the required information to make informed decisions about efficiently apprehending dangers. This factor is stimulating the market growth and development.

High Development and Manufacturing Costs – Recent years have seen a noteworthy surge in the global market for surveillance radar systems owing to technological advancements and a growing need for enhanced security measures. Nevertheless, fluctuating defense budgets and overall spending pose primary obstacles hindering this industry's growth. Governments' economic uncertainties and competing financial priorities often prompt them to re-analyze their defense expenditures, leading to reductions that consequentially affect manufacturers of radar systems and contractors involved in the field of defense. The impact of fluctuations in the global economy must be considered regarding defense budgets. In times of sluggish or negative economic growth, many governments tend to trim down non-essential expenses like military spending, including surveillance radar systems' research, development and procurement. The ever-changing security landscape presents new challenges and threats, frequently causing a reallocation of resources towards addressing these situations, which could lead to decreased funding for advanced surveillance technology needs.

Proliferation of Unmanned Aerial Vehicles (UAVs) & Drones - The growth in unmanned aerial vehicles (UAVs) and drones is anticipated to provide lucrative growth opportunities for the surveillance radar systems market. There is an increasing need for surveillance detection systems as these technologies continue to advance. There is an increasing demand for surveillance radar with drone detection capabilities that can monitor and protect vital infrastructure, public gatherings and military bases from potential UAVs and drone threats. Drones have several uses, from commercial applications like product delivery to military operations such as search & rescue activities. Surveillance radar systems are essential in identifying unauthorized drones. These systems utilize radio frequency detection or electromagnetic sensing techniques to detect and monitor the activity of drones that fly without authorization. Integrating their capabilities for detecting hostile drones into these kinds of surveillance detection systems thus enhances an organization's ability to protect sensitive areas against threats from potentially hostile drones and UAVs.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region emerged as the most prominent global surveillance radar systems market, with a 39.0% market revenue share in 2022. The United States, particularly North America, is a pioneering force regarding technological advancements and the creation of state-of-the-art surveillance radar systems. The area has access to an extensive network of defense contractors, research institutions, and tech companies that promote innovation while constantly expanding the limits of radar technology, thus making the region a global leader. North America's stronghold on the global surveillance radar systems market is closely linked to its considerable investment in defense. The United States, being a major player, commits huge investments towards modernizing its military and acquiring advanced radar technology. This emphasis on maintaining a superior military edge while addressing evolving threats fosters an increased demand for advanced surveillance capabilities. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

North America Region Surveillance Radar Systems Market Share in 2022 - 39.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment includes software and hardware. The hardware segment dominated, with a market share of around 57% in 2022. Surveillance radar systems rely on antennas and transmitters as their core hardware components, responsible for emitting and detecting radar signals. Based on design capabilities, these constituents determine the range, resolution, and overall effectiveness of the system's performance. Advancements in technology have led to increased use of phased-array antennas and high-powered transmitters that aid enhanced target-tracking abilities while improving agility. The criticality of receivers alongside signal processing units cannot be overlooked since they play a vital role in capturing incoming echoes from reflected signals whilst analyzing them suitably for precision extraction purposes during operation, thereby ensuring accuracy is maintained at all times through these integral parts required to make up any effective surveillance mechanism.

The platform segment includes land, air, naval, and space. The land segment dominated, with a market share of around 38% in 2022. Border security heavily relies on land-based surveillance radar systems, which are crucial in monitoring and securing territorial boundaries. These robust systems are designed to track various threats like intruders, smugglers, and unauthorized crossings with remarkable precision. The market share of these sophisticated technologies is determined by the need for advanced detection capabilities coupled with seamless integration into other sensor solutions. Land-based surveillance radar systems also play an integral part in protecting critical infrastructure such as communication centers, power plants & transportation hubs through real-time monitoring and threat identification processes that contribute to overall asset safety measures being put in place at all times.

The radar range type segment is bifurcated into short-range, medium-range and long-range. The medium-range segment dominated, with a market share of around 41% in 2022. Medium-range radar systems are versatile and effective for air defense and tactical situational awareness due to their balanced coverage and precision. They can detect aircraft, missiles, and other aerial threats within a broader range of operations. The ever-changing threat landscape influences market trends, necessitating adaptable radar solutions with suitable coverage that will meet emerging needs. Within maritime surveillance operations in coastal areas, medium-range radars play an important role in monitoring vessels while safeguarding coastlines against potential intrusions from surface vessels; they significantly contribute to these objectives because of their operational reach capabilities.

The application segment is bifurcated into commercial, military, and homeland security. The military segment dominated, with a market share of around 48% in 2022. Surveillance radar systems play a critical role in air and missile defense within the military sphere. Specifically engineered to identify and monitor aerial hazards, such as hostile aircraft or ballistic missiles, these systems supply timely notifications and targeting data. The marketplace for surveillance radar is impacted by factors like its essentialness to national security functions and increasing demands for sophisticated threat apprehension abilities.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2022 | USD 33.64 Billion |

| Market size value in 2032 | USD 53.76 Billion |

| CAGR (2023 to 2032) | 4.8% |

| Historical data | 2019-2021 |

| Base Year | 2022 |

| Forecast | 2023-2032 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Radar Range Type, Platform, Component, Application |

As per The Brainy Insights, the size of the surveillance radar systems market was valued at 33.64 billion in 2022 to USD 53.76 billion by 2032.

The global surveillance radar systems market is growing at a CAGR of 4.8% during the forecast period 2023-2032.

North America region became the largest market for surveillance radar systems.

The technological advancements within the industry is influencing the market's growth.

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. The Brainy Insights has segmented the global surveillance radar systems market based on below-mentioned segments:

Global Surveillance Radar Systems Market by Component:

Global Surveillance Radar Systems Market by Platform:

Global Surveillance Radar Systems Market by Radar Range Type:

Global Surveillance Radar Systems Market by Application:

Global Surveillance Radar Systems Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date