- +1-315-215-1633

- sales@thebrainyinsights.com

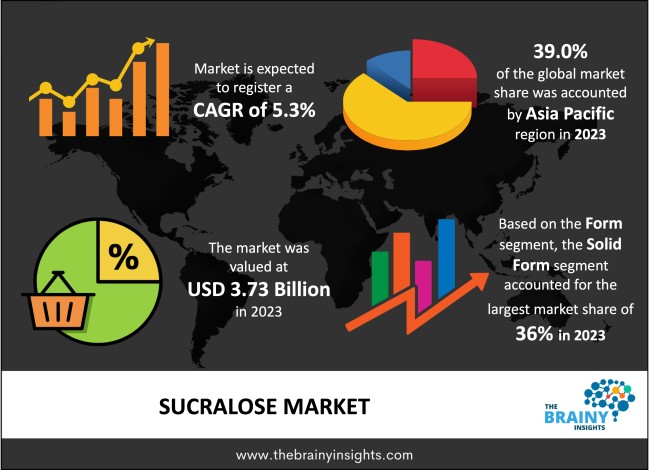

The global sucralose market was valued at USD 3.73 billion in 2023 and is anticipated to grow at a CAGR of 5.3% from 2024 to 2033. In the European Union, this artificial sweetener is referred to as E955. Because the body does not typically absorb it, it doesn't contain calories. Sucralose boasts a sweetness level that surpasses several other sugar substitutes like aspartame and potassium acesulfame- three times sweeter than some of them, such as 320 to 1000 times more potent in terms of natural sugar equivalent values sucrose; sodium saccharin falls just slightly behind its potency levels. Its applications are vast within the food and beverage industry due in part to its use with frozen foods, confectioneries, or even beverages, among many other examples. Sucralose is versatile in various forms, including granular, powder, and liquid. As a result of this versatility, it has been used across an extensive range of food products, such as dairy products, confectionary goods and others.

Sucralose was developed in 1976 by Tate & Lyle scientists & researchers. The chemical name of Sucralose is 1,6-dichloro-1,6-dideoxy-β-D-fructofuranosyl-4-chloro-4-deoxy-α-D-galactopyranoside. The manufacturing process involved the chlorination of sucrose molecules. This transformation replaced three hydroxyl groups with chlorine atoms and increased its sweetness level to around six hundred times that of normal table sugar. The structural change also allows it to withstand high temperatures during cooking or baking while retaining quality even after extended storage periods - making it a popular choice within the food industry.

Sucralose is versatile due to its extremely low-calorie content, positioning it apart from natural sweeteners. Therefore, this alternative sweetener does not contribute any calories to one's overall daily intake and benefits individuals seeking weight or blood sugar regulation benefits. Many health-conscious consumers with specific dietary needs, such as those living with diabetes or adhering to restricted-calorie meal plans, have found value in this impressive aspect of Sucralose.

Get an overview of this study by requesting a free sample

Rising Demand for Health Products - The growing cases of health issues like diabetes, obesity and cardiovascular diseases have led people to question their dietary options carefully. Sucralose's absence of calories and its insignificant effects on blood sugar levels make it an attractive choice for those striving to maintain a healthy weight and wellness. As knowledge about the harmful consequences associated with excessive consumption of sugars increases, there is expected growth in demand for sucralose-sweetened products that are low-calorie or free from added sugars. The growing desire for accessible, health-conscious food and drink choices has driven an increasing demand for easy-to-consume options that align with wellness objectives. Sucralose presents a solution to manufacturers looking to create products satisfying these preferences while maintaining their quality and flavor standards. Sucralose is becoming increasingly integrated into everyday consumer staples due to its adaptable nature and stability across various applications - from baked goods to dairy items, snacks, or carbonated beverages.

Price Volatility – Sucralose manufacturers may face challenges with production costs and profit margins due to the frequent changes in prices of raw materials, particularly chlorinated sugars used during sucralose synthesis. The price volatility for key ingredients like sucrose and chlorinated hydrocarbons is affected by various factors such as weather patterns, agricultural yields, and market demand-supply dynamics alongside energy prices. Adding to this complexity is stiff competition from alternative sweeteners- natural alternatives like stevia or monk fruit extracts- which can exert pricing pressures on the industry and limit their scope for profitability within the Sucralose Market. Although there is abundant research and regulatory clearance that establish sucralose as a safe food ingredient for humans, many people still entertain unfounded health fears linked to artificial sweeteners like sucralose. These misconceptions may involve concerns over issues such as cancer-causing properties or harmful effects on gut microbiota and digestion, which can ultimately dampen consumer trust in products containing the additive.

Emergence of Functional and Fortified Foods - The growth of the worldwide food and beverage industry, along with rising consumer expenditure on processed and prepackaged items, has opened up considerable prospects for sucralose suppliers and manufacturers. To stand out from competitors in delivering products that meet developing customer tastes, food companies are turning towards sucralose as a low-cost means of achieving desired sweetness levels while decreasing sugar intake. Additionally, this sweetener's ability to blend effectively with similar additives enables formulators significant flexibility when integrating it into many different edible offerings. The popularity of functional and nourishing foods packed with vitamins, minerals, and other biologically active elements has paved the way for incorporating sucralose into various products that promote health. Consumers now look for food items that offer more than just basic nutrition benefits; hence, sucralose is an excellent option as it enhances taste while maintaining nutritional value. It blends well with different healthy ingredients, making it ideal for creating health-promoting drinks or meals tailored to specific wellness goals like immunity, cognitive function or digestive system improvement.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific region emerged as the most prominent global sucralose market, with a 39.0% market revenue share in 2023. Sucralose is experiencing a surge in demand within the Asia Pacific region due to various factors, including urbanization, increasing disposable incomes, evolving dietary preferences and consumers' heightened awareness of health consciousness. The sucralose market share across this region is heavily propelled by countries like China, India, Japan, South Korea and Australia - their rapidly growing populations, improving economies and expanding food & beverage sectors bolstering its growth potential. The sucralose market in the Asia Pacific exhibits a wide array of applications, encompassing established and emerging product categories such as beverages, dairy items, snacks, sauces/condiments and functional foods. Sucralose's adaptability to regional cuisines and stability allows for formulating products that cater to various dietary needs/preferences prevalent throughout this region. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

Asia Pacific Region Sucralose Market Share in 2022 - 39.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The form segment includes solid form and liquid form. The solid form segment dominated, with a market share of around 36% in 2023. In its solid form, Sucralose is available in either crystalline or powder formulations, which facilitates handling, storage, and integration into dry food and beverage products. This type of Sucralose undergoes a thorough crystallization process to create finely textured granules or powders with high sweetness levels that exhibit laudable stability properties. This variant's versatility, compatibility and functional qualities make it highly popular among industries such food & beverage, pharmaceutical and others. Sucralose's solid form holds the largest market share worldwide due to its extensive usage in baked goods, confectioneries, snacks, dairy items and dietary supplements. It is an optimal ingredient for developing low-calorie or sugar-free products with maintained taste quality and texture because it possesses high sweetness potency, heat stability, and resistance against degradation. This is the primary factor for the segment’s growth.

The application segment is bifurcated into food & beverage, pharmaceutical and others. The food & beverage segment dominated, with a market share of around 54% in 2023. The dominant segment in the worldwide sucralose market is the food and beverage industry due to its prevalent use as a potent sweetener, enhancing diverse products' taste and texture. Sucralose, being non-caloric yet as sweet as sugar, meets consumer preferences for low-sugar or calorie-free options while increasing shelf life. Hence, it finds extensive application by manufacturers catering to consumers demanding reduced-sugar alternatives across several food categories. Sucralose is widely used in various food and beverage industry product categories, such as carbonated soft drinks, juices, dairy products, baked goods, confectionery items, snacks and more. Its capability to provide high sweetness potency and stability under diverse processing conditions has made it a preferred choice for formulating an extensive range of products catering to dietary requirements across global markets while satisfying consumer preferences.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 3.73 Billion |

| Market size value in 2033 | USD 6.25 Billion |

| CAGR (2024 to 2033) | 5.3% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Application, Form |

As per The Brainy Insights, the size of the sucralose market was valued at 3.73 billion in 2023 to USD 6.25 billion by 2033.

The global sucralose market is growing at a CAGR of 5.3% during the forecast period 2024-2033.

Asia Pacific region became the largest market for sucralose.

The rising demand for sucralose is driving the market's growth.

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. The Brainy Insights has segmented the global sucralose market based on below-mentioned segments:

Global Sucralose Market by Form:

Global Sucralose Market by Application:

Global Sucralose Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date