- +1-315-215-1633

- sales@thebrainyinsights.com

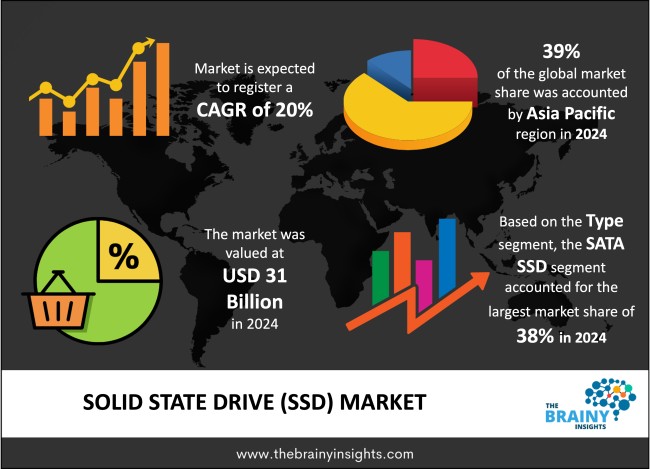

The global solid state drive (SSD) market was valued at USD 31 billion in 2024 and grew at a CAGR of 20% from 2025 to 2034. The market is expected to reach USD 191.94 billion by 2034. The rapid automation and digitization of the global economy will drive the growth of the global solid state drive (SSD) market.

SSDs serve as a data storage solution through flash memory to reach enhanced speeds and dependability when contrasted with the conventional Hard Disk Drives. SSD technology differs from HDD operation because it lacks spinning disks and moving parts within its design. Measurements from SSDs improve data retrieval and file transfer efficiency because of their major structural difference. SSDs function with NAND-based flash memory systems which maintain data storage during power outages. A unique architecture inside SSDs enhances performance and provides better durability and physical shock resistance which makes them the perfect choice for mobile devices as well as laptops and rugged environments. Fast data retrieval stands as one of the main advantages that SSDs offer to users. Systems running from SSD drives flap into operation within seconds while programs launch immediately followed by faster file movement than HDD systems. SSDs feature soundlessness and power efficiency that leads to prolonged battery usage in portable equipment. The adoption of SSD technology by various industries and consumer electronics entities became widespread due to its multiple advantages. The storage capabilities of SSD devices have grown extensively as current models provide terabytes of space which allows them to meet the requirements of large data storage operations.

Get an overview of this study by requesting a free sample

Advanced features of SSDs catering to the contemporary needs of the world economy – SSDs serve as a data storage solution through flash memory to reach enhanced speeds and dependability when contrasted with the conventional Hard Disk Drives. Measurements from SSDs improve data retrieval and system boot and file transfer efficiency because of their major structural difference. SSDs function with NAND-based flash memory systems which maintain data storage during power outages. A unique architecture inside SSDs enhances performance and provides better durability and physical shock resistance which makes them the perfect choice for mobile devices as well as laptops and rugged environments. SSDs feature soundlessness and power efficiency that leads to prolonged battery usage in portable equipment. The adoption of SSD technology by various industries and consumer electronics entities became widespread due to its multiple advantages in gaming systems and enterprise servers and cloud computing platforms and consumer electronics devices. SSDs maintain a higher price-per-gigabyte rate than HDDs do although their cost differences have declined throughout the years. The storage capabilities of SSD devices have grown extensively as current models provide terabytes of space which allows them to meet the requirements of large data storage operations.

High costs of SSDs per gigabyte – Although SSD prices have declined over the years due to advancements in NAND flash production, they still remain more expensive than traditional Hard Disk Drives (HDDs), especially at higher storage capacities. For users or enterprises requiring bulk storage—such as data archiving, surveillance, or media production—HDDs remain the more cost-effective choice, making price a major barrier to SSD adoption in these areas. Another significant concern is the limited lifespan and write endurance of SSDs. In environments where data is written and rewritten frequently—such as enterprise servers, real-time logging systems, or content creation platforms—this limitation can affect long-term reliability and increase maintenance costs. Additionally, data recovery from SSDs poses more challenges than from HDDs. This risk can deter organizations from fully switching to SSDs, especially in critical data environments where backup and recovery are vital.

Advancements in NAND flash technology – NAND flash technology developments together with government-supported smart city projects drive the market demand for Solid State Drives (SSDs). Major advances in NAND flash memory production come from Samsung and other companies operating in this field. Samsung started its 9th-generation V-NAND flash memory mass production in May 2024 with 286 layers integrated. This development enhances storage capacity, speed, and energy efficiency, addressing the escalating demands of data-intensive applications. These innovations contribute to the production of SSDs with higher capacities and improved performance, catering to the needs of modern computing environments. The adoption of SSD continues to increase because government smart city projects have directed attention toward these storage solutions. These projects depend on efficient storage and processing capacity which SSDs efficiently provide because of their speed and reliability. The investment of governments in smart city construction should lead to an expanding SSD market which enables development of interconnected and intelligent urban networks.

Regional segmentation analysis

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global solid state drive (SSD) market, with a 39% market revenue share in 2024.

The major consumer role of China, Japan, South Korea and Taiwan extends to their dominance in SSD manufacturing and production including NAND flash memory as well as SSD controllers manufacturing. The leading technology companies located in these nations create an advantage for the entire region regarding both component supplies and technological development. Asia-Pacific achieves its dominant market position because it hosts a successful electronics and IT hardware industry. The mass production of laptops, desktops, smartphones and gaming products along with increasing demand for SSD storage technology as a high-speed solution makes the market grow rapidly. The area possesses numerous tech-literate consumers who keep growing in number especially within major urban centres where digital living has become widespread. Rising disposable income levels together with expanding internet penetration and ubiquitous smartphone and PC adoption make SSDs the preferred storage option because they offer fast performance and elevated reliability and efficient operation. The SSD demand grows indirectly as the government invests in digital transformation and smart cities while implementing 5G infrastructure.

Asia Pacific Region Solid State Drive (SSD) Market Share in 2024 - 39%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into SATA SSD, NVMe SSD, PCIe SSD and others. The SATA SSD segment dominated the market, with a market share of around 38% in 2024. SATA (Serial Advanced Technology Attachment) SSDs serve as HDD (hard disk drive) replacement options due to sharing the same interface features so users can easily upgrade their systems while keeping their hardware intact. SATA SSDs provide simple hardware installation making them the ideal solution for broad markets because they deliver the best value for money in older computer systems. Their price-to-performance ratio remains a primary driver behind SATA SSDs becoming the main storage choice in the market. The universal 2.5-inch form factor commonly associated with SATA SSDs provides simple and cost-effective fitting into almost all available hardware bays during installation. The universal form factor enables continued high market demand for these drives during periods when new interfaces have not fully penetrated certain technologies or older infrastructure is still in use. Numerous consumer electronics devices and initial enterprise deployments continue to rely on SATA SSDs for their market strength due to their cost effectiveness and proven capabilities with everyday computing applications. The reliable pricing structure of SATA SSDs together with their broad compatibility standards makes them a leading force within the SSD market.

The form factor segment is divided into 2.5 Inch, M.2, U.2, Add-in Card (AIC) and others. The 2.5 Inch segment dominated the market, with a market share of around 35% in 2024. 2.5-inch SSD storage dimensions lead the global market because they suit a wide range of devices seamlessly and follow universal standards. Customers and businesses particularly choose this format for performance upgrades because it allows them to keep their current hardware in place. The main factor behind its leadership position is its broad universal support capabilities. Most users can easily install 2.5-inch SSDs as they receive support from virtually all desktops and laptops and select server platforms. The adaptable physical design of 2.5-inch SSDs minimizes setup difficulties and expenses. Large-scale IT infrastructures benefit from 2.5-inch SSD deployment because this standardizes storage upgrading and maintenance operations across multiple devices. The widespread manufacturing and economies of scale have resulted in low pricing for 2.5-inch SSDs thereby promoting their adoption throughout the market. Mainstream computing relies primarily on 2.5-inch SSDs because their combination of affordability and practicality makes them ideal.

The storage capacity segment is divided into 250 GB – 1 TB, below 250 GB, 1 TB – 2 TB and above 2 TB. The 250 GB – 1 TB segment dominated the market, with a market share of around 43% in 2024. Most users and companies find this capacity range fits their storage needs perfectly for operating systems. This capacity range stands as the best practical choice for daily computing needs which makes it the most popular capacity selection. This capacity segment successfully fulfils the performance needs of regular consumers along with students as well as small business operations and professionals. The manufacturing industry intensively targets this storage capacity segment because it enables large-scale production which leads to competitive market pricing thus solidifying its market-leading position. SSD prices have continued to decrease due to NAND flash market trends and this has lowered costs so emerging economies have access to this storage range. The 250 GB to 1 TB storage capacity stands as the ideal choice for most users who want dependable yet reasonable and power-efficient storage solutions. The market dominance of the storage solution continues because it offers both efficiency and competitive pricing benefits.

The end-user segment is divided into client, enterprise, industrial and automotive. The client segment dominated the market, with a share of around 34% in 2024. The client segment controls most of the global solid state drive (SSD) market because SSDs are commonly used in consumer electronics and personal devices and gaming systems. SSDs support everyday functions of end-users who include people at home and school together with professional users who operate desktops laptops and notebooks. SSD demand from consumers has experienced major growth because of their benefits in fast startup times and quick application loading and enhanced system performance. The client segment maintains its leadership position because manufacturers of laptops and PCs have performed massive commercial operations in developing markets along with distant work and online education and learning processes. Super-sized solid-state drives deliver attractive benefits of quick speeds combined with reduced power consumption and extended lifespan when compared to standard hard disk drives (HDDs) in electronic devices. Manufacturers are integrating SSDs into both budget and premium laptops as standard storage so customers from different income levels adopt them further.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 31 Billion |

| Market size value in 2034 | USD 191.94 Billion |

| CAGR (2025 to 2034) | 20% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Form Factor, Storage Capacity and End-User |

As per The Brainy Insights, the size of the global solid state drive (SSD) market was valued at USD 31 billion in 2024 to USD 191.94 billion by 2034.

Global solid state drive (SSD) market is growing at a CAGR of 20% during the forecast period 2025-2034.

The market's growth will be influenced by advanced features of SSDs catering to the contemporary needs of the world economy.

High costs of SSDs per gigabyte could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global solid state drive (SSD) market based on below mentioned segments:

Global Solid State Drive (SSD) Market by Type:

Global Solid State Drive (SSD) Market by Form Factor:

Global Solid State Drive (SSD) Market by Storage Capacity:

Global Solid State Drive (SSD) Market by End-User:

Global Solid State Drive (SSD) Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date