- +1-315-215-1633

- sales@thebrainyinsights.com

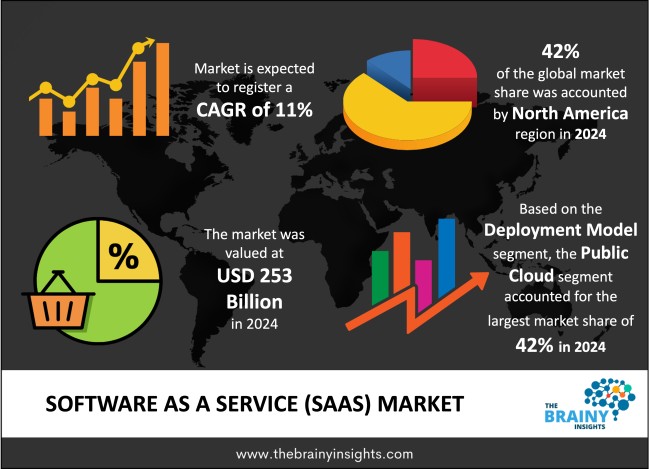

The global software as a service (SaaS) market was valued at USD 253 billion in 2024 and grew at a CAGR of 11% from 2025 to 2034. The market is expected to reach USD 718.37 billion by 2034. The rapid digital transformation will drive the growth of the global software as a service (SaaS) market.

The web browser provides users with software access instead of traditional computer-based software installations while subscriptions serve as their payment method. With SaaS organizations can free themselves from installation concerns and maintenance requirements since the provider manages all aspects of performance, maintenance, upgrades and security from one platform. SaaS solutions provide two strong benefits through their easy availability and adaptable client base expansion capabilities. Users gain freedom to access software from any connected device so they can increase teamwork possibilities and adapt to remote work environments. SaaS platforms enable simple adjustments in user capacity which makes them appropriate for businesses of any magnitude. Through its payment structure which requires users to pay only for what they use organizations can better control their costs and expenses. A wide range of SaaS products includes Google Workspace together with Microsoft 365, Salesforce, Zoom and Slack. Customers must consider data protection and security when using SaaS because they rely on third-party server storage for their sensitive material. SaaS has transformed the entire method through which software is distributed and utilized by customers.

Get an overview of this study by requesting a free sample

Advancements in SaaS – The core factors which drive the Software as a Service (SaaS) marketplace demand stem from the built-in characteristics and advancements found within SaaS itself. The central aspect that drives the demand for Software as a Service (SaaS) is its ability to provide efficient cost benefits. The subscription-based pricing approach of SaaS eliminates big upfront hardware costs and licensing expenses which makes this solution available to organizations of different sizes. The ability to scale and adapt its usage plans effectively makes SaaS appealing to organizations since they can easily modify plans according to changing business needs while avoiding major disruptions to their infrastructures. The critical internal strength of SaaS providers lies in data security and compliance because they provide sturdy protection measures while respecting international regulations. The protective features establish company and client trust while ensuring the safety of confidential information. The value proposition of SaaS platforms increases because providers continue to integrate advanced technologies such as artificial intelligence with machine learning and analytics tools. The system capabilities enable businesses to conduct automated processes and acquire useful insights that lead to better decision-making capabilities. These internal factors collectively establish SaaS as a preferred platform for organizations because it provides functional, financial and technological advantages particularly relevant to digital transformation and business operational enhancement.

Data privacy and security concerns – The principal challenge regarding Software as a Service (SaaS) adoption is ensuring safekeeping and protecting customer data privacy. Businesses face security issues because their third-party cloud-based data storage requires handling sensitive business data through external servers. Data-protection concerns become vital issues for companies operating in environments where they manage legally restricted or highly sensitive business data. Furthermore, Many SaaS solutions restrict their users because these platforms provide limited customization options and flexible implementations. The scalability of SaaS platforms does not resolve complete customization needs for certain organizations which need specialized tailored solutions. The main disadvantage of vendor lock-in occurs when businesses depend on third-party vendors to manage system updates while also requiring them to handle maintenance tasks as well as guarantee system uptime. The absence of control hinders both switching providers and software environment management for companies. The wide-scale implementation of SaaS software encounters obstacles from security issues and difficulties with adaptation as well as restricted flexibility and dependency on individual providers.

Changing global economic landscape – Cloud-based tools emerged as a result of businesses seeking flexible on-the-go functionalities in their cloud solutions to support mobile workforces. The new standard of remote and hybrid work depends heavily on SaaS platforms because they supply fundamental features to support this operational shift. The digital transformation projects which companies execute in various industries represent a fundamental external variable. Modern companies need competitive technologies for success so SaaS has emerged as a fast solution for migrating from legacy systems toward adaptable cloud-based systems. Better online connectivity together with the worldwide growth of cloud infrastructure makes SaaS solutions more attractive to users worldwide. Both uncertain economic periods and their related conditions play a substantial role in boosting SaaS product marketplace demand. SaaS market growth receives support from multiple external factors that include work trends together with digital transformation and global connectivity as well as economic conditions.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global software as a service (SaaS) market, with a 42% market revenue share in 2024.

Amazon Web Services (AWS), Microsoft Azure and Google Cloud operate from the United States which is known as one of the biggest areas for cloud service providers in the world. The industry leaders created cloud computing technologies and helped develop the worldwide SaaS market. Their enterprise-level infrastructure development accompanied by heavy investment creates the SaaS industry standard which drives global market expansion. High-speed internet connectivity along with advanced digital infrastructure in the area creates favourable conditions which simplify SaaS solution implementation for companies. The North American region functions as a central centre for venture capital and funding opportunities that help SaaS startups to develop through rapid expansion. The region’s support for digital transformation and cloud adoption through favourable regulations together with business needs have rapidly accelerated SaaS adoption. Due to the growing need for cheap and more scalable solutions businesses transition from their traditional software systems to cloud-based platforms.

North America Region Software as a Service (SaaS) Market Share in 2024 - 42%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The deployment model segment is divided into public cloud, private cloud and hybrid cloud. The public cloud segment dominated the market, with a market share of around 42% in 2024. Public cloud management provides superior advantages which enable its leading position in the worldwide SaaS market ecosystem. The public cloud infrastructure provides scalability to technologies at rates that both private and hybrid cloud models find difficult to achieve. The clouds public environment enables businesses to eliminate their expenses on physical hardware because providers handle resource deployment and maintenance. The public cloud system enables businesses to increase or decrease their resource levels based on customer demands because it remains flexible to changing business requirements. Customers gain security advantages through public cloud providers who deliver ongoing investments aimed at maximizing system reliability and data security and operational performance. Public cloud providers maintain several data centres spread throughout the world which supports data protection through redundancy and ensures continued service operations so that SaaS applications exhibit greater reliability. Businesses operating in the public cloud can manage services at any location because these systems extend their reach worldwide. This results in consistent user experiences through multiple regions. Most SaaS applications select the public cloud because of its simple management features along with easy accessibility.

The organization size segment is divided into small and medium-sized enterprises (SMEs) and large enterprises. The small and medium-size enterprises (SMEs) segment dominated the market, with a market share of around 56% in 2024. Small and medium-sized enterprises navigate with minimal resources and limited budgets. SaaS enables organizations to benefit from affordable and sophisticated tools which they can access through subscriptions instead of investing large sums of money into initial capital expenditures. All these make SaaS a top choice for small and medium-sized organizations working to boost productivity levels. SMEs find SaaS attractive because deployment is simple while maintenance demands minimal effort and software updates are automatic thus freeing up internal IT department resources. Small enterprises benefit greatly because most of them operate without specialized technical personnel. The scalability of SaaS platforms enables SMEs to begin with fundamental packages that extend with company growth leading to flexibility. Remote work models together with hybrid workplaces became widespread which led to an exponential rise in SMEs adopting SaaS solutions. Cloud-based communication and collaborative systems in addition to CRM solutions enable teams spread across different locations to perform with maximum efficiency. Specialty SaaS tools made specifically for different industries now help various SMEs including retail establishments and healthcare organizations to digitalize their activities.

The end-user industry segment is divided into IT and telecommunications, BFSI (banking, financial services, and insurance), retail, healthcare, manufacturing, government, education and others. The IT and telecommunications segment dominated the market, with a market share of around 37% in 2024. The IT and telecommunications industry commands leadership in the worldwide Software as a Service (SaaS) market because its core operations require adjustable and flexible solutions that deliver affordable software capabilities. IT and telecommunications companies require SaaS services to perform their operations covering CRM management, network control and analytics functionalities. IT and telecommunications sector experiences advantages through SaaS solutions because of their unlimited flexibility and easy access features. Through SaaS operations these firms implement software tools rapidly and adjust their capacity to match customer needs while eliminating substantial capital expenses for infrastructure requirements. SaaS applications deployed worldwide enable IT and telecom providers to maintain uniform business operations across all regions thus enhancing collaboration between teams while delivering new service capabilities to their customers. The automation processes and service optimization functions of SaaS serve critical purposes for the success of IT and telecom organizations. The digital industry transformation continues to drive IT and telecommunications operators toward cloud-based services which requires SaaS technology as an essential tool for achieving innovation and competitive advantages.

The application segment is divided into Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Resource Management (HRM), Supply Chain Management (SCM), collaboration tools, accounting and others. The Customer Relationship Management (CRM) segment dominated the market, with a market share of around 35% in 2024. The world-wide supremacy of Customer Relationship Management (CRM) in the Software as a Service (SaaS) market results from businesses embracing customer-focused strategies along with requirements for optimizing customer interaction administration. The central feature of CRM software allows businesses to control customer information alongside their sales progression actions and promotional activities. It provides vital data analyses to enhance decision making and improve customer satisfaction and enhance relationships. Businesses recognize CRM as their essential tool for improving customer experience to develop enduring relationships in the competitive customer-oriented markets. CRM solutions have become even more vital due to the increasing interest in data-led decisions together with personalized marketing strategies. Businesses can provide customized real-time solutions to their customers through CRM systems that engage users through various communication platforms. The solution enhances customer loyalty and simultaneously accelerates sales performance by providing knowledgeable information about client actions and choices to selling personnel. CRM solutions provided through SaaS have become the dominant choice because they offer simple deployment alongside scalability and reduced expenses. Companies can leverage cloud computing CRM systems to obtain real-time data from all locations which boosts communication between teams as well as strategic decisions across departments.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 253 Billion |

| Market size value in 2034 | USD 718.37 Billion |

| CAGR (2025 to 2034) | 11% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Deployment Model, Organization Size, End-User Industry and Application |

As per The Brainy Insights, the size of the global software as a service (SaaS) market was valued at USD 253 billion in 2024 to USD 718.37 billion by 2034.

Global software as a service (SaaS) market is growing at a CAGR of 11% during the forecast period 2025-2034.

The market's growth will be influenced by advancements in SaaS.

Data privacy and security concerns could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global software as a service (SaaS) market based on below mentioned segments:

Global Software as a Service (SaaS) Market by Deployment Model:

Global Software as a Service (SaaS) Market by Organization Size:

Global Software as a Service (SaaS) Market by End-User Industry:

Global Software as a Service (SaaS) Market by Application:

Global Software as a Service (SaaS) Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date