- +1-315-215-1633

- sales@thebrainyinsights.com

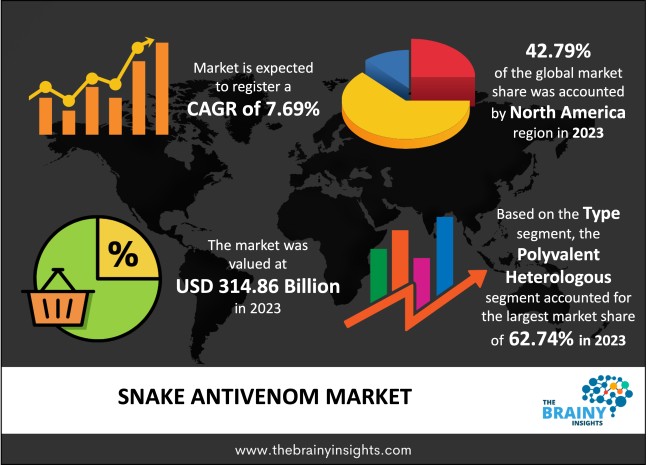

The global snake antivenom market generated USD 314.86 billion revenue in 2023 and is projected to grow at a CAGR of 7.69% from 2024 to 2033. The market is expected to reach USD 660.50 billion by 2033. The growth of the snake antivenom market is largely propelled by an increase in the occurrence of venomous bites and stings on a global scale. Additionally, technological advancements and supportive initiatives from international health organizations to enhance health awareness are contributing to expanding the market.

Snake antivenom is a therapeutic serum developed to counteract the toxic effects of snake venom following a snakebite. It is typically produced by injecting non-lethal doses of venom into horses or sheep. These animals then produce antibodies against the venom, which are harvested and purified to create antivenom. When administered to a snakebite victim, antivenom works by binding to the venom molecules in the bloodstream, neutralizing their harmful effects, and aiding in their elimination from the body. Which helps mitigate symptoms such as tissue damage, bleeding, paralysis, and organ failure caused by snake venom. It's important to note that antivenom is specific to the snake species responsible for the bite, as different snakes produce different venoms with unique compositions and effects. Therefore, the appropriate antivenom must be administered based on identifying the snake species whenever possible. While antivenom is a crucial treatment for snakebites and can save lives promptly and correctly, it is not without risks. Adverse reactions, including allergic reactions, can occur, and there may be limitations to its effectiveness based on factors such as the amount of venom injected and the time elapsed since the bite. Overall, snake antivenom plays a vital role in the medical management of snakebites, offering a targeted approach to neutralizing venom toxins and improving the chances of recovery for those affected.

Get an overview of this study by requesting a free sample

High Incidence of Snakebites - Regions with a high prevalence of venomous snakes experience a greater demand for antivenom. For instance, countries in Africa, Asia, and Latin America report a significant number of snakebite cases annually, necessitating the availability of antivenom.

Growing Awareness and Education - Efforts to raise awareness about snakebites, their prevention, and treatment have been growing. Education campaigns targeted at rural populations and healthcare providers contribute to increased recognition of the importance of antivenom in managing snake envenomation.

Rising Healthcare Expenditure - Increasing healthcare spending, particularly in developing countries, allows for better access to essential medicines like antivenom. As healthcare infrastructure improves and more resources are allocated to emergency medical services, the demand for antivenom will likely increase.

Limited Access in Remote Areas - One significant challenge is ensuring antivenom availability in remote and rural areas where snakebites are common. Infrastructure limitations, including poor road networks and inadequate healthcare facilities, hinder the timely delivery of antivenom to these regions.

High Cost of Treatment - Antivenom production involves complex processes and stringent quality control measures, leading to high manufacturing costs. As a result, antivenom can be expensive, making it less accessible to individuals in low-income communities where snakebites are prevalent.

Innovations in Manufacturing Processes - Advances in biotechnology and immunology present opportunities to refine and improve antivenom manufacturing processes. Techniques such as recombinant DNA technology and monoclonal antibody production hold promise for enhancing the efficacy, safety, and scalability of antivenom production.

Developing Next-Generation Antivenoms - Research into novel therapeutic modalities, such as peptide-based antivenoms and nanotechnology-based delivery systems, offers opportunities to develop next-generation antivenom products with improved specificity, reduced adverse effects, and enhanced stability.

Targeted Therapies for Specific Snake Venoms - With a deeper understanding of snake venom composition and pathophysiology, there is potential to develop targeted antivenom therapies tailored to neutralize the toxins of specific snake species or venom components. This approach could improve treatment outcomes and minimize the risk of cross-reactivity.

Complexity of Venom Composition - Snake venoms are highly complex mixtures of toxins, enzymes, and proteins that vary between species and geographical regions. Developing effective antivenoms requires a comprehensive understanding of venom composition, which can be challenging due to the diversity of snake species and the limited availability of venom samples for research.

Regulatory Hurdles - Regulatory approval processes for antivenom vary between countries and regions, leading to delays in product registration and market entry. The complex regulatory requirements, coupled with limited harmonization of standards, pose barriers to innovation and hinder the availability of antivenom in areas where it is needed most.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global Snake Antivenom market, with a 42.79% market revenue share in 2023.

North America, particularly the United States, is home to leading pharmaceutical companies and research institutions. These entities may contribute significantly to the development and production of snake antivenom. While snakebite incidence may be lower compared to other regions, North America is home to several venomous snake species, including rattlesnakes, copperheads, and cottonmouths. The presence of these snakes necessitates the availability of antivenom for treatment. Furthermore, North America attracts millions of tourists yearly, many of whom engage in outdoor activities such as hiking, camping, and wildlife exploration. The risk of encountering venomous snakes in these environments may drive demand for antivenom among tourists and outdoor enthusiasts. Additionally, the regulatory framework for pharmaceuticals in North America is robust, ensuring the safety, efficacy, and quality of antivenom products. This favourable regulatory environment may attract manufacturers to supply the North American market. Moreover, the region boasts advanced healthcare infrastructure and resources, including hospitals that manage snakebites and administer antivenom. In addition, snake antivenom may be used in veterinary medicine to treat snake envenomation in domestic animals such as dogs and horses. The North American market for veterinary antivenom products could contribute to the overall prominence of snake antivenom in the region.

North America Region Snake Antivenom Market Share in 2023 - 42.79%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is classified into polyvalent heterologous and monovalent heterologous. The polyvalent heterologous segment dominated the market, with a share of around 62.74% in 2023. Polyvalent heterologous antivenom is formulated to neutralize the venoms of multiple snake species. This broad-spectrum coverage makes it versatile and suitable for regions with diverse snake fauna, where identifying the species responsible for a snakebite may be challenging. Furthermore, polyvalent antivenoms offer cost advantages compared to monovalent or species-specific antivenoms. By targeting multiple snake species with a single product, healthcare providers can streamline procurement and reduce inventory costs, making polyvalent antivenom a cost-effective solution for resource-limited settings. Moreover, using polyvalent antivenom simplifies treatment protocols and logistics, as healthcare providers do not need to determine the specific snake species involved in a bite before administering treatment. This simplification can lead to faster and more efficient management of snakebite cases, particularly in emergency settings. Besides, polyvalent antivenom products are often more widely available and distributed than monovalent antivenoms, which may be specific to certain snake species or geographic regions. The broader applicability of polyvalent antivenom increases its accessibility to healthcare facilities in areas where snakebites are endemic.

The application segment is divided into hospitals and clinics. The hospitals segment dominated the market, with a share of around 56.82% in 2023. Hospitals are typically the primary point of care for individuals suffering from snakebites. They have the necessary facilities, equipment, and healthcare professionals trained in snakebite management to provide timely and appropriate treatment, including antivenom administration. Most importantly, hospitals employ healthcare professionals, including emergency physicians, toxicologists, and intensivists, with specialized training and expertise in managing snakebite envenomation. These professionals know the indications for antivenom therapy, dosing regimens, and potential complications, ensuring safe and effective treatment. In addition, hospitals have access to diagnostic tests and imaging studies that may aid in assessing and managing snakebite patients. Laboratory tests, such as venom detection assays or coagulation studies, can help identify the snake species involved and assess the severity of envenomation, guiding the appropriate use of antivenom. Furthermore, hospitals often follow established treatment guidelines and protocols for managing snakebite envenomation, which may include recommendations for using antivenom based on clinical severity scores or venom detection tests. Adherence to standardized protocols promotes consistent and evidence-based care for snakebite patients.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 314.86 Billion |

| Market size value in 2033 | USD 660.50 Billion |

| CAGR (2024 to 2033) | 7.69% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type and Application |

As per The Brainy Insights, the size of the snake antivenom market was valued at USD 314.86 billion in 2023 to USD 660.50 billion by 2033.

The global snake antivenom market is growing at a CAGR of 7.69% during the forecast period 2024-2033.

North America became the largest market for snake antivenom.

The high incidence of snakebites and increasing awareness and education drive the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global snake antivenom market based on below-mentioned segments:

Global Snake Antivenom Market by Type:

Global Snake Antivenom Market by Application:

Global Snake Antivenom Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date