- +1-315-215-1633

- sales@thebrainyinsights.com

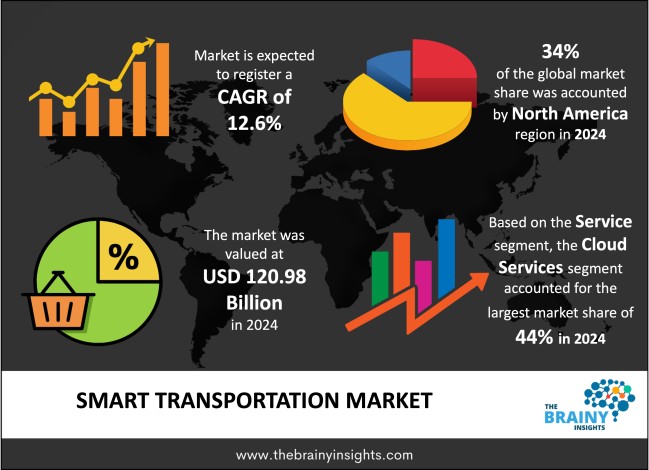

The global smart transportation market was valued at USD 120.98 Billion in 2024 and grew at a CAGR of 12.6% from 2025 to 2034. The market is expected to reach USD 396.37 Billion by 2034. The global smart transportation market has become a pivotal force in transforming the global transportation landscape. This transformation is driven by rapid technological advancements, increasing urbanization, and a pressing need for sustainable, efficient, and safe mobility solutions. The market combines intelligent transportation systems (ITS), advanced data analytics, connected vehicles, autonomous technologies, and cutting-edge infrastructure to address increasing transportation challenges, including congestion, pollution levels, energy usage issues, and road safety concerns. Worldwide collaboration among government sectors, along with private enterprises, including technology innovators, works hard to establish smart transport ecosystems that utilize real-time information accuracy achieved through automation and connectivity, enabling the optimized movement of both people’s commutes and goods across vast areas, from within city streets to between-city travel corridors alike.

Smart transportation involves the cutting-edge integration of modern technologies, data-driven systems, and innovative mobility solutions designed to enhance the efficiency, safety, sustainability, and convenience of transportation networks in urban, suburban, and inter-urban areas. This aspect marks a significant advancement in the transportation sector, achieved by merging information and communication technologies (ICT), artificial intelligence (AI), the Internet of Things (IoT), cloud computing, and advanced analytics to develop interconnected, intelligent transit ecosystems. The primary goal is to transform conventional static transport systems into dynamic ones centred on users' needs, which can swiftly adapt to real-time conditions while addressing societal demands. As a result, it alleviates congestion, enhances safety, reduces environmental impacts & improves overall travel experiences for both passengers and freight operators alike.

Get an overview of this study by requesting a free sample

Increasing Demand for Sustainable and Green Mobility Solutions – The global shift towards sustainable development and environmental conservation has significantly fuelled the growth of the smart transportation market. As concerns about climate change, air pollution, and dwindling fossil fuel resources intensify, both governments and consumers are increasingly seeking eco-friendly transportation options. Smart transportation technologies support sustainability by enhancing traffic management, minimising vehicle idling time, and promoting low-emission and electric vehicles. Furthermore, integrated Mobility-as-a-Service (MaaS) platforms facilitate multimodal transportation by combining walking, cycling, car-sharing, public transit, and electric scooters. This approach helps decrease dependence on private cars. Electrifying public transport fleets, integrating renewable energy sources with charging networks, and establishing low-emission zones further enhance the market's focus on sustainable growth. Cities around the globe are increasingly adopting smart transportation solutions to achieve carbon neutrality targets, comply with international climate agreements, and foster healthier living environments. This factor contributes to the growth and development of the global smart transportation market.

Cybersecurity Risks and Data Privacy Concerns – As smart transportation systems grow more digital and interconnected, cybersecurity threats and data privacy issues have become significant challenges in the market. These intelligent transportation systems depend on the smooth exchange of real-time data between vehicles, infrastructure, and cloud platforms. However, this level of interconnectivity also makes them vulnerable to potential cyberattacks such as hacking, ransomware attacks, or other forms of malicious activities. Such cyber incidents could lead to traffic signal tampering, unauthorised vehicle access, service interruptions, or even accidents within those networks. Additionally, breaches in data privacy may result in the exposure of sensitive user information such as travel patterns, payment details, and personal identification. This situation heightens serious concerns about data ownership, user consent, and adherence to regulations. As a consequence, governments and transportation providers are under mounting pressure to adopt robust cybersecurity protocols alongside encryption measures and access controls—factors that further complicate and increase the expense of implementing smart transportation systems.

Growing Popularity of Mobility-as-a-Service (MaaS) – Mobility-as-a-Service (MaaS) has become a transformative force in the transportation industry, significantly advancing the smart transportation market. MaaS platforms unify various transport modes into cohesive, app-based digital services that allow users to plan, book, and pay for multimodal trips seamlessly. By providing convenient on-demand access to diverse transport options—such as public transit, ride-hailing services, car-sharing programs, bike-sharing systems, and micro-mobility solutions—MaaS minimizes reliance on personal vehicle ownership while encouraging shared mobility models. This transition towards service-oriented mobility aligns with the objectives of smart transportation by reducing congestion levels, optimizing resource usage, and minimizing environmental impact. Numerous cities are conducting MaaS pilot projects or implementing full-scale solutions to address urban mobility challenges and promote integrated transportation networks. This factor is anticipated to provide lucrative growth opportunities in the upcoming years.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global smart transportation market, with a 34% market revenue share in 2024.

The region, primarily encompassing the U.S. and Canada, leads in smart transportation innovation thanks to its early emphasis on intelligent transportation systems (ITS), connected vehicles, and autonomous mobility solutions. The United States holds a particularly dominant position within the North American market due to proactive initiatives from federal and state governments, strong public-private partnerships, and substantial investments by major technology and automotive firms. Initiatives such as the Smart City Challenge by the U.S. Department of Transportation, efforts by the Federal Highway Administration's ITS Joint Program Office, and numerous autonomous vehicle testing projects have significantly accelerated the adoption of advanced mobility solutions nationwide. In summary, North America's established technology ecosystem, extensive vehicle ownership rates, and substantial research and development efforts in autonomous driving, artificial intelligence, and 5G connectivity come together to establish the region as a global leader in smart transportation deployment.

North America Region Smart Transportation Market Share in 2024 - 34%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The service segment is divided into cloud services, professional services and business services. The cloud services segment dominated the market, with a market share of around 44% in 2024. The segment is expected to maintain its leading position throughout the forecast period due to its ability to manage large volumes of data generated by mobile technology and sensors. As technologies such as big data and cloud computing continue to evolve, their role in transportation systems becomes increasingly vital. Cloud platforms provide secure storage facilities and processing capabilities that support traffic forecasting. Additionally, the growing adoption of machine learning, data analytics, IoT, and cybersecurity will influence smart transportation projects during the forecasted years.

The solution segment is divided into ticketing management system, traffic management system, integrated supervision system and parking management system. The ticketing management system segment dominated the market, with a market share of around 35% in 2024. As transportation agencies and mobility operators globally transition towards digitised, contactless, and integrated fare collection methods, these systems have become increasingly vital. In the past, public transportation relied on manual ticketing or magnetic stripe cards; however, technological advancements and a demand for enhanced operational efficiency have driven the widespread adoption of smart ticketing systems. The widespread use of Ticketing Management Systems across metro systems, bus networks, suburban railways, ferries, and shared mobility services, such as e-scooters and bike-sharing, is a key factor in their significant market share. Smart ticketing platforms offer seamless fare payment options through various methods, including mobile apps, smart cards, NFC (Near Field Communication), RFID (Radio Frequency Identification), QR codes, and contactless credit or debit cards. These systems help reduce operational costs by decreasing the need for cash handling and manual processing while enhancing passenger convenience with multi-modal unified ticketing across different transport modes.

The transportation mode segment is divided into roadways, airways, railways, and maritime. The roadways segment dominated the market, with a market share of around 39% in 2024. Roadways continue to dominate the smart transportation market due to the widespread implementation of Intelligent Transportation Systems (ITS), advanced traffic management technologies, electronic toll collection systems, smart parking solutions, and vehicle-to-infrastructure (V2I) communication platforms. To enhance traffic flow and reduce delays, tools such as smart traffic lights, adaptive signal control technologies, dynamic message signs, and road weather information systems (RWIS) are being extensively utilized. Additionally, the growing adoption of road user charging methods, such as congestion pricing and tolling, is helping to curb excessive private vehicle use while providing funding for infrastructure projects.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 120.98 Billion |

| Market size value in 2034 | USD 396.37 Billion |

| CAGR (2025 to 2034) | 12.6% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Service, Solution and Transportation Mode |

As per The Brainy Insights, the size of the global smart transportation market was valued at USD 120.98 billion in 2024 to USD 396.37 billion by 2034.

Global smart transportation market is growing at a CAGR of 12.6% during the forecast period 2025-2034.

The market's growth will be influenced by growing popularity of Mobility-as-a-Service (MaaS).

High capital investments could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global Smart Transportation market based on below mentioned segments:

Global Smart Transportation Market by Solution:

Global Smart Transportation Market by Service:

Global Smart Transportation Market by Transportation Mode:

Global Smart Transportation Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date