- +1-315-215-1633

- sales@thebrainyinsights.com

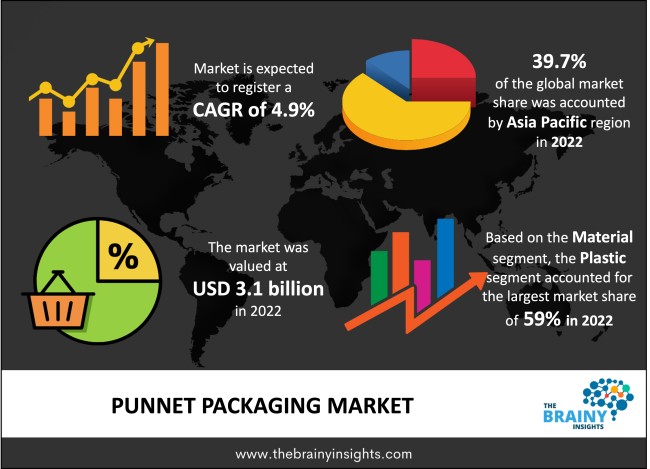

The global punnet packaging market was valued at USD 3.1 billion in 2022, growing at a CAGR of 4.9% from 2023 to 2032. The market is expected to reach USD 5.0 billion by 2032. The two main reasons contributing to the punnet packaging market's growth are the horticulture industry's increasing use of punnet packaging and the food and beverage industry's continued growth and expansion.

A punnet is a small, compact basket that packages soft fruits and vegetables like mushrooms, grapes, berries, and cherries. Because the punnet packaging keeps soft fruits and vegetables from bruising, squashing, or rotting, it extends their shelf life. Punnet packaging is classified into many types based on the materials used, including paper, moulded fibre, and plastics. Punnets made of plastic are widely used as a practical method of packaging fresh soft fruits. Manufacturers are concentrating on recycling plastic punnets to meet regulatory standards for product safety as a secure alternative for effective food storage. Punnet packaging is becoming more popular owing to its ease of use and recyclable nature, bucking the global trend away from traditional packaging. Due to the growing need for punnet packaging for horticulture output, the market is anticipated to expand. R-PET or recyclable polyethene films and polypropylene thin gauge sheets replace traditional polypropylene punnet packaging for mushroom storage because they can have a smaller environmental impact.

Get an overview of this study by requesting a free sample

In February 2022, the government implemented the Plastic Packaging Tax in the UK. The new rule states that any plastic packaging produced or imported into the UK containing less than 30% recycled plastic would be subject to a pound-toned tax of £200 per tonne. Unless the opposite can be shown, it is presumed that a plastic packaging part contains less than 30% recycled plastic. To help customers comply with the impending strict tax system, PET punnet manufacturer and exporter AVI Global Plast introduced ready-to-adopt rPET or recycled PET punnets with 30% post-consumer recycled content, typically recycled bottles. This was confirmed by international certification and testing company InterTek. These punnets can all be recycled.

In November 2022, Nespak, a sustainable Guillin Group member, unveiled Securipack, a state-of-the-art plastic punnet with integrated tamper evidence. Securipack presents a novel option for people looking for packaging that blends sustainability, usability, style, and security. It's a brand-new, fully recyclable rPET punnet with a seal button. The bag may go anywhere, including the car, the office, and the classroom. The seal cracks when the punnet is first opened, but it is easy to close again, owing to the moveable top. After the punnet has been expanded, the lid is left connected to prevent it from lying around and endangering the environment. The gadget is highly conspicuous, has a great design, and is easy to use.

In January 2023, An investment of €11 million was made in Solidus' Future packaging solutions, including punnets, skin packaging and modified atmosphere packaging (MAP). Benelux, Germany, France, Poland, the UK, and Spain have already received the product line. The company claims that its skin and MAP packaging solutions require at least 80% less plastic and are easily detached, making it possible to recycle paper-based components after usage. With slight adjustments to the current packaging technology, the trays allow the transition from plastic to paper packaging. Because skin packaging uses deep vacuum technology to increase product shelf life and decrease the need for protective packaging fillers, it is a more affordable option than other techniques.

The growing need for environmentally friendly substitutes for plastic packaging- Plastic packaging bans are spreading worldwide. For example, over the next few years, France will gradually outlaw the use of plastic wrap for fruits and vegetables. Given the EU criteria, other European countries are expected to follow France's example. Furthermore, the market is becoming more and more in need of environmentally friendly packaging. Smart Packaging Solutions developed sustainable punnets in response to this expanding demand. Our creative fruit and vegetable punnets solve the growing demand for consumer packaging that is less environmentally harmful. Lightweight solid cardboard is the ideal material to pack plums, berries, tomatoes, pears, Brussels sprouts, and other produce since it is strong and durable.

Growing cost of raw materials- The punnet is one of the main components used in food packaging. Punnet packaging is made of PET plastic, which is transparent, lightweight, semi-rigid, and features lockable caps. The price fluctuations of certain raw materials impact the punnet packaging industry. Laws enacted by the government and organisations dedicated to resource conservation are driving up the cost of these raw materials and impeding the growth of the punnet packaging market. Punnet packaging solutions cannot advance technologically due to a shortage of easily accessible raw materials. Due to the increasing cost of raw materials, many new packaging technologies are becoming prohibitively expensive, forcing businesses to rely on conventional packaging, which has a negative impact on the economy and the environment.

Growing demand for exotic packaging of fruits and vegetables- Punnet packing costs are rising due to the increased demand for exotic packaged fruits and vegetables brought on by rising personal discretionary income and population. Customers' search for nutrient-dense foods that are better for their diets has increased the demand for fruits and vegetables. Many economies import goods from other producing nations to meet the growing demand for fruits and vegetables, encouraging the growth of punnet packaging enterprises. In addition, European consumers are becoming more curious about novel fruit varieties and flavours. In Northern Europe, most imported items raise the price of exotic fruit on the market. Every year, imports of higher-value exotics surpass imports. Packaging is becoming more and more necessary as the market expands. As a result, an increasing need for exotic fruits and vegetables is driving the punnet packaging business.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the largest global punnet packaging market, with a 39.7% market revenue share in 2022.

This is because of the packaging industry's growth and increased urbanisation, industrialisation, and globalisation. Due to the food and beverage industry's growing use of punnet packaging, China, India, Malaysia, and Japan will become major contributors to this region. The region's growing emphasis on packaged fruits and vegetables has aided the punnet packaging market growth.

Asia Pacific Region Punnet Packaging Market Share in 2022 - 39.7%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The material segment is divided into plastic and paper. The plastic segment dominated the market, with a market share of around 59% in 2022. Globally, PET and polypropylene are the two most often utilised materials in the production of plastic punnets. Several well-known industry competitors are concentrating on creating plastic punnet packaging options to stay competitive. For example, INFIA Srl, a well-known manufacturer of fruit packaging solutions, offers a range of plastic punnets made from recycled PET and polypropylene. Plastic punnets are a popular and simple way to store fresh food. Customers find it difficult to recycle them even though they are not recyclable and are composed of many types of plastic. Furthermore, plastic punnets cannot absorb moisture from food like fruit can, so they have a lower shelf life.

The capacity segment is divided into 150 gm, 151-300 gm, 301-500 gm, and over 500gm. The 301-500 gm segment dominated the market, with a market share of around 34% in 2022. It is utilised as most retail chains sell leafy greens in cans that hold up to 150 g of leafy vegetables and 400 g of berries or other soft fruits. In addition, a significant market growth rate is anticipated for the 150–300 gm category. These two volume sizes are used to package most fresh fruits and vegetables. Reputable businesses also offer various plastic punnets in different packing sizes.

The application segment is divided into frozen food, meat and seafood, vegetables and fruits, poultry, and ready-to-eat food. The vegetables and fruits segment dominated the market, with a market share of around 28% in 2022. Since fruits and vegetables are particularly perishable, safer packing techniques are needed. Punnet packaging methods can shield Fruits and vegetables against pest damage, microbiological deterioration, and transportation concerns. Fruits and vegetables have a longer shelf life when stored in punnet boxes. During the forecast period, the segment's growth will be bolstered by the growing e-commerce sales of fruits and vegetables and the increased emphasis on packaged fruits and vegetables.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2022 | USD 3.1 Billion |

| Market size value in 2032 | USD 5.0 Billion |

| CAGR (2023 to 2032) | 4.9% |

| Historical data | 2019-2021 |

| Base Year | 2022 |

| Forecast | 2023-2032 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Material, Capacity, Application |

As per The Brainy Insights, the size of the punnet packaging market was valued at USD 3.1 billion in 2022 to USD 5.0 billion by 2032.

The global punnet packaging market is growing at a CAGR of 4.9% during the forecast period 2023-2032.

Asia Pacific emerged as the largest punnet packaging market.

This study forecasts global, regional, and country revenue from 2019 to 2032. The Brainy Insights has segmented the global punnet packaging market based on the below-mentioned segments:

Global Punnet Packaging Market By Material:

Global Punnet Packaging Market By Capacity:

Global Punnet Packaging Market By Application:

Global Punnet Packaging Market By Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date