- +1-315-215-1633

- sales@thebrainyinsights.com

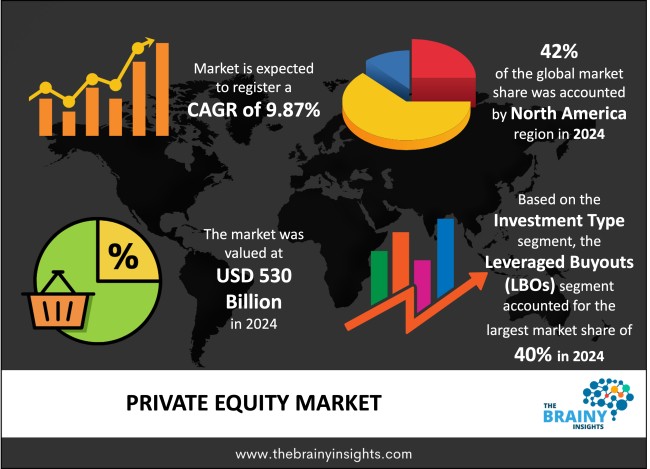

The global private equity market was valued at USD 530 billion in 2024 and grew at a CAGR of 9.87% from 2025 to 2034. The market is expected to reach USD 1358.52 billion by 2034. The possibility of higher returns will drive the growth of the global private equity market.

Private equity describes investments made for acquiring share or full ownership control of unlisted private businesses. Private equity firms alongside venture capitalists and angel investors combine investment funds from institutional as well as high-net-worth individuals to make these purchases. Private equity investments achieve multiple goals which start with buying substantial ownership stakes in companies and transform them for improved productivity and profitability before selling the acquired stake at a premium value. Private equity firms conduct operations using four main strategies such as leveraged buyouts (LBOs) and venture capital alongside growth capital and distressed investments. Leveraged buyouts represent the main private equity strategy because investment groups unite funding from both equity and debt to purchase companies which they further develop through operational enhancements. Private equity includes venture capital as one of its branches which provides funding for emerging startups with strong potential for growth. The strategy of growth capital involves investing capital in existing companies which plan extended operations or business structure changes whereas distressed investments bring funds to struggling businesses so they can be rehabilitated. Private equity substantially impacts financial operations because it supplies financial resources while offering business guidance combined with operational efficiencies to generate employment and propel economic growth and innovation. The liquidity of PE investments remains low during the entire investment period because investors need to commit funds for a minimum of five to ten years.

Get an overview of this study by requesting a free sample

Emerging economic markets – Private equity spending has substantially increased because of worldwide economic integration and fast-developing developing marketplaces. Privat equity firms expand their investments beyond traditional North American and European markets to pursue business opportunities across emerging economies in Asia, Latin America and Africa. The regions present an engaging investment environment because their middle-class expansion, increasing consumer market and growing urban populations. Technological adoption together with developing legal frameworks enable business expansion and profitability to thrive. Private equity investors choose emerging markets to invest in sectors with strong performance including infrastructure and healthcare among others income elevation and positive population statistics drive their rapid growth. The capital needs of many family-owned firms and small to medium-sized enterprises in these regions merge perfectly with PE firms' ability to deliver both capital and operational guidance. The established partnerships facilitate achievement of multifaceted benefits because the firms help local businesses expand their scope of operation alongside professional development. Globalization allows PE-backed companies in emerging markets to access international talent together with technology and cross-border capital leading to their global competitiveness.

Economic uncertainties – Severe limitations exist for private equity investments which decrease investor interest because they include high-risk profiles and illiquidity along with unpredictable economic conditions. The degree of public stock market tradability does not exist for private equity investment assets. Investments in private equity generally force investors to maintain their funds inside the asset for periods exceeding five to ten years. Private investments may discourage investors who want fast fund access because they lack liquidity. Private equity presents high levels of risk because investors typically support business restructurings of struggling companies or support untested ventures that might lead to negative results. The private equity market suffers direct impacts from economic instability along with unpredictable market conditions. Fundamental changes in worldwide conditions such as political upheaval or rising prices or disease outbreaks cause investors to decrease their investment risk tolerance. Strong economic uncertainties encourage investors to move toward safer investment assets thereby causing capital reduction for private equity funds.

Underperforming public equity – The market demand for private equity steadily increases because of subpar public market performance. Investors turn to alternative options because public markets have demonstrated declining stability and diminished returns and minimal growth throughout recent years. Investors find private equity more attractive than public markets because it combines an active ownership model and long-term value creation strategy which produces stable performance together with higher returns. The total private equity investments among pension funds and sovereign wealth funds and insurance companies keep growing steadily. Their investment in private equity is motivated by their requirements for portfolio diversification as well as higher yields together with the capability to pair long-term liabilities to long-term investments. Private equity now has large investment opportunities because industry-wide digital transformation enables high-growth businesses that use technology.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global private equity market, with a 42% market revenue share in 2024.

The region leads the global private equity market due to its developed financial system, depth of capital markets and robust legal framework while having many institutional investors. Blackstone, KKR and Carlyle lead numerous private equity companies with headquarters in the United States that execute major investment projects throughout various market sectors. Technology sector strength within the U.S. primarily through Silicon Valley and its related innovation centres encourages substantial venture capital and private equity monetary investments. The entrepreneurial business culture and willingness to take risks creates an active commercial atmosphere perfect for private equity operations. Global investors feel secure about investing in North America because its regulatory and legal protocols provide protection as well as transparency.

North America Region Private Equity Market Share in 2024 - 42%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The investment type segment is divided into leveraged buyouts (LBOs), venture capital, growth capital, distressed investments and mezzanine financing. The leveraged buyouts (LBOs) segment dominated the market, with a market share of around 40% in 2024. Leveraged buyouts (LBOs) remain the leading investment approach in the worldwide private equity market since they capture the majority of transaction value and deal numbers. A private equity firm acquires control of a company through borrowed funds by using acquired assets as loan security in LBO transactions. Through this method PE firms can accomplish major acquisitions by investing minimal equity funds which results in amplified financial returns when their investments succeed. These investments rule the market because they create substantial profit by implementing financial transformations and operational effectiveness alongside strategic corporate transformations. LBOs succeed best in companies that generate consistent cash flow from stable businesses with existing market dominance. LBOs used cheap debt during periods of low interest rates which made the strategy even more appealing to financial buyers and resulted in a significant increase in its popularity.

The fund type segment is divided into buyout funds, venture capital funds, growth funds, fund of funds, mezzanine funds and distressed asset funds. The buyout funds segment dominated the market, with a market share of around 37% in 2024. Global private equity demonstrates buyout funds as its prototypical fund structure because they gather most capital pool investment and implement the largest volume of deals along with managing the biggest concentration of assets under management. The fund's control over financial markets arises from their capacity to generate reliable risk-adjusted returns and produce predictable cash flows. Buyout funds find success with institutional investors who prefer stable investments and scalable opportunities because of their mechanisms. Fund managers operating buyout funds have the freedom to select different exit options including IPOs as well as strategic sales and recapitalizations due to adjustable market-specific strategies. The private credit market expansion has contributed to their dominance through financial support for major transactions.

The industry vertical segment is divided into technology, healthcare, financial services, consumer goods & retail, industrial & manufacturing and energy & utilities. The technology segment dominated the market, with a market share of around 35% in 2024. Private equity companies focus more often on tech businesses because these businesses demonstrate growth potential through flexibility combined with steady revenue streams alongside abundant profits and disruptive capacity. The technological sector establishes value faster than conventional sections while needing less funding capital. These firms maintain dependable cash flow streams through subscription-based income and strong customer retention which makes them appealing for leveraged buyout transactions and return generation. The global digitalization movement now occurring across industries has significantly increased market demand for tech solutions thus enhancing the sector's total attraction. The active management approach of private equity firms attracts both established tech companies and mid-sized fast-growth enterprises which need improved professionalization and rapid scaling.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 530 Billion |

| Market size value in 2034 | USD 1358.52 Billion |

| CAGR (2025 to 2034) | 9.87% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Investment Type, Fund Type and Industry Vertical |

As per The Brainy Insights, the size of the global private equity market was valued at USD 530 billion in 2024 to USD 1358.52 billion by 2034.

Global private equity market is growing at a CAGR of 9.87% during the forecast period 2025-2034.

The market's growth will be influenced by emerging economic markets.

Economic uncertainties could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global private equity market based on below mentioned segments:

Global Private Equity Market by Investment Type:

Global Private Equity Market by Fund Type:

Global Private Equity Market by Industry Vertical:

Global Private Equity Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date