- +1-315-215-1633

- sales@thebrainyinsights.com

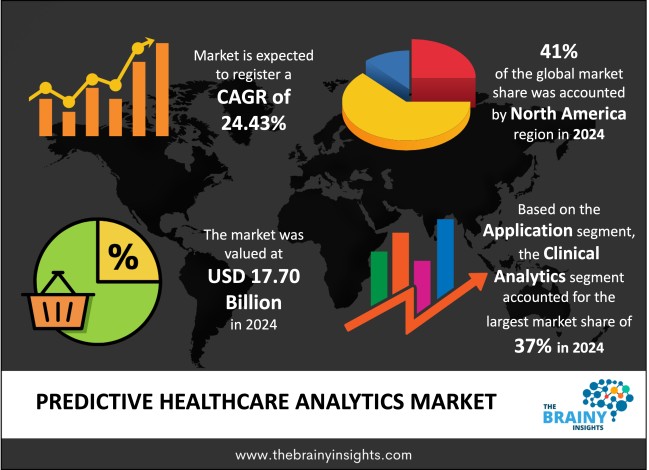

The global predictive healthcare analytics market was valued at USD 17.70 billion in 2024 and grew at a CAGR of 24.43% from 2025 to 2034. The market is expected to reach USD 157.47 billion by 2034. The increasing healthcare expenditure will drive the growth of the global predictive healthcare analytics market.

Predictive healthcare analytics uses data, mathematical techniques and machine learning tools to predict what may happen in healthcare based on what has already occurred. It is important for helping healthcare shift from responding to problems to predicting and addressing them in advance which is considered a more proactive approach. Predictive analytics helps healthcare providers determine how diseases will progress for patients, how likely they are to need to be hospitalized again, how they will react to different treatments and when outbreaks might happen with the already existing patient data sets. Chronic disease management is a major use of predictive analytics in healthcare. As a result, medical teams can use models to pinpoint patients who are more likely to get diabetes, heart disease or cancer, so they can give them personal attention and proper care. Predictive models can also help hospitals predict the number of patients who will need to be admitted, so that staff and resources are used wisely. The system makes it possible for clinicians and administrators to take timely actions because of its real-time information. Staying on top of diseases, understanding community risks and planning the right responses are enabled with the use of predictive models in public health. Even so, implementing predictive healthcare analytics does pose certain problems. Issues related to privacy, connecting and integrating various kinds of data and biased algorithms.

Get an overview of this study by requesting a free sample

The evolving healthcare landscape worldwide – Growing demand for predictive healthcare analytics comes from new and developing needs and priorities in healthcare. Hospitals and clinics predict patient admissions, spot patients at higher risk and decrease the chances of expensive readmissions using predictive analytics. The growing emphasis on value-based care has led to an increasing need and demand for tools that encourage preventive care and personal treatment options. The rise in EHRs has given a strong push to the development of predictive analytics. Since EHRs record both well-structured and unstructured data about patients, these data support the construction of predictive models. The use of data allows providers to make wise decisions and boost how they provide care. A major issue is that chronic diseases like diabetes, heart problems and cancer are putting more of a burden on people’s health. Dealing with these long-term diseases is becoming a priority for healthcare and prediction tools help them plan for complications, keep an eye on how the conditions develop and make sure treatments are effective. Working together, these drivers show the overall aim of the industry to increase patient satisfaction, manage healthcare costs better and provide properly informed services.

Integration challenges, insufficient skilled operators and high acquisition costs – A particularly big issue is that companies’ data is often in separate silos and systems. Patient information is spread out across various parts of the organization making it difficult to bring data together, clean it and use it effectively. The information used can be unreliable due to errors, gaps in records and disorderly documents which leads to unreliable results. A serious issue is that companies often lack people with the required skills to create and run predictive analytics systems. Most healthcare groups have people without data science, machine learning and healthcare informatics knowledge which hinders them from making sense of complex information. Besides, there are times when workers oppose new technology given the prevalence of job insecurity. Worries about disruption, complications or losing their role in decision-making leads to many healthcare providers resisting the us of new healthcare tools. Furthermore, small and mid-sized health organizations may not be able to use EHRs given the high costs associated with predictive healthcare analytics. Along with getting advanced tools and equipment, predictive analytics requires employers to spend on staff education, support IT changes and ensure ongoing support.

Increasing budget allocations for the healthcare sector across global economies – The increase in demand for predictive healthcare analytics is driven mainly by wider changes in technology, laws, the economy and society affecting the healthcare field. Big data technologies, AI and machine learning have led to easier and cheaper ways to tackle the huge amounts of healthcare data involved. Therefore, healthcare systems can now rely on accurate and scalable models attributed to the advancements in the said technologies making it more useful and applicable for them. Healthcare analytics are greatly influenced by government policies and regulatory protection. Health reforms throughout the world motivate the use of digital tools in healthcare which supports investments in predictive analytics. The rise in healthcare costs worldwide is motivating governments, insurers and healthcare businesses to look for data-based approaches to improve results and spending down the line. Situations such as the COVID-19 pandemic have highlighted the need for better use of predictive tools in detecting outbreaks early, forecasting the spread of illness and preparing for emergencies. Consequently, public health organizations and governments are putting more effort into using predictive analytics as an important tool to better the healthcare infrastructure.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global predictive healthcare analytics market, with a 41% market revenue share in 2024.

The leading position of North America in this market is mostly because of its well-developed healthcare infrastructure, broad use of health information technology and regulatory support for using data in making clinical choices. Of all countries, the United States is investing heavily in electronic health records (EHRs), artificial intelligence (AI) and machine learning technologies within the region. The strength of the region is reinforced by the support of government policies. Hospitals and physician networks now use digital health technologies and data analytics more widely because of the HITECH Act and incentives included in the Affordable Care Act. North America is also home to many important predictive analytics suppliers, technology providers and research groups that continuously improve technology and support in healthcare. The area is supported by laws that encourage new ideas and also require strict protection of personal data such as adherence to HIPAA standards. Currently, more attention is given to value-based care and managing populations, both of which depend strongly on predictive tools to spot at-risk groups, tailor treatments to different needs and watch how patients respond.

North America Region Predictive Healthcare Analytics Market Share in 2024 - 41%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The application segment is divided into clinical analytics, financial analytics, operational & administrative analytics and population health analytics. The clinical analytics segment dominated the market, with a market share of around 37% in 2024. Clinical analytics allows healthcare providers to forecast illnesses, stay informed on chronic diseases, assess possible risks to patients and help prevent hospital readmissions using data collected in the past. It proves crucial for cardiovascular, diabetes and cancer cases because providing timely and appropriate treatment leads to better outcomes and saves money. Clinical analytics are getting more attention given the rising demand for value-based care. Through the use of clinical analytics, organizations can identify at-risk patients, design better treatment plans and make evidence-based decisions which improves patient outcomes, saves time, money and resources. EHR systems, wearable tech and health AI are now used which gives doctors access to more accurate and useful information for clinical use. Clinical analytics is vital in the area of managing the health of populations and providing preventive care which is now growing in popularity around the world.

The deployment mode segment is divided into on-premise and cloud-based. The cloud-based segment dominated the market, with a market share of around 67% in 2024. Most companies in the predictive healthcare analytics market are now choosing cloud-based deployment given its flexibility, ability to expand and cost savings. Healthcare organizations can use analytical tools on the cloud without making big investments or ongoing maintenance costs. Small and medium-sized healthcare facilities that need to save money find it easier to get advanced analytics given the affordability offered by cloud-deployment model. Cloud deployment stands out because it lets people from different departments collaborate in real time using the same data. Platforms in the cloud facilitate the linking of EHRs, medical devices and other digital health systems, resulting in a comprehensively integrated system. Besides, having a system in the cloud means it can be implemented more quickly, regularly updated with software and best of all, includes strong recovery features that reduce downtime. Since the pandemic, maintaining remote healthcare is now more important which has sped up the move to cloud solutions because they help with telehealth, home monitoring and dispersed care. Additionally, advancements in cloud-computing, encryption and compliance with regulations are ensuring better security for data.

The end-user segment is divided into healthcare providers, insurance companies, pharmaceuticals and government agencies. The healthcare providers segment dominated the market, with a market share of around 58% in 2024. Healthcare providers lead the predictive healthcare analytics market given their central role in patient care and their access to a lot of clinical information. Hospitals, clinics and specialty care centres are always working to raise the quality of patient care, cut back on readmissions and make better use of resources. They can meet their objectives with the help of predictive healthcare analytics by reviewing patient backgrounds, spotting those at danger, estimating disease outcomes and encouraging decisions based on solid research. Paying more attention to value and patients in healthcare has encouraged providers to rely more on predictive analytics. Health providers are expected to provide quality medical care by effectively optimizing resources at disposal. Using predictive tools, they can manage chronic conditions, lower the number of emergencies, improve resource allocation and link their healthcare performance to budget needs. Furthermore, providers can take advantage of the link between analytics and Electronic Health Records which are used everywhere now. Also, after the pandemic, providers are quickly adopting new digital technologies for health care to improve care using telehealth, remote monitoring and early detection solutions. Healthcare providers are the largest group of users in predictive healthcare analytics because they are key in healthcare delivery and require data to make informed decisions.

The component segment is divided into services, software and hardware. The services segment dominated the market, with a share of around 37% in 2024. Services are the main segment in the predictive healthcare analytics market because they play a key role in set-up, adaptation and ongoing back-up of analytic platforms. Even though software and platforms are required, the real power of predictive analytics comes from service offerings of consulting, integration, training and maintenance. More healthcare companies are requesting consulting services because they help evaluate data preparation, pick suitable analytical resources and plan the best ways to apply them. Further growth in the segment is being fuelled by training and support services. After deployment, support helps ensure systems keep operating well, stay current with software updates and are up to date with the latest rules. The service segment is vital because it helps translate technology into clinical practice which is why it dominates predictive healthcare analytics.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 17.70 billion |

| Market size value in 2034 | USD 157.47 billion |

| CAGR (2025 to 2034) | 24.43% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Application, Deployment Mode, End-User and Component |

As per The Brainy Insights, the size of the global predictive healthcare analytics market was valued at USD 17.70 billion in 2024 to USD 157.47 billion by 2034.

Global predictive healthcare analytics market is growing at a CAGR of 24.43% during the forecast period 2025-2034.

The market's growth will be influenced by the evolving healthcare landscape worldwide.

Integration challenges, insufficient skilled operators and high acquisition costs could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global predictive healthcare analytics market based on below mentioned segments:

Global Predictive Healthcare Analytics Market by Application:

Global Predictive Healthcare Analytics Market by Deployment Mode:

Global Predictive Healthcare Analytics Market by End-User:

Global Predictive Healthcare Analytics Market by Component:

Global Predictive Healthcare Analytics Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date