- +1-315-215-1633

- sales@thebrainyinsights.com

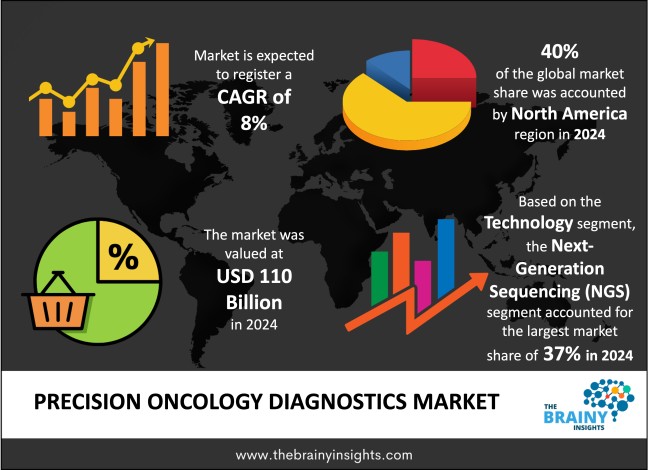

The global precision oncology diagnostics market was valued at USD 110 billion in 2024 and grew at a CAGR of 8% from 2025 to 2034. The market is expected to reach USD 237.48 billion by 2034. The increasing incidence and prevalence of cancer will drive the growth of the global precision oncology diagnostics market.

Precision oncology diagnostics involves testing a cancer patient’s genes, molecules and cells to find the best treatment. Unlike previously available cancer drugs, precision oncology uses personal information about a tumour to choose treatments that work more effectively while sparing patients from possible side effects. Most modern precision oncology techniques such as next-generation sequencing (NGS) and polymerase chain reaction (PCR), rely on molecular profiling. Clinicians use these tools to spot genetic changes, gene expression, epigenetic effects and biomarkers that contribute to cancer. Detecting changes in BRCA1/2, EGFR or KRAS genes can show if a patient will benefit from targeted treatment or immunotherapy. In precision oncology, companion diagnostics mean tests that help decide whether a person is suitable for a certain drug. With this way of working, the correct drugs are provided to the correct patients when needed, making the most of efforts and avoiding pointless treatments. Matching bioinformatics technology with artificial intelligence has improved the precision of oncology. The use of these technologies makes it possible to review genomic data rapidly and accurately for clinical analysis. Advances in precision oncology diagnostics are improving cancer care by helping catch the disease early, giving accurate predictions and watching how the patient responds to treatment.

Get an overview of this study by requesting a free sample

The rising incidence of cancer worldwide and technological advancements – The reasons behind increased demand for precision oncology diagnostics have to do mainly with the increasing incidence and prevalence of cancer worldwide, new technological developments and industry changes. A major reason for this is that NGS technology has now made acquiring accurate genetic information faster, comprehensive and more affordable. Doctors can identify particular genetic mutations and biomarkers that help choose the right therapy for each person’s cancer because of these new techniques. AI and bioinformatics are now being integrated into the ways laboratories diagnoses diseases. They support the study of difficult genomic information, resulting in quicker, accurate and more reliable diagnoses. AI helps create predictions and offers tailored advice for diagnosis which adds more value to precision diagnostics. Targeted therapies and companion diagnostics are becoming more available and popular which is fuelling the demand for targeted cancer medicines. Additionally, less invasive techniques such as liquid biopsy, are changing the way diagnostics are carried out. Using these devices, changes in cancer and its response to treatment can be quickly detected with simple blood tests, so surgery is needed less often and diagnostics are simpler for patients. The combination of advances in diagnostics, use of AI and changes in oncology practice is leading to a rapid growth in demand for precision oncology diagnostics.

High costs, technical and operations hurdles associated with precision oncology diagnostics – A major obstacle is that many precision diagnostic tests are expensive. Technologies such as NGS and whole-genome profiling are associated with expensive equipment, chemicals and trained staff making it hard for both healthcare providers and patients to use them, especially in developing countries. Data interpretation can also be extremely complicated. Since precision oncology produces a huge volume of genetic and molecular data, it must be analysed by expert professionals and advanced computer tools. Yet, many clinicians find it hard to use these new tools since the training is often unavailable or restricted, resulting in unclear choices about treatment or not using test results to the fullest. In some cases, even with precise diagnostics, the usefulness for clinical treatment is not well defined. Although these drugs are very effective for lung, breast and melanoma cancers, many other forms of cancer do not have useful biomarkers or approved targeted treatments. Because of this, there are doubts about how widely these tests are useful. Since standards and validation are lacking in lab equipment and solutions, the adoption is even more difficult. Using different measures and methods for testing, preparing results and understanding findings often results in inconsistency and can reduce doctors’ confidence when planning treatments.

Increasing healthcare investment and supportive regulatory framework – the rising incidence and prevalence of cancer worldwide has led to a strong demand for better and faster ways to diagnose and treat patients. Healthcare providers are turning more often to precise oncology diagnostics to detect cancer in early stages and offer effective personalized treatments given the rising number of cancer patients. In addition, there is now a shift globally toward personalized medicine, as patients, medical professionals and policymakers realize the benefits of personal care plans over the same care for all. The government and private companies are playing an important role too. government funding, supportive laws and regulations and help from private entities is fostering an environment for the growth of precision oncology diagnostics globally. furthermore, the rising awareness about cancer, the importance of early screening and the availability of modern medicine in the general populace is also driving the market’s growth. Because patients are now more aware of different medical technologies and remedies, they are more interested in getting treatments designed specifically for them. Increased health care spending and expanded medical facilities in developing countries are giving new opportunities to precision oncology diagnostics. They are increasing their use of advanced testing, helping spread the use of personalized cancer treatment worldwide.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global precision oncology diagnostics market, with a 40% market revenue share in 2024.

This region has a developed healthcare system, supported by well-known hospitals, doctoral research entities and advanced diagnostic laboratories. A key reason North America leads is the huge investment in research and development made by both government and private companies. In the United States, much of the world’s financial support for precision medicine is concentrated on NGS, identifying biomarkers and improving companion diagnostics. Thanks to its powerful research and development community, it’s possible to create and commercialize new diagnostic tests driving the regional market’s growth. The region is aided by regulations that make it faster and easier for precision oncology diagnostics to get approval and become available. On top of this, having many cases of cancer and more people aware of their health is why demand for new kinds of diagnostics and targeted drugs is rising.

North America Region Precision Oncology Diagnostics Market Share in 2024 - 40%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The technology segment is divided into Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), In Situ Hybridization (ISH), Immunohistochemistry (IHC), Microarray and others. The Next-Generation Sequencing (NGS) segment dominated the market, with a market share of around 37% in 2024. NGS is leading the way in precision oncology diagnostics given its unique high-throughput genome analysis. NGS is different from PCR and microarrays because it can test hundreds of thousands of fragments in one look, uncovering mutations and biomarkers in different genes all at the same time. The importance of this capacity appears in oncology, as spotting many forms of genetic changes helps doctors choose the best targeted treatments. Scalability and speed are among the main benefits of NGS. Improvements in sequencing technology and lower costs make it more accessible and affordable, thereby by making NGS more popular in both hospital and laboratory settings. Its versatility enables it's use with tissue biopsies and blood samples which makes it helpful for both diagnosis and progress monitoring. NGS helps oncologists decide if patients are eligible for the targeted drugs designed for their disease. It also helps find biomarkers and develop individualized treatments. The use of NGS together with advanced bioinformatics and AI technology helps clarify complex data, increase the accuracy of diagnosis and support clinical trials. Basically, NGS is dominant in this market because it has extensive features, is becoming cheaper and ensures cancer can be treated in a personalized way. Its ongoing development will probably maintain its strength in oncology, making care more effective and adapted to individual patients.

The application segment is divided into biomarker discovery, companion diagnostics, prognostics, monitoring and recurrence and early detection and screening. The biomarker discovery segment dominated the market, with a market share of around 35% in 2024. The importance of personalized cancer care and targeted therapy development makes biomarker discovery the leading technology in this market. Biomarkers are molecules found in our biology—such as genes, proteins or mutations—that mark the beginning, changes or details of cancer. Discovering trustworthy biomarkers helps in understanding cancer, predicting therapy effects and guiding medicine in choosing clinical approaches. Enhancing cancer diagnosis, prognosis and choosing the best treatment are the main reasons why biomarker discovery is so important. The use of high-throughput methods such as next-generation sequencing and proteomics, has greatly improved the way biomarkers are discovered in tumours. Moreover, discovering biomarkers helps produce companion diagnostics which are necessary to find the best targeted therapies and immunotherapies for patients. In addition, studying biomarkers makes it possible to detect and monitor cancer at an earlier stage, so treatment can be given sooner. Biomarker discovery is a major priority for pharmaceutical and research groups, as they believe it improves their performance and advances innovation in cancer medicine.

The cancer type segment is divided into lung cancer, breast cancer, colorectal cancer, prostate cancer, leukemia and others. The lung cancer segment dominated the market, with a market share of around 34% in 2024. Lung cancer is the number one reason for the growth of precision oncology diagnostics because it is commonly found, has a high death rate and strongly requires personalized treatments. Due to the variation between lung tumours, it is important to have precise diagnostics because they let doctors find the unique genetic changes and chemical markers that drive treatment plans. Moreover, the market for oncology is dominated by lung cancer since there are many molecular targets, for which some targeted therapies have been approved. Additionally, there is a strong need for improved ways to diagnose and treat lung cancer which drives substantial funding from the pharmaceutical sector, research groups and healthcare providers to improve precision oncology diagnostics.

The end-user segment is divided into hospitals & clinics, diagnostic laboratories, academic & research institutes and biopharmaceutical companies. The hospitals & clinics segment dominated the market, with a share of around 38% in 2024. Hospitals and clinics, as the main providers of cancer care, take up the largest share of users in the precision oncology diagnostics market. They are key places where cancer patients are diagnosed, have their treatment outline created and are monitored over time, so precision diagnostics can happen there. Advanced testing equipment in extended care allows oncologists to review full genetic and molecular information about patients before making treatment decisions. An important reason why cancer care is so effective is that qualified experts including oncologists, pathologists and genetic counsellors cooperate closely in hospitals and clinics. By uniting all kinds of expertise, it becomes possible to better explain test results and choose treatments which leads to improved results for patients. Besides, hospitals and clinics generally have what it takes to carry out precision diagnostics themselves or arrange such testing with specialized laboratories. As people learn more about how effective personalized medicine can be, hospitals and clinics are adding new technologies and training to make these tests part of their routine work. Regulatory and insurance rules generally benefit practicing precision diagnostics in hospitals, leading doctors to provide these services as part of treating cancer.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 110 Billion |

| Market size value in 2034 | USD 237.48 Billion |

| CAGR (2025 to 2034) | 8% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Technology, Application, Cancer Type and End-User |

As per The Brainy Insights, the size of the global precision oncology diagnostics market was valued at USD 110 billion in 2024 to USD 237.48 billion by 2034.

Global precision oncology diagnostics market is growing at a CAGR of 8% during the forecast period 2025-2034.

The market's growth will be influenced by the rising incidence of cancer worldwide and technological advancements.

High costs, technical and operations hurdles associated with precision oncology diagnostics could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global precision oncology diagnostics market based on below mentioned segments:

Global Precision Oncology Diagnostics Market by Type:

Global Precision Oncology Diagnostics Market by Application:

Global Precision Oncology Diagnostics Market by Cancer Type:

Global Precision Oncology Diagnostics Market by End-User:

Global Precision Oncology Diagnostics Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date