- +1-315-215-1633

- sales@thebrainyinsights.com

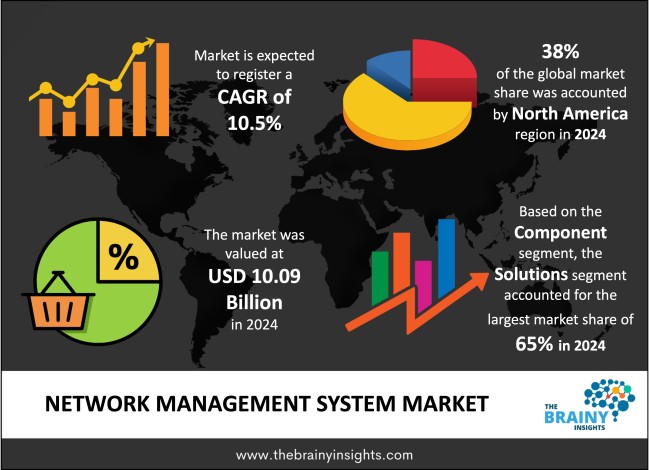

The global network management system market was valued at USD 10.09 Billion in 2024 and grew at a CAGR of 10.5% from 2025 to 2034. The market is expected to reach USD 27.39 Billion by 2034. A network management system offers numerous advantages to companies and their users, such as enhanced network visibility, downtime detection, performance optimization, and fault identification. The increasing investments in IT network infrastructure, the ongoing deployment of 5G technology, and the expanding reliance on networks for internal and external organizational operations are anticipated to propel the market growth during the forecast period.

A network management system is a collection of software applications and tools designed to oversee, monitor, and control various facets of network infrastructure. These systems ensure smooth, efficient, and secure network operations. Organizations can tackle issues such as network downtime, performance decline, security incidents, and service disruptions by utilizing an NMS. The concept of a network management system includes a wide array of functionalities ranging from basic device monitoring and fault detection to advanced tasks like performance analysis, configuration management, and optimization efforts. With the rise in complexity due to cloud computing advancements, the Internet of Things (IoT), and distributed computing networks, the importance of network management systems has grown significantly. The system evolves to modern infrastructures and integrates with other IT tools before enhancing overall reliability.

A network management system is an all-encompassing solution designed to manage, control, and enhance network infrastructure. The solution ensures optimal performance, security measures, and reliability standards are met. The network management system platforms cover everything from fault detection and configuration management to performance monitoring and security enforcement while integrating seamlessly with larger IT systems. As network environments become increasingly complex—and technologies like AI and cloud computing emerge—advancements in network management system solutions continue to evolve. These innovations make them essential for business enterprises aiming to sustain strong, high-performance networks that remain secure amid today’s rapidly changing digital landscape.

Get an overview of this study by requesting a free sample

Growing Demand for Digital Transformation and Modernization – A major factor propelling the global Network Management Systems market is the continuous digital transformation happening across various industries. Companies are making significant investments to update their IT infrastructure, aiming to support new business models, boost agility, and enhance customer experiences. This digital shift necessitates real-time, flexible network environments that can efficiently handle a range of applications, services, and workflows. As a result, NMS platforms are becoming essential for managing complex hybrid networks and software-defined structures that encompass both on-site systems and cloud-based setups, as well as remote endpoints. Business enterprises prioritizing digital-first strategies depend significantly on uninterrupted connectivity, rendering network downtime or degraded performance a major business threat. Companies transforming are implementing Network Management Systems platforms to gain comprehensive visibility into network activities, anticipate potential performance issues, and automate routine tasks. Additionally, Network Management Systems tools facilitate network segmentation, virtualization, and multi-tenant setups—all of which are essential for contemporary enterprise networking. The shift towards modernization also involves transitioning from outdated legacy systems to cutting-edge network infrastructures. This transition necessitates Network Management Systems solutions that can seamlessly manage both traditional and modern network components within a single, integrated framework.

Complexity of Integration with Legacy Systems – A major limiting factor in the global Network Management Systems (NMS) market is the complexity of merging new NMS platforms with existing legacy infrastructure. Many large organizations—especially those in sectors such as manufacturing, banking, financial services, insurance (BFSI), public sector, and utilities—depend on longstanding legacy network environments that are not always compatible with next-generation network management tools. These systems often comprise proprietary hardware, use traditional communication protocols, and have siloed architectures that make integration with modern software-defined or cloud-native tools challenging. The diversity of network devices from various vendors, each having its unique interface and configuration model, presents significant challenges for seamless interoperability. Sometimes, outdated and traditional legacy infrastructure requires custom-built interfaces or middleware solutions, leading to increased time, cost, and complexity during deployment. Additionally, the potential risk of downtime during integration can be particularly dangerous to operations. Consequently, enterprises may defer or reduce their investments in NMS (Network Management Systems), opting instead to stick with familiar yet less efficient systems, which ultimately hinders market growth.

Rise of Internet of Things (IoT) and the Expansion of Networked Devices – The rapid expansion of connected devices, ranging from consumer IoT gadgets to industrial sensors, is placing extraordinary demands on network infrastructure and, consequently, on Network Management System (NMS) capabilities. The surge in IoT devices brings considerable network complexity due to the variety of device types, communication protocols, and operating environments. To maintain consistent performance and security levels, enterprises need Network Management System platforms that can effectively monitor, manage, and configure a substantial number of connected endpoints. IoT deployments are often used in different end-user environments, including manufacturing plants, smart cities, healthcare facilities, and energy grids. These instances require NMS solutions that provide comprehensive visibility from the edge to the cloud, facilitating real-time event processing, anomaly detection, and predictive analytics. Furthermore, IoT networks must ensure robust reliability and security, as they are often used in applications such as remote surgery, autonomous vehicles, or industrial automation. Managing IoT networks requires a focus on scalability and automation. Network Management System (NMS) platforms that offer auto-discovery, dynamic topology mapping, and AI-driven insights are becoming increasingly indispensable for effectively managing the extensive and varied nature of IoT ecosystems.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global network management system market, with a 38% market revenue share in 2024.

This market dominance is fuelled by a combination of technological leadership, significant enterprise IT expenditures, widespread cloud adoption, and the early development of next-generation networks. The region's advantage as an early adopter of digital transformation and automation has positioned it at the forefront of the demand for intelligent and scalable network management platforms. The U.S. stands as a key country within the North America global network management system market. The country's advanced telecommunications infrastructure, well-integrated digital business strategies, and substantial investments from major enterprises position it consistently among the highest spenders on network infrastructure and management tools.

Furthermore, North America's dominance in industries such as financial services, healthcare, e-commerce, and media—each requiring high-bandwidth, low-latency connectivity with minimal interruptions—places continuous pressure on network operations to maintain optimal performance and reliability. As these sectors undergo digital transformation, the need for proactive real-time network monitoring tools intensifies. This shift has led to a broad embrace of software-defined networks (SDNs), multi-cloud setups, and edge computing solutions—all of which demand strong network management systems for orchestration, analytics capabilities, and optimization techniques.

North America Region Network Management System Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into solution and services. The solutions segment dominated the market, with a market share of around 65% in 2024. Configuration management, performance management, security management, fault management, and account management are considered within the solutions segment category. The introduction of standalone solutions and customizable options tailored to client needs is expected to drive growth in this area. Rising concerns about data security are leading business enterprises to adopt network security management solutions that protect against data breaches and cyber-attacks. This trend is anticipated to boost demand for network management solutions throughout the forecast period.

The deployment mode segment is divided into on-premises and cloud. The on-premises segment dominated the market, with a market share of around 64% in 2024. Deploying software on-premise provides enhanced customization and control tailored to a company's specific requirements. Additionally, it restricts third-party network access, thereby bolstering security measures. However, managing the software internally may require additional IT personnel and resources; furthermore, upgrades or replacements are necessary as the software becomes outdated over time. The robust security and customization features offered by on-premise deployments have played a significant role in this segment's leading market position.

The organization size segment is divided into SMEs and large enterprises. The large enterprises segment dominated the market, with a market share of around 62% in 2024. Large enterprises typically manage a vast network of devices and employees, often spread across multiple office locations that need to be connected to the company's server. For these business enterprises, Network Management Systems (NMS) offer an effective solution for maintaining robust networks. Network downtime can significantly impact revenue and decrease employee productivity; however, implementing network management systems helps mitigate these issues by reducing financial losses and boosting efficiency. Additionally, key benefits such as minimizing human errors, quickly identifying and resolving underlying causes of network malfunctions, and enhancing security through reduced manual interventions—thereby decreasing configuration mistakes—are compelling reasons why large enterprises are increasingly adopting network management systems.

The end-use industry segment is divided into IT & telecom, BFSI, government, manufacturing, healthcare, transportation & logistics, retail and other industries. The IT & telecom segment dominated the market, with a share of around 28% in 2024. IT and Telecommunication companies require a robust network infrastructure for their daily operations. The industry depends on dependable networks to transmit data, signals, and messages efficiently. Network management systems play a critical role in ensuring seamless network performance, boosting security measures, and identifying issues early to prevent downtime—ultimately reducing costs and increasing productivity. Furthermore, the vast scale of these networks makes manual oversight nearly impossible. Therefore, automating tasks such as tracking updates, maintenance activities, and troubleshooting through NMS is crucial for managing large-scale operations effectively—a factor that is fuelling growth within this segment.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 10.09 Billion |

| Market size value in 2034 | USD 27.39 Billion |

| CAGR (2025 to 2034) | 10.5% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Deployment Mode, Organization Size and End-user Industry |

As per The Brainy Insights, the size of the global network management system market was valued at USD 10.09 billion in 2024 to USD 27.39 billion by 2034.

Global network management system market is growing at a CAGR of 10.5% during the forecast period 2025-2034.

The market's growth will be influenced by rise of internet of things (IoT) and the expansion of networked devices.

High initial investments and total cost of ownership (TCO) could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global network management system market based on below mentioned segments:

Global Network Management System Market by Component:

Global Network Management System Market by Organization Size:

Global Network Management System Market by Deployment Mode:

Global Network Management System Market by End-Use Industry:

Global Network Management System Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date