- +1-315-215-1633

- sales@thebrainyinsights.com

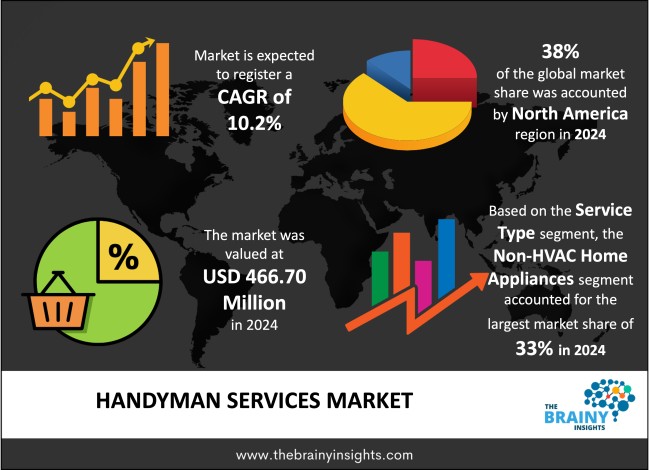

The global handyman services market was valued at USD 466.70 Million in 2024 and grew at a CAGR of 10.2% from 2025 to 2034. The market is expected to reach USD 1,232.68 Million by 2034. The global handyman services market has become a vital component of the broader home maintenance and property management sector, providing a range of on-demand repair, installation, renovation, and maintenance solutions for both residential and commercial properties. As societies become more urbanised and fast-paced, consumers are increasingly seeking convenient, affordable, and dependable service options to tackle minor to moderate home improvement tasks without resorting to expensive specialist contractors. This shift has driven the expansion of professional handyman services in both developed and developing countries. The market's growth can be attributed to several factors, including an increasing number of ageing homes requiring continuous maintenance, a rise in dual-income households with limited time for DIY projects, and the widespread use of digital platforms that make access to on-demand labour easier than ever before.

Handyman services encompass a wide range of skilled and semi-skilled maintenance, repair, and minor renovation tasks for residential, commercial, and institutional properties. These activities are typically conducted by individuals or small teams, often referred to as handymen or general maintenance workers, who possess practical experience in various trades such as plumbing, electrical work, carpentry, painting, drywall repair, tile installation, furniture assembly, appliance setup, and home improvement. Although they may not hold licenses in specialised fields, handymen often bring significant expertise in bridging the gap between do-it-yourself (DIY) projects and larger endeavours, such as certified contractors and technicians. Historically associated with local informal service providers capable of fixing almost anything around homes and workplaces, the role of a handyman has evolved into an increasingly structured segment within the property-care industry, encompassing solo practitioners, small enterprises, franchise operations, and extensive digital platforms that connect consumers with vetted professionals. Their flexibility and diverse skill sets characterize the services of a handyman. Unlike specialists such as electricians, plumbers, or HVAC technicians, who focus on specific areas and typically require certification, handymen are expected to have a working knowledge of various household systems. They typically handle tasks that involve identifying issues, suggesting affordable solutions, and carrying out simple to medium-level repairs or upgrades without needing complex permits or specialized engineering skills. Often called upon for routine maintenance work that doesn't require hiring a contractor or trade-specific expert, handymen offer property owners both time-efficient and cost-effective options.

Get an overview of this study by requesting a free sample

Increasing Awareness of Property Maintenance and Value Preservation – Homeowners and commercial property stakeholders are increasingly acknowledging the enduring benefits of preventive maintenance and regular upkeep. Informed consumers recognize that addressing repairs and servicing promptly not only enhances aesthetic appeal and functionality but also safeguards the long-term value of real estate investments. This aspect, fuelled by television programs, social media content, and real estate blogs, has increased awareness and led to a more proactive approach in hiring handyman services for minor tasks that might otherwise be overlooked. The resale value of properties is closely linked to visual appeal and structural integrity; both can suffer if small repairs are ignored. Regular attention to windows, doors, lighting systems, tiling work, and water fixtures helps avert larger-scale expenses down the line. As a result, handyman services have gained recognition as an investment in asset preservation rather than merely reactive spending—particularly relevant in high-value markets like Singapore, New York, London, Dubai, and Sydney. This factor contributes to the growth and development of the global handyman services market.

Shortage of Skilled and Multi-Disciplinary Labor – Even though many developing and developed countries have an ample supply of general labourers, there is a noticeable shortage of skilled professionals in the handyman services sector. Being a handyman requires expertise across various trades, including carpentry, plumbing, painting, drywall repair, electrical work, tiling, and appliance installation. However, formal training covering such diverse skills is seldom available. As a result, most handymen acquire these abilities through informal apprenticeships or hands-on experience, which can lead to inconsistencies in technical proficiency. In wealthier countries such as the United States, Canada, Germany, and Australia, this issue is exacerbated by factors including ageing workforces and declining interest among young people in manual trade careers. As more young people pursue white-collar or tech jobs, fewer are entering fields related to maintenance or repair, creating a skills gap that limits service availability and quality. This talent scarcity restricts business growth, increases labour costs for companies providing these services, and thereby impacts consumer affordability. This factor is anticipated to hamper the market growth and development.

Digitalization and the Emergence of On-Demand Platforms – A key factor transforming the handyman services market is the rise of digital platforms that enable real-time connections between service providers and consumers. Apps and websites such as TaskRabbit, Handy, Thumbtack, Urban Company, Angi, and HomeAdvisor have revolutionized how people find, evaluate, and utilize handyman services. These platforms facilitate seamless service delivery through easy-to-use interfaces that feature background-verified professionals alongside customer ratings and reviews. They also ensure transparency in pricing while integrating payment systems effectively. This has led more consumers to prefer these modern methods over traditional word-of-mouth or classified ads when looking for independent providers. The convenience, coupled with trustworthiness, offered by these digital aggregators has significantly broadened their market appeal—particularly among technologically advanced and younger generations—and fostered greater consumer confidence overall. Moreover, for those providing such essential domestic help, these online networks offer streamlined solutions, including improved lead generation capabilities, optimized route planning options, efficient inventory control processes, and enhanced client retention strategies. With global smartphone adoption on an upward trajectory –especially within developing regions-digital channels' influence will further boost uptake across this sector's landscape moving forward. This factor is anticipated to provide lucrative growth opportunities in the upcoming years.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global handyman services market, with a 38% market revenue share in 2024.

The region enjoys several structural, economic, and socio-cultural advantages that have fueled the swift growth and professionalization of handyman services. In North America, the U.S. leads in revenue generation, dominating the market due to its vast housing inventory, high homeownership rates, substantial disposable incomes, and a consumer tendency to outsource domestic maintenance tasks. In North America, the home improvement culture significantly contributes to market growth. While some people enjoy DIY (do-it-yourself) projects, an increasing number of consumers are opting for DIFM (do-it-for-me) solutions due to time limitations, convenience needs, or a lack of skills. Dual-income families and older homeowners, in particular, prefer hiring professional handymen for essential tasks such as installations, repairs, and upgrades. Tasks such as furniture assembly, TV mounting, leaky faucet repairs or wall painting are increasingly delegated by both urban and suburban residents. Additionally, the growing popularity of smart home devices—such as Ring doorbells, Nest thermostats, and Wi-Fi-enabled lighting systems—is driving demand for technically skilled handymen in this region.

North America Region Handyman services Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The service type segment is divided into non-HVAC Home appliances, HVAC systems, electricity, gas, and plumbing. The non-HVAC home appliances segment dominated the market, with a market share of around 33% in 2024. This category encompasses everyday household appliances, such as washing machines, dishwashers, refrigerators, microwave ovens, cooking ranges, water purifiers, and other essential consumer devices used in daily home life. Over the past ten years, there has been a significant surge in demand for repair services, installation assistance, and regular maintenance of these appliances. This increase is driven by the rising presence of durable consumer goods in both developed and emerging markets. Non-HVAC home appliances often require a high number of maintenance calls due to their constant use, which leads to wear and tear from daily usage. Appliances such as washing machines and dishwashers often encounter issues like mechanical malfunctions, clogged pipes, motor failures, or software glitches in their smart versions. Refrigerators and ovens commonly need recalibration, door seal replacements, or sensor diagnostics. Although manufacturers provide warranties and have authorised service centres available during the warranty period, local or independent handyman services often handle post-warranty maintenance needs, as well as minor repairs.

The deployment segment is divided into online and offline. The offline segment dominated the market, with a market share of around 53% in 2024. Offline deployment remains the foundation of the global handyman services market, primarily because this sector has traditionally operated through informal means. This approach encompasses services offered through word-of-mouth recommendations, local classifieds, neighbourhood service providers, independent contractors, family-run repair shops, and self-employed professionals who operate without digital platforms or formal affiliations. A key factor contributing to the prevalence of offline deployment in developing areas is the informal nature of labour. In nations like India, Indonesia, Nigeria, and Brazil, many handyman services are performed by freelancers or small contractors who work independently rather than through registered businesses. These service providers often rely on verbal agreements, local advertising efforts, and repeat business from clients within a specific area to sustain their operations. The affordability of these services—arising from the absence of formal expenses such as taxes, licensing fees, or digital platform charges—makes offline handyman options particularly appealing to consumers sensitive to price.

The end-user segment is divided into commercial, industrial and residential. The residential segment dominated the market, with a market share of around 59% in 2024. The widespread need for continuous home maintenance, appliance installation, routine repairs, and improvement projects in urban, suburban, and rural households fuels the growth and development of these services within the residential sector. As homeownership grows alongside rising urbanization and an ageing housing stock, paired with a heightened demand for convenience-based services, residential end-users have become the primary force driving demand for general maintenance and repair solutions. In developed countries like the U.S., Canada, Germany, the UK, and Australia, a substantial share of recurring service contracts and on-demand tasks undertaken by handymen is attributed to the residential sector. In developing countries such as India, China, Brazil, and Southeast Asia, the residential sector is experiencing rapid growth, driven by rising disposable incomes, urban migration trends, and an expanding middle class. The surge in apartment complexes, gated communities, and housing societies has heightened the demand for readily available handyman services.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Million) |

| Market size value in 2024 | USD 466.70 Million |

| Market size value in 2034 | USD 1,232.68 Million |

| CAGR (2025 to 2034) | 10.2% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Service Type, Deployment and End-user |

As per The Brainy Insights, the size of the global handyman services market was valued at USD 466.70 million in 2024 to USD 1,232.68 million by 2034.

Global handyman services market is growing at a CAGR of 10.2% during the forecast period 2025-2034.

The market's growth will be influenced by growing demand for handyman services across residential and commercial sectors.

Pricing pressures and lack of transparency could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global Handyman Services market based on below mentioned segments:

Global Handyman Services Market by Service Type:

Global Handyman Services Market by Deployment:

Global Handyman Services Market by End-user:

Global Handyman Services Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date