- +1-315-215-1633

- sales@thebrainyinsights.com

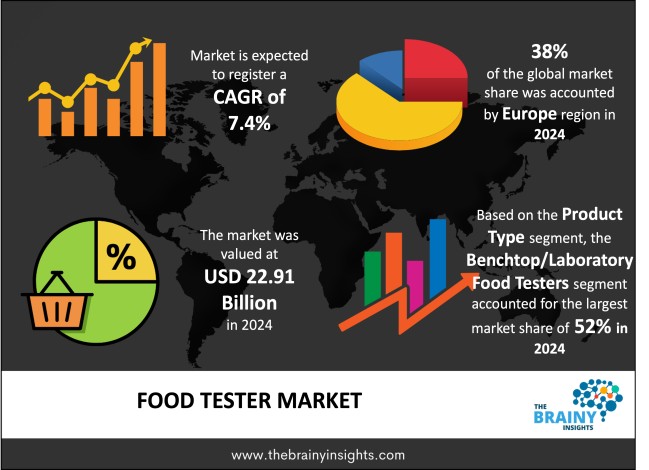

The global food tester market was valued at USD 22.91 Billion in 2024 and grew at a CAGR of 7.4% from 2025 to 2034. The market is expected to reach USD 46.78 Billion by 2034. The Global Food Tester Market has become a crucial part of the broader food safety and quality assurance landscape. This growth is fueled by increasing consumer awareness, stricter regulatory standards, and an ever-growing global supply chain for food products. Food testers encompass various devices, kits, and systems that assess the safety, nutritional content, and authenticity of food products. These tools are used at all stages of the food value chain—from sourcing raw materials to production processes, as well as distribution points through retail—playing an essential role in ensuring compliance with regulations while safeguarding public health and reducing economic risks associated with foodborne illnesses or product adulteration.

A food tester encompasses any tool, device, method, or system designed to detect and evaluate the composition, quality, safety, authenticity, and nutritional value of food and beverages. These testers are crucial in contemporary food safety management systems, as they play a vital role in recognising and addressing potential risks, including microbial contamination, chemical residues, physical adulterants, inaccuracies in nutrition data, allergens, and toxins such as genetically modified organisms (GMOs), while also ensuring labelling accuracy. They have diverse applications, ranging from verifying the safety of raw agricultural materials to overseeing quality control on production lines and validating cleanliness standards within commercial kitchens while also ensuring adherence to national and international regulations regarding food security. Essentially, the food testers act as both operational pillars for global assurance efforts concerning product compliance integrity, alongside providing technological support that aids in legislative norms derived through various enforcement agencies globally.

Get an overview of this study by requesting a free sample

Urbanization & Infrastructure Development: Macro urbanization trends are driving the need for centralised food distribution systems, including cold-chain networks, industrial kitchens, and fast-casual restaurants. This shift is consequently elevating food safety standards. In megacities, consumers demand consistent quality across various food providers, compelling vendors to implement rapid testing procedures to ensure this standard. For example, the rise of cloud kitchens in South Asian cities has increased the demand for hygiene certifications; similarly, the day-to-day expansion of supermarkets in Africa and South America necessitates standardized QA measures. Additionally, country governments intensify their investment in food-testing infrastructures as part of urban modernisation efforts by establishing municipal labs and border inspection facilities for enhanced safety verification.

Global Economic Growth and GDP Trends: Global economic trends have a significant impact on investments in food safety. When GDP grows, companies involved in food manufacturing, processing, and retailing tend to increase their spending on compliance infrastructure, such as testing equipment. For instance, ongoing GDP growth in regions such as China, India, and Southeast Asia has led to the modernization of food value chains and a strong demand for lab and field-based testing devices. In contrast, during times of global economic decline—for example, during the 2008 financial crisis or the COVID-19 downturn—budgets are often slashed, and projects are postponed. Consequently, regional macroeconomic conditions have a significant impact on capital investment decisions for mid to high-end food testing technology purchases.

Rising Consumer Awareness of Food Quality, Safety, and Transparency – Today's food consumers are more informed and concerned than ever about food safety, nutrition, labelling, and the sourcing of their food. There is a rising demand for clean-label products, ingredient traceability, allergen-free options, organic certification, and ethical sourcing practices. Consumers insist on transparency regarding nutritional content details, the origins of raw materials, and adherence to religious or dietary requirements, such as halal qualifications, kosher constraints, and vegan standards. Deviations from these expectations may lead to reputational harm, product recalls, and legal consequences; as such, both producers and retailers invest heavily in infrastructure that verifies claims and addresses consumer concerns pre-emptively. Increasingly, portable testers and smartphone-based kits, as well as QR code-linked systems, have become integral elements that satisfy market demands. This pressure significantly influences the adoption rates of testing technologies worldwide in both developed and emerging markets. This factor contributes to the growth and development of the global food tester market.

High Capital and Operating Costs – A major challenge in the global food testing market is the significant initial and ongoing expenses associated with advanced laboratory equipment. High-end tools, such as chromatography systems, mass spectrometers, and DNA analysers, require substantial investment, often ranging from tens of thousands to hundreds of thousands of dollars. This aspect makes it difficult for small and medium-sized enterprises (SMEs), independent food producers, and developing economies to afford them. Additionally, operating costs—covering reagents, maintenance services, calibration efforts, and skilled personnel—can add considerable financial burden over time. These economic barriers hinder widespread adoption among financially constrained food processors and exporters in low- or middle-income nations. This factor is hindering the market growth and development.

Growth in Packaged and Processed Food Consumption – The worldwide increase in the consumption of packaged, ready-to-eat, and processed foods is driving a growing need for food testers. Factors such as urbanization, evolving lifestyles, and an expanding middle class—particularly in emerging markets like India, China, Brazil, and Southeast Asia—are fueling demand for convenience foods. However, these processed products are more prone to contamination due to handling issues or formulation errors involving additives. This situation necessitates robust food safety monitoring systems that can be integrated across manufacturing lines from packaging through distribution processes. Food testers play a crucial role in ensuring ingredient integrity by examining shelf-life stability, assessing microbial loads, detecting synthetic additives, identifying preservatives, and detecting harmful chemicals present within consumables that directly affect public health standards thoroughly at every level possible. Meanwhile, rising trends favouring e-commerce platforms, along with cloud kitchen models, emphasize the decentralization of fast-paced, portable testing requirements, complementing higher recruitment rates among professionals working throughout entire value chains. This ultimately reinforces the demand for testers, leading to increased global demand for repeat exposure experiences, which drive advancements in technology. This factor is anticipated to provide lucrative growth opportunities in the upcoming years.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe emerged as the most significant global food tester market, with a 38% market revenue share in 2024.

Europe captures a significant portion of the global food tester market, largely due to its extensive food safety regulations, stringent environmental standards, and increasing demand for sustainable food systems. The European Union (EU) plays a key role in this through entities such as the European Food Safety Authority (EFSA) and the Rapid Alert System for Food and Feed (RASFF), which implement one of the world's most comprehensive regulatory frameworks for food safety. Regulations such as EC 178/2002 focus on traceability, risk assessment, and mandatory testing to detect contaminants, allergens, and additives throughout the entire food value chain. Countries such as Germany, France, the UK, and the Netherlands play a crucial role in influencing the regional market. Notably, Germany acts as a central hub for manufacturing analytical instruments. European food companies make significant investments in laboratory infrastructure to meet both EU-wide and national standards. Moreover, with the expanding organic food sector and increasing consumer demand for clean-label and non-GMO products across Europe, regular testing is essential to ensure compliance and maintain a brand's reputation.

Europe Region Food tester Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into portable food testers, benchtop/laboratory food testers and consumables & reagents. The benchtop/laboratory food testers segment dominated the market, with a market share of around 52% in 2024. Benchtop or laboratory food testers comprise the traditional and central segment of the global food testing equipment market. These devices, including high-performance liquid chromatography (HPLC) systems, gas chromatography-mass spectrometry (GC-MS), inductively coupled plasma (ICP) analysers, microbiological culture analysers, and DNA sequencing platforms, are primarily used in centralised laboratories and quality assurance facilities. Although portable devices are gaining popularity, benchtop and laboratory testers continue to dominate the market due to their unmatched accuracy, extensive range of analyte detection, and compliance with stringent regulatory standards. Food manufacturers, government testing laboratories, research institutions, and third-party certification bodies depend significantly on these advanced instruments for thorough screening of contaminants, nutritional analysis, authenticity verification, and shelf-life studies. This segment is characterised by significant investments in research and development, technological advancements, and automation aimed at reducing turnaround times and operational costs. The integration with laboratory information management systems (LIMS), cloud computing, and AI-driven data analytics is transforming benchtop testing, providing improved throughput and predictive quality control.

The application segment is divided into dairy products, meat, poultry, & seafood, fruits and vegetables, beverages and others. The dairy products segment dominated the market, with a market share of around 35% in 2024. Dairy products hold a substantial portion of the global food tester market primarily because milk, cheese, yoghurt, butter, and cream are highly perishable. These items pose complex risks related to microbial contamination, spoilage organisms, antibiotic residues, and mycotoxins. The structure of dairy supply chains—which involve bulk purchases from farms followed by centralized processing and swift consumption—requires ongoing real-time quality checks at various stages to ensure safety and quality standards. Common tests in the dairy industry include somatic cell count analysis, antibiotic residue screening, pasteurization verification, and detection of listeria and salmonella. The rise of value-added products such as infant formula, lactose-free milk, flavoured yoghurts, and probiotics has heightened testing complexity. This increase necessitates a greater demand for both benchtop and portable testers along with rapid test kits.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 22.91 Billion |

| Market size value in 2034 | USD 46.78 Billion |

| CAGR (2025 to 2034) | 7.4% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type and Application |

As per The Brainy Insights, the size of the global food tester market was valued at USD 22.91 billion in 2024 to USD 46.78 billion by 2034.

Global food tester market is growing at a CAGR of 7.4% during the forecast period 2025-2034.

The market's growth will be influenced by rising consumer awareness of food quality, safety, and transparency.

High capital and operating costs could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global Food Tester market based on below mentioned segments:

Global Food Tester Market by Product Type:

Global Food Tester Market by Application:

Global Food Tester Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date