- +1-315-215-1633

- sales@thebrainyinsights.com

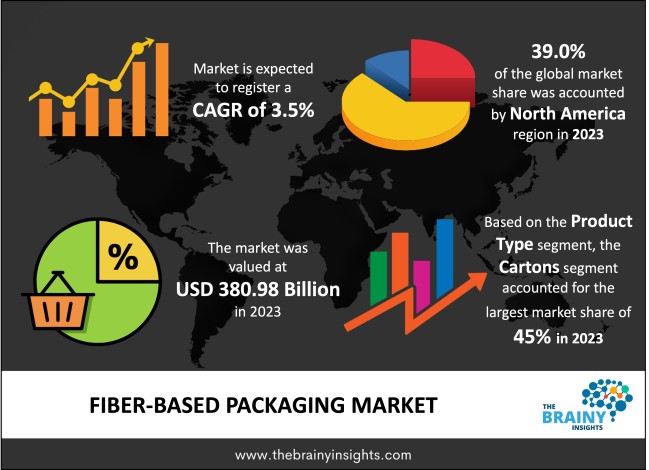

The global fiber-based packaging market was valued at USD 380.98 billion in 2023 and is anticipated to grow at a CAGR of 3.5% from 2024 to 2033. A flexible and eco-friendly material known as fiber-based packaging, also called cardboard or paperboard packaging, is utilized for various product packing needs. This package comprises either wood pulp or recycled paper fibers, rendering it incredibly sustainable. Its exceptional durability, stiffness, and lightweight composition make it the optimum means for shielding goods during shipment. As it's recyclable and biodegradable, companies and consumers prefer it for eco-friendly yet efficient packaging solutions. The packaging can be tailored with print and is adaptable to different formats, including boxes, cartons, and containers. It caters to various sectors like food & beverage, electronics & cosmetics.

Modern packaging solutions rely heavily on fiber-based packaging, which is a sustainable option that allows products to be protected while minimizing potential harm to the environment. Essentially, this type of packaging refers to a wide range of materials derived from natural fibers like wood pulp or recycled paper and agricultural residues. These materials undergo complex processing methods to become adaptable mediums for various industries' packing needs.

The essence of fiber-based packaging is its innate environmental compatibility, founded on the renewable source of its main components. Many fiber-based materials for packaging rely on wood pulp extracted from responsibly-managed forests. To fulfil worldwide demand while safeguarding crucial ecosystems, industry leaders prioritize responsible forestry and efficient manufacturing practices as a delicate balancing act. The potential of fiber-based packaging is limitless, with a vast array of tailored products to suit different requirements. Among these, corrugated cardboard stands out as one of the most widespread forms due to its remarkable strength-to-weight ratio, making it perfect for shipping goods in diverse sizes and shapes. Its ability to safeguard delicate items during transportation highlights its essential role within current supply chains.

Get an overview of this study by requesting a free sample

Growing Emphasis on Sustainability - The elevated concern for sustainability has emerged as the primary impetus behind the surge in fiber-based packaging demand. As consumers become increasingly environmentally conscious, there is a visible trend away from conventional packing materials like plastics and towards eco-friendly substitutes that can degrade or be recycled. Fiber-based packaging fulfils this requirement efficiently by being sourced from renewable elements such as paper, cardboard, and corrugated board, thus integrating flawlessly with these green objectives to provide an environment-friendly option in comparison to non-biodegradable alternative. Industries are facing considerable pressure to embrace sustainable practices due to strict regulations and the development of global environmental policies. Governments have implemented prohibitions on single-use plastics while encouraging the utilization of recyclable substances and promoting fiber-based packaging alternatives. It has become vital for business enterprises to follow these mandates as they strive towards eco-friendly packaging choices, avoiding penalties and upholding corporate social responsibility obligations.

Cost Considerations and Raw Material Price Volatility – The fiber-based packaging market encounters a significant obstacle in the form of soaring raw material expenses. The primary packaging components are paper and cardboard, whose prices fluctuate due to numerous factors like demand-supply dynamics, currency fluctuations, and geopolitical tensions. This price volatility pressures manufacturers by affecting their profit margins and pricing plans. Besides, the growing cost of acquiring sustainable and environmentally friendly materials aggravates this issue since consumers increasingly prefer eco-friendly packing options. Besides cost pressures, the fiber-based packaging industry faces significant challenges posed by regulatory constraints. Worldwide, governments enforce strict regulations to decrease environmental pollution and encourage sustainability. These policies include mandates for recyclability, biodegradability, and reduction of carbon footprint, which directly affect the creation, design, and removal of products made from fiber-based packaging. Adhering to these rules requires extensive research & development (R&D) investments and operational adjustments that contribute significantly towards manufacturers' operating costs. Non-compliance with such guidelines may result in fines and damaging brand image or market reputation, mainly with companies dealing with fiber-based Packaging sectors.

Cost-Effectiveness and Supply Chain Efficiency - Fiber-based packaging solutions are gaining recognition throughout the supply chain for their cost-effectiveness and operational efficiency. Thanks to improvements in production processes driving down manufacturing costs, it's now financially feasible for businesses to use this type of packaging over more traditional materials. The added perk? Fiber-based packages weigh less, which cuts both transportation expenses & carbon emissions—making them a top choice for optimizing overall supply chains. Purchasing decisions are being reshaped by consumer preferences, which now reflect an increased awareness of environmental issues. Consumers prioritize products that use sustainable packaging materials to align with their values. As a result, brands feel pressure to adopt eco-friendly packaging options to present themselves positively and attract environmentally conscious consumers. By utilizing fiber-based packaging, companies can satisfy these demands while standing out from competitors by showcasing their dedication to sustainability principles.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region emerged as the most prominent global fiber-based packaging market, with a 39.0% market revenue share in 2023. The fiber-based packaging market considers North America a major hub, thanks to the leading positions of the United States and Canada. The region's competitive share results from its strong manufacturing infrastructure, technological progressions, and increasing consumer awareness about sustainable options for packing solutions. Given this situation in recent years, there has been a noticeable trend toward environmentally friendly alternatives that have driven up demand for products based on fibers as their primary component. Stringent environmental regulations in North America have increased the use of recyclable and biodegradable packaging materials. This aspect has further enhanced the market share of fiber-based packaging, providing a sustainable solution that does not compromise quality or performance. Besides, there is a significant boost in demand for corrugated boxes and other fiber-based solutions due to expanding e-commerce activities, contributing significantly to regional market growth dominance. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

North America Region Fiber-based Packaging Market Share in 2023 - 39.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment includes cartons, clamshell, bags & pouches, corrugated boxes and others. The cartons segment dominated, with a market share of around 45% in 2023. The fiber-based packaging market comprises a noteworthy sector in the form of cartons, which present adaptable and personalized options for packing various products. The extent to which this segment dominates the industry hinges upon its ability to accommodate diverse requirements and provide long-lasting functionality and good looks. Cartons are extensively employed across numerous sectors, spanning food & drink, pharmaceuticals, personal care items, home essentials, etc. Sustainable fiber sources have become increasingly popular for carton packaging due to a rise in eco-friendly materials. Manufacturers adhere to the public's preference for recycled and biodegradable options, increasing cartons' market share within the fiber-based packaging industry while accommodating regulatory demands.

The end-user segment is bifurcated into chemicals, food & beverages, consumer electronics, construction and others. The food & beverage segment dominated, with a market share of around 53% in 2023. The fiber-based packaging sector has secured a prominent position worldwide in the food and beverage industry. As consumers become more mindful of health, safety, and environmental issues, an evident inclination is towards eco-friendly packaging solutions within this domain. An array of sustainable options, such as cartons, clamshells, bags & pouches, and corrugated boxes made from fibres, provide versatile packing alternatives ideal for various food and drink products. Paperboard and cardboard cartons are extensively utilized for packing perishable items such as dairy products, juices, and cereals. They are excellent medium-to-brand products due to their weightlessness, printable surfaces and barrier features that enhance product visibility. Moulded pulp or corrugated cardboard-made clamshells dominate the market in packaging fresh produce, baked goods and prepared meals owing to their reliability in providing protection plus consumer convenience.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 380.98 Billion |

| Market size value in 2033 | USD 537.41 Billion |

| CAGR (2024 to 2033) | 3.5% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Source, Waste Type |

As per The Brainy Insights, the size of the global fiber-based packaging market was valued at 380.98 billion in 2023 to USD 537.41 billion by 2033.

The global fiber-based packaging market is growing at a CAGR of 3.5% during the forecast period 2024-2033.

North America region became the largest market for fiber-based packaging.

The rising demand for fiber-based packaging across end-user vertical is driving the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global fiber-based packaging market based on below-mentioned segments:

Global Fiber-based Packaging Market by Product Type:

Global Fiber-based Packaging Market by End-user:

Global Fiber-based Packaging Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date