- +1-315-215-1633

- sales@thebrainyinsights.com

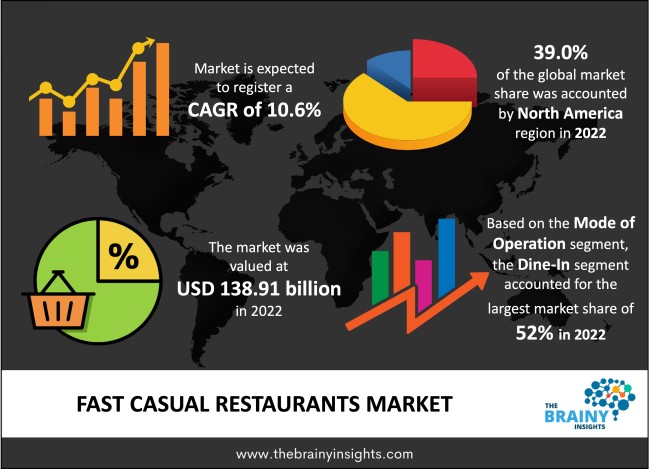

The global fast casual restaurants market was valued at USD 138.91 billion in 2022 and is anticipated to grow at a CAGR of 10.6% from 2023 to 2032. Fast casual restaurants bridge the gap between more formal dining experiences and classic fast-food locations, constituting a lively and evolving area of the food service industry. The need for convenience, high-quality dining options, and changing customer preferences have boosted the popularity of fast-casual restaurants in the current scenario. Some unique features distinguish fast-casual restaurants from both fast-food and casual dining venues. An important component is the focus on creating a modern yet welcoming environment. In contrast to fast-food restaurants, fast-casual restaurants frequently include continental and visually beautiful interiors that foster a more laid-back and comfortable dining experience. Additionally, these eateries frequently provide some degree of self-service to their customers, who place their orders at a counter before selecting a seat.

Fast casual restaurants are known for their dedication to creativity and personalization. Fresh, premium products are usually prioritized in these restaurants, and they blend international flavors and culinary traditions into their menu. The fast-casual experience is distinguished by its capacity to provide consumers with the customization of their orders, including the selection of specific toppings, sauces, and protein alternatives. This degree of personalization influences the impression that fast casual dining is superior to traditional fast food in terms of quality and customized practices. The gradual shift in consumer behavior towards dining practices in the late 20th century is the origin of fast-casual dining. The growth of fast-casual restaurants was facilitated by the growing awareness of health consciousness amongst the people in developed and developing countries.

Global influences, larger culinary trends, and consumer preferences drive the fast-casual industry. Many fast-casual restaurants have evolved into international restaurants, serving meals inspired by Mexican, Mediterranean, Asian, and other culinary traditions due to their customers' taste for authentic and varied flavors. This global influence gives the world more diversity and captures modern eating tastes' increasingly cosmopolitan and interconnected nature. Fast casual restaurants are becoming more aware of the significance of social and environmental responsibilities in addition to culinary tasks. Customers are becoming more concerned about community involvement, sustainable methods, and ethical resources. Many fast-casual restaurants use eco-friendly packaging, source locally, and participate in charitable endeavors in response to this change. Socially conscious consumers generally perceive fast casual restaurants positively because of their dedication to ethical business methods.

Get an overview of this study by requesting a free sample

Changing Consumer Preferences - Changing consumer preferences is one of the main factors behind the fast-casual restaurant industry's expansion. Consumers nowadays, especially those in the younger age group represented by millennials and Generation Z, strongly prefer experiences that combine quality with ease. Fast casual restaurants have become increasingly popular due to consumers' growing demand for tasty, freshly made meals that are also health-conscious. These enterprises aim to satisfy discriminating customers. The market reacts to consumers' growing awareness of what they eat by providing various customizable options. The mark-moving element of personalization and customization is essential to the success of fast-casual dining establishments. Compared to conventional fast-food retail chains that provide a set menu of goods, fast-casual restaurants allow patrons to customize their meals to fit their tastes. With a focus on customization, customers can select a wide range of food ingredients to improve the dining experience. This is the primary factor for the market growth and development.

Stringent Regulatory Compliance and Food Safety Concerns- The regulatory framework in which fast-casual restaurants operate requires adhering to several health and safety regulations. Respecting strict guidelines for food safety, hygiene practices, and worker welfare is not just the law but also essential to practicing customer confidentiality. Multinational fast-food chains may face difficulties due to the intricate and diverse rules that differ among various regions and nations. It takes a substantial financial commitment to monitor, train, and make operational changes to ensure continuous compliance with various regulatory frameworks. The market for quick casual restaurants may also face problems due to shifting consumer behaviors brought on by health concerns, demographic developments, and lifestyle trends. For example, traditional dining habits have changed as food delivery services have become more common and remote work has become more popular. It may be difficult for fast-casual restaurants catering to dine-in customers to adjust to these changes. This factor is limiting the market growth and development.

Rise in Food Delivery Services - The rising popularity of food delivery services is anticipated to provide lucrative growth opportunities in upcoming years. Fast casual restaurants have a wider customer base than traditional restaurants because of the growing emergence of food delivery services across the globe. Many customers have busy lives, so the convenience of freshly made, restaurant-quality meals delivered right to their door is appreciable. Fast casual eateries frequently collaborate with these delivery services to increase brand awareness and reach a wider audience. Affordability and value for money are two important economic factors influencing the fast casual restaurant industry. Despite provides a more sophisticated dining experience than conventional fast-food chains. These locations are reasonably priced concerning full-service restaurants. Sustaining success requires balancing providing premium ingredients and keeping prices competitive. Fast casual restaurants that manage this equilibrium will attract many customers without paying a hefty price.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region emerged as the most prominent global fast casual restaurants market, with a 39.0% market revenue share in 2022. U.S., Canada and Mexico are the key countries contributing towards the regional market growth and development. Regarding macroeconomic variables, the US economy is the largest in the world regarding GDP, and its enterprises are more flexible than those in Western Europe. Canada, on the other hand, has an advanced industrial economy. Even though the nation's economy grew slowly in 2008, it recovered quickly. There has been a substantial shift in food tastes toward healthier options among North American consumers. Organic, natural, and clean-labelled foods are becoming increasingly popular among the region's customers. Additionally, the prevalence of illnesses like diabetes and obesity is rising. As a result, customers choose their cuisine carefully, which leads to a preference for fast-casual restaurants. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

North America Region Fast Casual Restaurants Market Share in 2022 - 39.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The food type segment includes burger/sandwich, pizza/pasta, Asian/Latin American food and others. The pizza/pasta segment dominated, with a market share of around 38% in 2022. Because it appeals to consumers' love of traditional comfort meals with a global reach, the pizza and pasta segment commands a sizable market share in the fast-casual restaurant industry worldwide. Pasta and pizza restaurants are popular alternatives for a broad range of customers because they provide a familiar and personalized experience. Combining classic pizzerias, fast-casual pizza chains, and pasta-focused restaurants characterizes this market share. The pasta and pizza market has also adjusted to the shifting tastes of its customers, with a growing emphasis on healthier options. Numerous restaurants have whole-grain or gluten-free crust options, and the growing trend of people choosing plant-based toppings aligns with the world's movement toward more sustainable and healthy eating practices. The widespread use of digital ordering and delivery services further improves the availability of pizza and pasta options.

The mode of operation segment is bifurcated into dine-in and takeaway. The dine-in segment dominated, with a market share of around 52% in 2022. The dine-in option has long been a strong attribute of fast-casual restaurants. Factors such as efficient customer service, ambience, and improved dining experience contribute towards the segment's growth. Fast casual restaurants prioritizing attentive service, stylish interior design, and a warm ambience tend to capture a substantial market share of the dine-in segment. An increasing focus on personalization and customization distinguishes the dine-in market. Customers may construct customized meals, sandwich toppings, and other orders to suit personal preferences in many fast-casual restaurants. This degree of adaptability improves the overall eating experience, which helps explain why dine-in services continue to be popular.

The nature segment is bifurcated into standalone and franchised. The standalone segment dominated, with a market share of around 55% in 2022. Market share dynamics within the fast-casual industry are significantly shaped by standalone restaurants, which are often run and owned separately. Establishments that function as separate businesses without being a part of a larger franchise network are called "standalone" businesses. The focus on regional tastes, distinct branding, and culinary independence defines the brand share of fast-casual restaurants. A restaurant's capacity to quickly adapt to shifting customer tastes, ambiance, and menu innovation are some elements that affect its brand share when it comes to understanding fast-casual eats. Standalone models give customers a sense of authenticity and exploration to experiment with non-traditional culinary techniques.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2022 | USD 138.91 Billion |

| Market size value in 2032 | USD 380.45 Billion |

| CAGR (2023 to 2032) | 10.6% |

| Historical data | 2019-2021 |

| Base Year | 2022 |

| Forecast | 2023-2032 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Food Type, Mode of Operation, Nature |

As per The Brainy Insights, the size of the fast casual restaurants market was valued at 138.91 billion in 2022 to USD 380.45 billion by 2032.

The global fast casual restaurants market is growing at a CAGR of 10.6% during the forecast period 2023-2032.

North America region became the largest market for fast casual restaurants.

The technological advancements within the industry is influencing the market's growth.

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. The Brainy Insights has segmented the global fast casual restaurants market based on below-mentioned segments:

Global Fast Casual Restaurants Market by Food Type:

Global Fast Casual Restaurants Market by Mode of Operation:

Global Fast Casual Restaurants Market by Nature:

Global Fast Casual Restaurants Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date