- +1-315-215-1633

- sales@thebrainyinsights.com

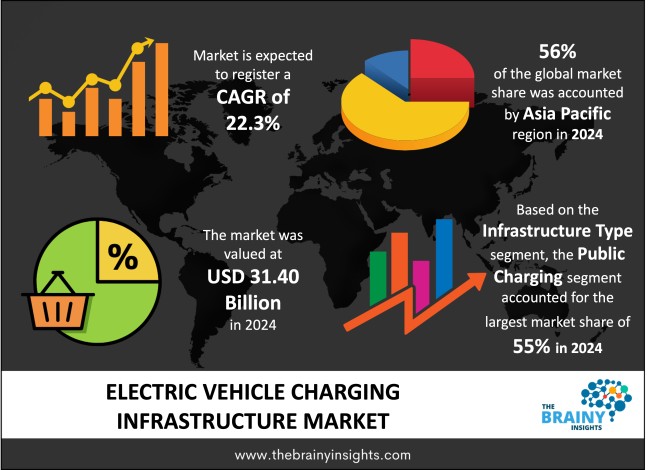

The global electric vehicle charging infrastructure market was valued at USD 31.40 Billion in 2024 and grew at a CAGR of 22.3% from 2025 to 2034. The global electric vehicle charging infrastructure market has become a pivotal sector within the international mobility landscape, driven by the rapid adoption of electric vehicles, stringent emission standards, technological advancements, and substantial investments in sustainable transportation. This market encompasses a broad range of charging types, charger types, infrastructure types and related services designed to facilitate efficient EV battery recharging for passenger cars, commercial fleets such as buses, and various two- or three-wheeled vehicles. The rapid growth in electric vehicle sales worldwide—propelled by supportive government policies, high fuel prices, increased environmental awareness, and improvements in battery technology—has generated strong ongoing demand for dependable, scalable, and cost-effective charging solutions across urban, suburban, and rural areas alike.

Electric Vehicle (EV) Charging Infrastructure encompasses all the physical elements, technologies, software networks, and service systems necessary to enable safe, efficient, and convenient electric vehicle charging. This infrastructure encompasses a diverse range of hardware and digital solutions that recharge vehicle batteries with electrical energy from power grids or renewable sources. At its core are the charging stations—also known as Electric Vehicle Supply Equipment (EVSE)—alongside power electronics components, connectors, cabling systems, control software, energy management systems, and grid interconnection interfaces. Together, these components ensure a seamless transfer of electricity from suppliers to vehicles worldwide, serving both public and private transportation networks. Essentially, EV charging infrastructure plays a vital role in recharging the batteries of all types of electric vehicles, including passenger cars, commercial vans, buses, trucks, and two-wheelers. This aspect ensures longer driving ranges and operational viability while promoting wider adoption of electric mobility. Serving as the modern equivalent of traditional fuelling stations for today's electric vehicles, this infrastructure is essential in facilitating decarbonized transportation globally. The increasing popularity of electric vehicles—driven by regulatory requirements, consumer demand, and advancements in battery technology—has made this network an indispensable component for achieving global energy sustainability.

Get an overview of this study by requesting a free sample

Rising Adoption of Electric Vehicles (EV) – The global electric vehicle charging infrastructure market is witnessing remarkable growth, propelled by a variety of dynamic factors that collectively boost the demand for reliable, accessible, and efficient charging solutions worldwide. A key driver of this trend is the increasing adoption of electric vehicles across major automotive segments, including passenger cars, commercial fleets, public vehicles, and two-wheelers. This widespread shift to electrified mobility has heightened the need for robust charging ecosystems that can meet the operational demands of various electric vehicle categories. The global automotive industry is undergoing a transformative change from internal combustion engine (ICE) vehicles to electric alternatives in response to environmental concerns, stricter emission regulations, and advances in battery technology. As penetration rates for electric vehicles continue to rise, the pressing necessity arises for residential and publicly available chargers, which unlock tremendous potential in serving all involved entities, especially manufacturers, network specialists, and energy distributors. This factor contributes to the growth and development of the global electric vehicle charging infrastructure market.

High Infrastructure Costs – Despite its rapid growth and promising future, the Global Electric Vehicle (EV) Charging Infrastructure Market is hindered by several significant restraints that affect its scalability, adoption, and operational efficiency on a global scale. One of the primary restraining factors is the high initial capital cost required for setting up EV charging stations—particularly advanced options like DC fast chargers and ultra-fast chargers. These high-power stations demand considerable investments not only in hardware but also in specialized electrical components, transformer upgrades, and civil works specific to each site. For many businesses, property owners, and municipalities, these expenses present a major barrier to entry—especially where public subsidies or financial incentives are scarce or non-existent. Furthermore, permitting procedures, local utility approvals, and compliance with safety regulations often add complexity, increase costs, cause project delays, and discourage potential investors. This factor is primarily restraining the market growth and development.

Growing Consumer Awareness Regarding Environmental Sustainability – The growing consumer awareness regarding environmental sustainability and the need to mitigate climate change is significantly driving the adoption of electric vehicles (EVs). This surge in EV popularity subsequently raises demand for charging infrastructure. As eco-friendly transportation gains priority among consumers, electric cars are being seen as practical alternatives to traditional gasoline-powered options. Corporate commitments to sustainability bolster the movement towards greener mobility solutions, municipal initiatives promoting clean transportation, and national strategies aimed at reducing carbon emissions. Additionally, the growing use of renewable energy sources, such as solar and wind power, enhances this trend, as many EV charging stations now incorporate on-site renewable energy generation along with energy storage systems. These efforts provide zero-emission charging solutions while further decreasing reliance on fossil fuels. This factor is anticipated to provide lucrative growth opportunities in the upcoming years.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global electric vehicle charging infrastructure market, with a 56% market revenue share in 2024.

The Asia Pacific region is currently the largest market for EV charging infrastructure worldwide, with China taking a dominating position. This country holds a significant share of the global market in terms of installed public charging stations, encompassing both AC and DC fast chargers. China's rapid adoption of electric vehicles has been driven by strong government backing, favourable incentives, and industrial policies, such as the New Energy Vehicle (NEV) Mandate, as well as substantial subsidies for installing charging stations. These factors have established China as the unparalleled leader in both EV sales and its corresponding infrastructure. Cities such as Beijing, Shanghai, and Shenzhen boast extensive charging networks, while highway corridors are being quickly outfitted to support long-distance travel via electric vehicles. Dominating this space are state-owned utilities, such as the State Grid Corporation of China, along with major private companies which frequently engage in large-scale deployments and are often supported by local governments' initiatives. Furthermore, China's focus on expanding DC fast-charging capabilities aims to minimise charge times, resulting in an unusually high number of high-capacity stations compared to other parts of the globe.

Asia Pacific Region Electric Vehicle Charging Infrastructure Market Share in 2024 - 56%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The infrastructure type segment is divided into private charging, semi-public charging and public charging. The public charging segment dominated the market, with a market share of around 55% in 2024. National and local governments, utility companies, and private charging network operators often spearhead the deployment of public charging infrastructure. Many countries have set specific targets for the number of publicly accessible chargers to be installed. For example, in Europe, policies such as the Alternative Fuels Infrastructure Directive (AFID) require the broad availability of public chargers. Similarly, in the United States, initiatives such as the National Electric Vehicle Infrastructure (NEVI) Formula Program are financing extensive networks of public charging corridors. In urban areas with limited residential off-street parking options—where home charging isn't feasible for many residents—the role of public charging becomes critically important. Additionally, it facilitates shared mobility services, including taxis and supports long-distance travellers who need convenient access to recharge along their routes.

The charger type segment is divided into Level 1, Level 2 and Level 3. The level 2 segment dominated the market, with a market share of around 49% in 2024. Level 2 charging, often considered the most prevalent type worldwide, operates at 208–240 volts and provides a significantly faster charge than Level 1 systems. With power outputs typically ranging from about 3 kW to as high as 22 kW—and potentially up to 50 kW in certain specialised commercial applications—these chargers can add between 10 and 60 miles of driving range per hour, depending on vehicle specifications and charger capabilities. This category encompasses both home-based and business-oriented charging stations, which are commonly found in private residences, workplaces, parking garages, hotels, retail areas, and semi-public areas. Level 2 charging has become the go-to option for individuals and businesses aiming for an optimum balance of speed and cost-effectiveness in their electric vehicle (EV) energy needs.

The charging type segment is divided into AC Type and DC Type. The AC type segment dominated the market, with a market share of around 65% in 2024. AC charging, also known as Level 1 and Level 2 depending on voltage and power specifications, currently accounts for the largest proportion of installed units worldwide. These chargers are primarily located in residences, workplaces, and semi-public areas where vehicles are parked for extended periods. The system functions by taking AC power from the grid into an onboard charger within the vehicle that converts it to DC power to charge its battery. Power delivery typically ranges between 1.4 kW with standard residential Level 1 chargers and up to about 22 kW with more advanced Level 2 systems; certain specialised commercial setups can reach up to 50 kW. The ease of overnight home charging, coupled with relatively low installation costs, has significantly driven their widespread adoption across markets. Many electric vehicle manufacturers further enhance market penetration by including AC home chargers with their cars or collaborating through partnerships with third-party providers.

The application segment is divided into residential and commercial. The commercial segment dominated the market, with a market share of around 58% in 2024. The market share of the commercial segment has been consistently growing both in terms of installed units and revenue. In densely populated urban areas, commercial chargers play a crucial role for EV drivers without access to private residential charging options, especially those living in apartments or crowded cities. Public charging networks located at shopping centres, transit hubs, and municipal parking facilities offer drivers the opportunity to charge their vehicles. At the same time, they engage in daily tasks such as shopping, dining out, or commuting. Another significant growth factor in the commercial sector is workplace charging. A growing number of employers are providing on-site charging stations as a benefit to attract and retain staff while also supporting their corporate sustainability objectives. Having access to chargers at work not only increases daily driving ranges but also promotes EV adoption among employees who might lack home charging options.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 31.04 Billion |

| Market size value in 2034 | USD 235.07 Billion |

| CAGR (2025 to 2034) | 22.3% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Infrastructure Type, Charging Type, Charger type and Application |

As per The Brainy Insights, the size of the global electric vehicle charging infrastructure market was valued at USD 31.40 billion in 2024 to USD 235.07 billion by 2034.

Global electric vehicle charging infrastructure market is growing at a CAGR of 22.3% during the forecast period 2025-2034.

The market's growth will be influenced by rising adoption of electric vehicles across developed and developing countries.

High infrastructural costs could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global electric vehicle charging infrastructure market based on below mentioned segments:

Global Electric Vehicle Charging Infrastructure Market by Infrastructure Type:

Global Electric Vehicle Charging Infrastructure Market by Charger Type:

Global Electric Vehicle Charging Infrastructure Market by Charging Type:

Global Electric Vehicle Charging Infrastructure Market by Application:

Global Electric Vehicle Charging Infrastructure Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date