- +1-315-215-1633

- sales@thebrainyinsights.com

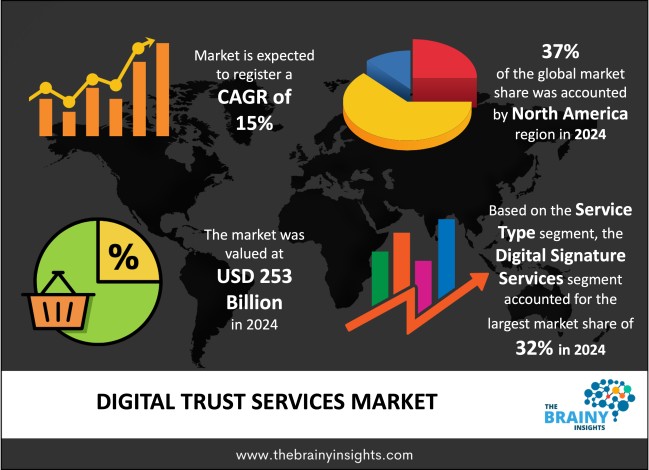

The global digital trust services market was valued at USD 253 billion in 2024 and grew at a CAGR of 15% from 2025 to 2034. The market is expected to reach USD 1023.52 billion by 2034. The rapid digital transformation worldwide will drive the growth of the global digital trust services market.

Digital Trust Services include different technologies and guidelines aimed at keeping online interactions safe, stable and reliable. Since people and organizations are now using the internet more for communication, shopping and sharing data, it has become very important to ensure their online interactions are valid, secure and private. Digital Trust Services relies on digital signatures, electronic certificates, encryption, verification of identities and secure forms of authentication. Digital signatures facilitate the verification of electronic documents. Encryption helps secure data whether it is saved or being transferred online to prevent unwanted access to it. Besides protecting technology, Digital Trust Services also include governance rules, compliance measures and risk plans put in place by organizations to protect their digital information. Such services are essential for banking, healthcare, e-commerce and the government since reliability and protection of data are highly important. Recently, due to cloud computing, mobiles and IoT devices, Digital Trust Services have started to deal with issues brought about by identity theft, cyberattacks and data breaches. Advances, like blockchain and decentralized identity, are being added to make sure personal information is transparent, trackable and better controlled by users. All in all, Digital Trust Services make it possible for individuals, businesses and government organizations to communicate safely and securely on the internet.

Get an overview of this study by requesting a free sample

The rapidly expanding digital integration and services – As more and more companies rely on cloud computing, mobile devices and the Internet of Things, making digital identities and information safe becomes extremely important. Inside a business, protection of sensitive data to curb breaches is important and digital trust tools are therefore important for their cybersecurity. With these services, businesses can speed up the process by automating verifications, electronic signatures and checking transactions which also costs less and cuts down on manual tasks. Besides, companies are encouraged to develop better risk management systems by using digital trust solutions that help reduce fraud and cyber-crimes. The requirement to stick to internal security policies and external laws like GDPR and HIPAA also leads to growth since companies rely on cybersecurity systems to constantly secure their data. Therefore, the growing automation and digitization of economies worldwide will drive the need for digital trust services to ensure safety, security and privacy of online interactions, transactions etc.

Financial costs and lack of human resources – It is difficult to adopt digital trust due to the high charges linked to acquiring, implementing, operating and maintaining systems. The needed investment in security can be very high for small and medium-sized companies, as they might not have enough money to afford advanced solutions. Digital trust solutions are hard to add to legacy systems from a technical perspective. Deploying innovative technology into existing IT systems takes more time and causes more disruptions, so many organizations are reluctant to try these services. A further problem is that not enough skilled staff are available to aid in handling, operating, maintaining and updating digital trust systems properly. If companies do not have qualified staff, they could find it challenging to use, maintain and fix their services which might lead to underutilization of these services.

Stringent laws governing online data security and privacy – As cyberattacks, identity theft and data breaches occur more in industries, businesses are expected to keep their customers and activities secure. Since external dangers are on the rise, companies now rely on modern digital trust measures, including strong authentication, encryption and digital signatures, to secure their online interactions, data among other things. Governments all over the world are strengthening their laws for data protection, digital money systems and personal identity, so companies are required to follow advanced trust frameworks. Besides, people are now interested in secure digital experiences which prompts companies to invest in digital trust services that build trust and loyalty. Since remote work and online collaboration now dominate the global work culture, more emphasis is placed on using solid external authentication and data security measures. furthermore, new technologies such as blockchain, decentralized identification, biometric tests and AI are enhancing digital trust services by ensuring better safety, efficiency and cost-effectiveness.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global digital trust services market, with a 37% market revenue share in 2024.

Digital trust services in North America have progressed given their modern technology, early adoption and use of new digital technologies/services and stringent government guidelines. Companies in banking, healthcare, government and the technology sector give high importance to secure data and operations contributing to a greater need for digital security and compliance measures. Besides, North America relies on strict rules such as HIPAA, GDPR and the CCPA which make businesses implement new digital trust technologies for privacy and security. Trust services are constantly evolving in the region due to the area’s evolving startup ecosystem and top technology vendors. Added to this, many people use the internet, have good tech skills and follow rules well, all of which support using digital trust solutions in all types of companies.

North America Region Digital Trust Services Market Share in 2024 - 37%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The service type segment is divided into digital signature services, identity and access management (IAM), public key infrastructure (PKI), encryption and data security, authentication services and certificate management. The digital signature services segment dominated the market, with a market share of around 32% in 2024. Rapid digital transformation has increased the importance of trustworthy ways to securely store data, exchange it and authentic. Digital signatures are effective and safe as an alternative to handwritten ones because they rely on cryptography to validate the content and authenticity of electronic documents. This reduces the chances of documents being stolen or changed which allows exchanges and approvals to be carried out more quickly. The awareness and legal recognition of digital signatures have been supported by European eIDAS regulation and the ESIGN Act in the USA, thus making them essential for organizations that operate digitally or online. The use of digital signatures in banking, healthcare, government and legal services by many parts of society has made it a dominant technology in the market. Today, digital signatures are needed more often because companies need to sign agreements and approvals without having to be in the same place. Linking digital signature services with identity verifications and encryption adds extra safety for everyone. Also, new cloud-based digital signature platforms allow companies of any size to use these services more easily, giving digital trust platforms an even stronger leading role. All in all, digital signature services make digital interactions secure, efficient and legally admissible, helping them dominate the digital trust services market.

The deployment mode segment is divided into cloud-based and on-premises. The on-premises segment dominated the market, with a market share of around 55% in 2024. Many banking, healthcare and government firms are strictly regulated, many of them want in-house digital trust solutions for guaranteed safety and security of their data and operations. By setting up their security services on-premises, organizations can match them closely with their old systems and oversee their security following the organization’s own rules. It is easier to regulate accesses, updates and settings within on-premises systems without any third-party interference. Also, fears over the control of data and legal rules that require keeping sensitive information in-house help explain why companies prefer to keep their systems on-premises. Since cloud computing is on the rise, people’s concerns about cloud security and data breaches push organizations to keep important functions installed on their own systems. Moreover, big companies usually possess advanced IT support and infrastructure that make it simpler for them to handle complex on-premises digital trust services, but this is not easy for small businesses. Even though cloud options for digital trust services are growing in popularity due to their cost and flexibility, most companies still choose on-premises, as it guarantees better security and more control. For organizations that place greatest value on trust and security, on-premises remains the top pick which is why it holds the leading spot in the digital trust services market.

The organization size segment is divided into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominated the market, with a market share of around 54% in 2024. The main reason for large companies leading the global digital trust services market is their considerable digital systems, strict requirements for security and the ability to invest more compared to others. As they handle a great deal of confidential data that includes customer details, inventions and money, it is crucial for these organizations to use reliable digital trust tools that keep their data safe. Large enterprises operating in banking, healthcare and government use advanced identity verification, encryption and digital signature solutions to adhere to the regulations and laws to avoid penalties and other consequences. They have big budgets which enables them to set up detailed digital trust frameworks. Having skilled and qualified IT and cybersecurity teams gives large organizations the ability to properly set up, manage and advance digital trust infrastructure, encouraging more users to adopt it. The rapid digital transformation and growing culture of remote work in these companies increase the demand for digital trust services. Besides, companies with many employees and partners take part in a high number of electronic exchanges and deal with different stakeholders, so trust in their security and data makes it easier to maintain their reputation and operations without interruptions.

The end-user industry segment is divided into banking, financial services, and insurance (BFSI), government and public sector, healthcare, IT and telecommunications, e-commerce and retail, manufacturing and others. The banking, financial services, and insurance (BFSI) segment dominated the market, with a share of around 35% in 2024. Each year, the Banking, Financial Services and Insurance sector requires more secure and dependable digital services which helps it control a major share within the digital trust services market. Since it is one of the industries subject to strict regulations, BFSI must stick to rules such as the GDPR, PSD2 and different AML laws. Strong authentication, secure data use and reliable verification methods are set as standards and so the sector needs advanced digital trust services like digital signatures, IAM and encryption. Besides, the BFSI sector gathers and handles lots of sensitive customer information, so it stands out as a popular target for cyberattacks and fraudsters. In order to guard their assets and keep customers reassured, financial institutions put in place advanced digital trust measures. Because banks, finance and insurance are going digital fast, the demand for security and compliance with laws has grown. Moreover, the markets in which these organizations work are very competitive, so firms rely on digital trust services to maintain their customer base and earn lasting loyalty.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 253 Billion |

| Market size value in 2034 | USD 1023.52 Billion |

| CAGR (2025 to 2034) | 11% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Service Type, Deployment Mode, Organization Size and End-User Industry |

As per The Brainy Insights, the size of the global digital trust services market was valued at USD 253 billion in 2024 to USD 1023.52 billion by 2034.

Global digital trust services market is growing at a CAGR of 11% during the forecast period 2025-2034.

The market's growth will be influenced by the rapidly expanding digital integration and services.

Financial costs and lack of human resources could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global digital trust services market based on below mentioned segments:

Global Digital Trust Services Market by Service Type:

Global Digital Trust Services Market by Deployment Mode:

Global Digital Trust Services Market by Organization Size:

Global Digital Trust Services Market by End-User Industry:

Global Digital Trust Services Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date