- +1-315-215-1633

- sales@thebrainyinsights.com

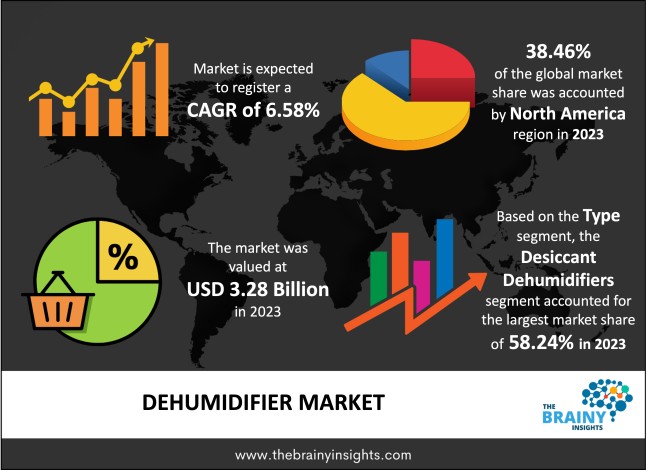

The global dehumidifier market generated USD 3.28 billion revenue in 2023 and is projected to grow at a CAGR of 6.58% from 2024 to 2033. The burgeoning adoption of household dehumidifiers for moisture control, bacteria, and mold prevention is a significant driver propelling the market forward. Furthermore, the imposition of stringent energy efficiency regulations by governments across various nations is accelerating the demand for energy-efficient dehumidifiers. Moreover, the global expansion of cold storage, warehousing, and pharmaceutical manufacturing facilities presents lucrative growth prospects for end-users over the coming years.

A dehumidifier is an air conditioning device that reduces air humidity within an enclosed space. It draws in moist air, passing over refrigerated coils or through a desiccant material. As the air cools or the desiccant absorbs moisture, water vapour in the air condenses into liquid water, which is collected in a reservoir or drained away. The dehumidified air is then released back into the room, resulting in a decrease in humidity levels. Dehumidifiers are generally used in places with high humidity levels to prevent mildew, mold, and moisture-related damage to furniture, walls, and other belongings. They are especially useful in basements, bathrooms, laundry rooms, and other areas prone to dampness.

Get an overview of this study by requesting a free sample

Rising Awareness of Health Concerns - Increasing understanding of the health threats linked with high humidity levels, such as mold growth, respiratory issues, and allergies, propels dehumidifier demand. Consumers are becoming more conscious of maintaining optimal indoor air quality, driving the adoption of dehumidification solutions.

Climate Change and Weather Patterns - Changing weather patterns and rising extreme weather events, including floods and hurricanes, lead to higher humidity levels in many regions. Consequently, there's an increased need for dehumidifiers to mitigate moisture-related problems in homes, commercial buildings, and industrial spaces.

Growing Construction Activities - The booming construction industry, particularly in developing economies, generates demand for dehumidifiers in newly built residential and commercial properties. Dehumidifiers are essential in preventing moisture-related damages during construction and ensuring the durability of buildings.

High Initial Cost - One of the main restraints of the dehumidifier market is the relatively high initial cost associated with purchasing a dehumidifier unit. Therefore, acquiring a dehumidifier, especially those with advanced features or larger capacities, can be prohibitive for some consumers, leading to a slower adoption rate.

Seasonal Demand - Demand for dehumidifiers is often seasonal, with higher demand during hot and humid months and lower demand during cooler seasons. This seasonality can drive instabilities in sales and production, making it challenging for manufacturers to maintain steady revenue streams throughout the year.

Technological Advancements - Ongoing advancements in dehumidifier technology are opening up new opportunities for market growth. Innovations such as smart dehumidifiers with Wi-Fi connectivity, energy-efficient models, and integrated air purification systems appeal to consumers seeking convenience, energy savings, and enhanced functionality.

Expansion of Applications - Dehumidifiers are not only used in residential settings but also find applications in commercial, industrial, and healthcare sectors. There is a growing demand for dehumidification solutions in food processing, pharmaceutical manufacturing, museums, warehouses, and data centers. Expanding into these diverse applications can help manufacturers tap into new market segments and revenue streams.

Regulatory Support - Increasing regulations to improve indoor air quality and energy efficiency are driving the adoption of dehumidifiers in residential and commercial buildings. Government incentives, rebates, and energy efficiency standards can incentivize consumers and businesses to invest in dehumidification solutions, thereby boosting market growth.

Consumer Perception and Education - Many consumers perceive dehumidifiers as luxury appliances rather than essential home comfort solutions. Educating consumers about the health benefits of maintaining optimal indoor humidity levels and addressing misconceptions about dehumidifier functionality can be challenging but essential for increasing market penetration.

Supply Chain Disruptions - Like many industries, the dehumidifier market faces risks associated with supply chain disruptions, such as lack of raw material availability, transportation delays, and geopolitical uncertainties. These disruptions can impact production schedules, increase costs, and hinder the ability to meet customer demand.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global dehumidifier market, with a 38.46% market revenue share in 2023.

North America encompasses different climates, from humid regions in the southern United States to drier climates in the western states and Canada. Areas with high humidity levels, such as the Southeastern United States and parts of Canada, strongly demand dehumidifiers to combat moisture-related issues like mold growth, musty odours, and discomfort. Furthermore, there is a growing awareness of the health implications associated with high humidity levels, including respiratory problems and mold-related allergies. This awareness has driven the demand for dehumidifiers among consumers who prioritize indoor air quality and seek to create healthier living environments for themselves and their families. Additionally, North America is a hub for technological innovation, with many leading manufacturers continuously developing and improving dehumidifier technology. Advanced features such as smart controls, energy efficiency, and integrated air purification systems make North American-made dehumidifiers attractive to consumers looking for convenient and effective solutions. In addition, stringent regulatory standards in North America often require humidity control measures in residential and commercial buildings. Building codes may mandate the use of dehumidifiers in locations prone to moisture buildup, such as crawl spaces, basements, and bathrooms, to prevent mold growth and structural damage. Besides, North America's relatively affluent consumer base has the purchasing power to invest in home comfort and wellness products like dehumidifiers. Consumers are willing to pay a premium for high-quality products with durability, reliability, and advanced features, driving sales in the dehumidifier market.

North America Region Dehumidifier Market Share in 2023 - 38.46%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into desiccant dehumidifiers, electronic/heat pump dehumidifiers and refrigerant dehumidifiers. The desiccant dehumidifiers segment dominated the market, with a share of around 58.24% in 2023. Desiccant dehumidifiers are highly effective in low-temperature conditions, making them appropriate for use in colder climates or spaces where traditional compressor-based dehumidifiers may struggle to operate efficiently. This aspect includes applications such as basements, crawl spaces, garages, and storage areas where low humidity is vital for stopping mold growth and preserving sensitive items. Moreover, desiccant dehumidifiers typically operate more quietly than compressor-based dehumidifiers, making them well-suited for use in residential settings where noise levels are a concern. Their quiet operation allows continuous use without disrupting occupants, making them an attractive option for bedrooms, living rooms, and other living spaces. Additionally, desiccant dehumidifiers are often more compact and lightweight than compressor-based models, making them easier to move and position in various locations. This portability and flexibility make desiccant dehumidifiers ideal for use in temporary or mobile applications, such as RVs, boats, cabins, and portable storage units.

The installation segment is split into portable dehumidifiers and fixed dehumidifiers. The fixed dehumidifiers segment dominated the market, with a share of around 58.46%. Fixed dehumidifiers are designed for permanent installation in a specific location, such as a basement, crawl space, or HVAC system. Once installed, they provide continuous moisture control without manual intervention, making them convenient and hassle-free for homeowners and building occupants. Most importantly, fixed dehumidifiers are often more energy-efficient than portable models, especially when integrated with HVAC systems or energy-saving features such as variable-speed fans and dehumidification cycles. Fixed dehumidifiers help lower energy consumption and utility costs for homeowners and building owners by operating more efficiently. Many fixed dehumidifiers are also designed to integrate seamlessly with existing HVAC (Heating, Ventilation, and Air Conditioning) systems. They can be installed as part of the HVAC system to provide whole-house or whole-building dehumidification, ensuring consistent humidity control throughout the indoor space.

The technology segment is classified into cold condensation, sorption, warm condensation and others. The cold condensation segment dominated the market, with a share of around 42.37%. Cold condensation dehumidifiers are versatile and can be used in various environments, including residential homes, commercial buildings, industrial facilities, and specialized applications such as laboratories, museums, and archives. They can effectively control humidity levels in different settings, providing comfort, preserving materials, and ensuring optimal conditions for processes and equipment. Furthermore, cold condensation technology is highly efficient in removing moisture from the air, making it well-suited for a wide range of applications. These dehumidifiers can effectively lower the air temperature below the dew point, causing moisture to condense and be collected. In addition, cold condensation technology has been widely used for decades and has a proven history of effectiveness and reliability. Consumers and businesses trust this technology to provide consistent and dependable moisture control, leading to its widespread adoption in the dehumidifier market.

The application segment includes commercial, industrial and residential. The industrial segment dominated the market, with a share of around 46.81% in 2023. Industries often have stringent requirements for moisture control to maintain product quality, ensure worker safety, and preserve equipment and materials. High humidity levels can lead to corrosion, mold growth, product spoilage, and decreased efficiency in industrial processes. Dehumidifiers are essential for controlling humidity levels in industrial settings to prevent these problems and maintain optimal conditions. Additionally, industries are subject to regulations and quality standards that mandate moisture control and environmental conditions in certain applications. For example, pharmaceutical manufacturing facilities must adhere to Good Manufacturing Practices (GMP) guidelines, including humidity control requirements, to prevent contamination and ensure product quality. Dehumidifiers help industries comply with regulatory standards and maintain a safe and controlled environment. Moreover, some industries have specialized moisture control requirements requiring custom-designed dehumidification solutions. For example, the aerospace industry may require dehumidifiers with low dew point capabilities to prevent moisture condensation on aircraft components during storage or maintenance. Dehumidifier manufacturers offer customized solutions to meet these specialized requirements and provide tailored moisture control solutions for industrial applications.

The distribution channel segment is divided into online and offline. The offline segment accounted for the highest market, with a share of around 65.31% in 2023. Offline distribution channels, such as brick-and-mortar stores, specialty appliance retailers, home improvement stores, and department stores, offer consumers convenient access to dehumidifiers. These physical retail outlets typically carry a wide selection of dehumidifier brands, models, and sizes, letting buyers compare products and make better purchasing decisions. Offline distribution channels also allow consumers to interact with dehumidifiers firsthand, allowing them to see, touch, and experience the product before purchasing. This hands-on experience can help build trust and confidence in the product's quality, features, and performance, leading to better conversion rates and customer delight. Besides, many offline retailers employ knowledgeable sales staff who can provide expert advice, product recommendations, and assistance in selecting the right dehumidifier for specific needs and requirements. Consumers can benefit from personalized guidance and support from trained professionals, especially when navigating various options and technical specifications.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 3.28 Billion |

| Market size value in 2033 | USD 6.20 Billion |

| CAGR (2024 to 2033) | 6.58% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Installation, Technology, Application and Distribution Channel |

As per The Brainy Insights, the size of the dehumidifier market was valued at USD 3.28 billion in 2023 to USD 6.20 billion by 2033.

The global dehumidifier market is growing at a CAGR of 6.58% during the forecast period 2024-2033.

North America became the largest market for dehumidifier.

Rising awareness of health concerns and growing construction activities drive the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global dehumidifier market based on below-mentioned segments:

Global Dehumidifier Market by Type:

Global Dehumidifier Market by Installation:

Global Dehumidifier Market by Technology:

Global Dehumidifier Market by Application:

Global Dehumidifier Market by Distribution Channel:

Global Dehumidifier Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date