- +1-315-215-1633

- sales@thebrainyinsights.com

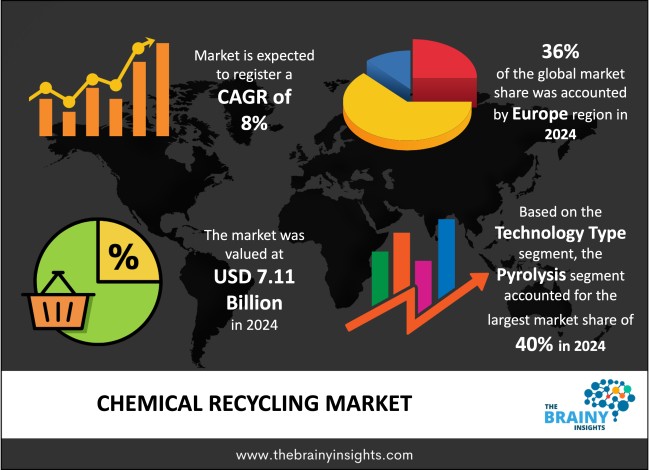

The global chemical recycling market was valued at USD 7.11 billion in 2024 and grew at a CAGR of 8% from 2025 to 2034. The market is expected to reach USD 15.34 billion by 2034. The growing emphasis on sustainability and environmental conservation will drive the growth of the global chemical recycling market.

Chemical recycling or advanced recycling or feedstock recycling is a group of new technologies aimed at converting plastic waste back into its original chemical feedstock. Mechanical recycling implies the cleansing, shredding, and remodelling of plastics by preserving the chemical compositions of these materials as they are without any further chemical interactions. In contrast, chemical recycling breaks down polymers into monomers or other fundamental chemicals. These may then be repolymerized into new plastics or turned into fuels, waxes, or other useful industrial feedstocks. The approach is critical in addressing the shortcomings of conventional recycling. Most of the plastics, in particular the multilayer packaging, contaminated or coloured plastics, and thermosets are not mechanically recyclable as they are structurally complex. Chemical recycling will solve the dilemma because these difficult-to-recycle types of plastic will be converted through the chemical recycling process and will increase the volume of plastic that can be landed out to avoid landfills and fires. Chemical recycling technologies come in a variety of forms, for example pyrolysis (thermal decomposition under proceeds of oxygen), gasification (waste to syngas), depolymerization (polymers to monomers) and solvent-based purification. Among the major advantages of chemical recycling, its outputs are said to be of the same quality as virgin materials, referring to circular economy objectives.

Get an overview of this study by requesting a free sample

The growing emphasis on sustainability and environmental conservation – The expanding desire of the chemical and plastic manufacturing industries to embrace the idea of using circular economy is driving the market’s growth. The key players in the industry are in pursuit of other options that could enable them to have closed circuits where waste products are transformed into raw materials of high quality. The chemical recycling helps further the virgin-quality products can be used in the same high-value activities like food packaging, car parts, and consumer products. Moreover, firms are coming under pressure to meet corporate sustainability goals and meet the regulatory compliance aspects concerning recycled content. Chemical recycling can help plug the gap that mechanical recycling has been unable to in many cases meet the required quality or quantity levels. Companies, particularly those in industries such as FMCG and packaging are taking advantage of chemical recycling in order to reach ambitious recycled content targets.

Technical and operational limitations – The first among the key limitations lies in the fact that to implement chemical recycling, large amounts of capital are demanded to build factories of this type, and overall costs of operation that include the costs of the utilization of energy, maintenance requirements, and complex processing devices are very high. These economic considerations also preclude the entry of smaller players into the market and also make such projects overall economically unviable unless it is heavily subsidized or through some sort of partnership. Moreover, most of the chemical recycling methods are at their initial stage of development or pilot stage, and have not achieved a stable level of performance at commercial rates. This low level of technological maturity discourages the scalability and benefit of investment. In addition, certain chemical recycling techniques lead to low conversion rates of the materials or production of secondary pollutants, which undermine sustainability assertions and process effectiveness. Chemical recycling has more than once become entangled in logistical complexities associated with the collection, separation and pre-treatment of waste in contrast to mechanical recycling, which is both easier and entrenched.

Regulatory pressure – Governments all over the world are introducing crackdowns in order to prevent plastic pollution and ensure sustainable waste management. Strict recycled content policies, prohibition of single-use plastics, and some forms of landfilling or incineration of a specified type of plastic is driving industries to consider advanced recycling. Ways that can be used to address these legal demands is through chemical recycling since it is able to recycle plastics that cannot undergo a mechanical recycling process effectively. Meanwhile, an increasing level of environmental awareness among politicians, corporations and individuals is causing a powerful backlash toward more sustainable options. The plastic waste predicament captivating the entire world through clogged garbage dumps, plastic wandering in the seas, and the impact of carbon emissions has testified to the insufficiency of the regular recycling processes. Chemical recycling is the way in which reliance on fossil fuels, as well as reducing the impact of plastic waste on the environment, is growing in the way of a genuine recovery and utilization of materials.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe emerged as the most significant global chemical recycling market, with a 36% market revenue share in 2024.

Europe has the leading role in the worldwide chemical recycling market because it has progressive environmental policies and effective regulatory solutions. European Union has adopted ambitious laws like the European Green Deal, EU Plastics Strategy and Circular Economy Action Plan establishing ambitious targets, with respect to decreasing the amount of plastic waste, increasing the rate of recycling and incorporating recycled material in new products. This policy action has formed a conducive atmosphere regarding the emergence and use of innovative recycling methods such as chemical recycling. Moreover, developed waste management network in Europe, as well as commitment to sustainability, has allowed efficient collection, sorting and processing of plastic waste - the basic requirements in the context of chemical recycling. National investments in chemical re-processing and recycling are also abundant and many pilot and commercial-scale chemical recycling projects call the region home. Moreover, European consumers and companies are quite environmentally aware, and the need to use sustainable materials and circular solutions is quite high, especially in such sectors as the packaging industry, automotive, and consumer goods.

Europe Region Chemical Recycling Market Share in 2024 - 36%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The technology type segment is divided into pyrolysis, gasification, depolymerization and solvent-based processes. The pyrolysis segment dominated the market, with a market share of around 40% in 2024. Pyrolysis has played the main position in the worldwide chemical recycling market because of the immense freedom in technology, scalability and capacity to handle mixed and polluted plastic waste that mechanical methods of recycling cannot receive. Pyrolysis is a type of thermal decomposition, without using oxygen, of a long-chain polymer and decomposes into shorter technology, or rather, hydrocarbon, molecules. The products usually come out to be pyrolysis oil (also called as synthetic crude), syngas, and char, although the most valuable is the pyrolysis oil. Such oil can be reduced into fuel or be converted into a feedstock to produce new virgin-quality plastics, which essentially contribute to a cyclic economy. The ability of pyrolysis to work with popular plastics such as polyethylene (PE) and polypropylene (PP) that are common materials in packaging waste, is one of the major factors that render the technology dominant. Moreover, the fact that pyrolysis technology is relatively less mature than other means of chemical recycling, including depolymerization or gasification, has resulted in its fast commercialization. Some international companies and start-ups are betting on mammoth-scale pyrolysis plants as it has already proved to be possible and the market is expanding further in the need of circular feedstocks. In addition, the flexibility of the process enables a decentralized or modular plant configuration, which is tailored to local wastes and local regulations.

The plastic type segment is divided into polyethylene (PE), polypropylene (PP), polystyrene (PS), polyethylene terephthalate (PET), polyvinyl chloride (PVC) and others. The polyethylene (PE) segment dominated the market, with a market share of around 38% in 2024. Polyethylene (PE) has taken the centre stage in chemical recycling in the global chemical recycling market because of the scale at which it has production activities which are large, its extensive use across sectors, and its high portion in post-consumer plastics waste. Polyethylene being the most common plastic in use throughout the world is found in the forms of high-density polyethylene (HDPE) and in low-density polyethylene (LDPE), which have been highly used in packaging materials, shopping bags, containers, films and bottles. Such wide consumption leads to a large volume of waste, making PE one of the key candidates in terms of recycling, in particular, chemical one. Further enhancing the pre-eminence of polyethylene is the fact that once contaminated, multilayered or mixed with other materials, this substance is very hard to recycle by methods that rely on mechanical recycling, which is common among packaging films and flexible wraps. Also, the comparatively simple architecture of polymer makes PE prone to chemical recycling operations, in particular, to thermal techniques of decomposition. As the prime feedstock, polyethylene is the major driving force behind the development and commercial attractiveness of the chemical recycling technologies especially in the packaging and consumer-related goods industries due to its market share dominance in both the volume of production and waste.

The end-use industry segment is divided into packaging, automotive, building & construction, textiles, electronics and others. The packaging segment dominated the market, with a market share of around 36% in 2024. The packaging market controlled the global chemical recycling market because of sheer volume of packaging wastes generated in the world as well as the limited recyclability of such packaging wastes using mechanical processes available. The strong relationship of packaging sector, especially in food, retail, and consumer items industry with plastics such as polyethylene (PE), polypropylene (PP) and multi-layer films, is because of its lightweight, flexibility, and durability features. Most of these materials, and in particular, flexible packaging, multilayer wrapping, and soiled films cannot be recycled mechanically since most of them are easily broken down, poorly sortable, and tend to have additives or blended polymers. The advantage of chemical recycling to solve this problem is, it compounds these complex packaging plastics into their chemical components and thus, the quality of output after recycling becomes high. This is why it is interesting to use it in packaging, where purity and performance of the material is of great importance. Chemical recycling has also emerged to benefit brands and manufacturers hoping to realize recycled content goals, minimize their carbon footprint and stay in line with government-imposed limitations on single-use plastics and the production of a more sustainable environment through extended producer responsibility (EPR) programs.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 7.11 Billion |

| Market size value in 2034 | USD 15.34 Billion |

| CAGR (2025 to 2034) | 8% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Technology Type, Plastic Type and End-Use Industry |

As per The Brainy Insights, the size of the global chemical recycling market was valued at USD 7.11 billion in 2024 to USD 15.34 billion by 2034.

Global chemical recycling market is growing at a CAGR of 8% during the forecast period 2025-2034.

The market's growth will be influenced by the growing emphasis on sustainability and environmental conservation.

Technical and operational limitations could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global chemical recycling market based on below mentioned segments:

Global Chemical Recycling Market by Technology Type:

Global Chemical Recycling Market by Plastic Type:

Global Chemical Recycling Market by End-Use Industry:

Global Chemical Recycling Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date