- +1-315-215-1633

- sales@thebrainyinsights.com

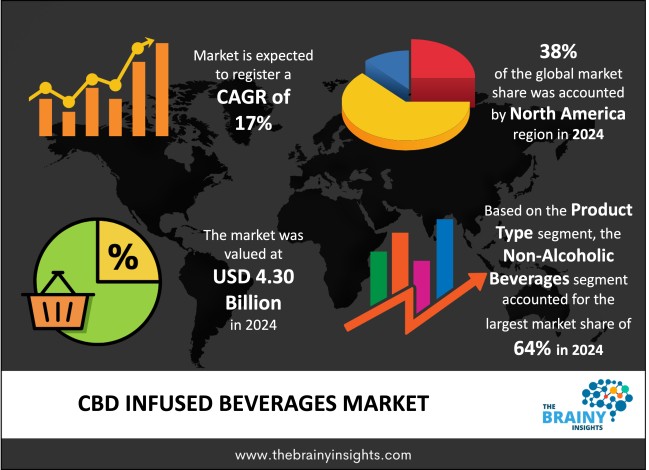

The global CBD infused beverages market was valued at USD 4.30 billion in 2024 and grew at a CAGR of 17% from 2025 to 2034. The market is expected to reach USD 20.66 billion by 2034. The increasing legal leniency for CBD based foods and beverages will drive the growth of the global CBD infused beverages market.

CBD-infused drinks are drink products which have a non-psychoactive compound, cannabidiol (CBD), which is an extract of the cannabis plant. In comparison to the popular THC (tetrahydrocannabinol), CBD does not lead to a higher condition, which makes it a very good choice among those who are interested in the potential healing qualities of cannabis but do not want to get intoxicated. Such drinks belong to a very fast developing niche both in the health and wellness segment as well as in the category of functional drinks. They exist in forms such as sparkling water, teas, coffees, energy drinks, juices to name a few. It is driven by the assumed advantages of using CBD in stress reduction, control of anxiety, treatment of pain, and improved relaxation. A large number of consumers are switching to CBD beverages as a natural supplement to conventional pharmaceutical products. The emergence of CBD-infused beverages is closely linked to the higher rates of hemp-derived CBD legalization in markets such as North America or certain areas in Europe. The advancement in water-soluble CBD technology has been of crucial importance as well, since it makes it easier to incorporate CBD into a liquid form and it gives the body the opportunity to absorb it more efficiently, or in other words, it increases bioavailability of CBD. Big drink and wellness names have emerged in the market, and new companies keep pushing innovation in taste and healthy products. Gen Z and Millennials, especially, are flocking to the use of these beverages as a result of their believed natural healing capabilities, suitability to their lifestyles, and low chance of side effects. With more and more research done on the effects of CBD, and clearer legal definitions, CBD-infused beverages will become a common staple in the functional drinks category, and the borders of health, relaxation, and daily refreshment will become indistinguishable.

Get an overview of this study by requesting a free sample

Product innovations and changing consumer preferences – The fact that such drinks match the current customer interest in health and wellness is one of the key drivers of the market. CBD also has potential therapeutical effects such as stress reduction, reduction of anxiety, and the enhancement of sleep, which makes these beverages desirable among health-aware people. Firms are capitalizing on this attraction by developing products that offer natural, practical, benefits but lack the psychoactive results of THC. The other important internal strategy is the technological innovation especially in the technology of the water-soluble CBD and nano-emulsification. Such innovations also increase bioavailability of liquid form of CBD to allow absorption and uniformity of dosage that heightens consumer satisfaction and credibility of a given product. Moreover, beverage companies are launching a variety of flavours and types of products as sparkling waters, teas, coffees, and juices as well to fulfil the demands of various consumers and uses. Such a diversity does not only make it more appealing to the market but also promotes trial and repeating purchases. High-quality ingredients and shiny brand also contribute to position CBD drinks as a high-end lifestyle product and enable businesses to pursue a premium price policy and focus on a narrow yet promising market niche. In addition, well established CBD or wellness brands have struck strategic partnerships with beverage firms to produce products of high quality and accorded consumer trust that are easily accepted in the market.

Inconsistent products with varying quality levels – It is a major issue that CBD products have not been standardized across brands. The discrepancy in dosage, the quality and the effectiveness pose a threat to the market’s growth as it erodes consumer trust and creates confusion in the market. Most products do not give the expected benefits stated and this limits the number of repeats as well as word of mouth advertising. Also, there is a problem of taste and aftertaste. Although positive technological advances have taken place, it is noted that certain types of CBD beverages retain the nasty taste of hemp or other types of bitter notes which is likely to turn off the customers that have never been exposed to the product before. Additionally, CBD of high quality is costly when it comes to the processing necessary to extract. High-quality CBD is especially costly to extract in the form of water-soluble. All this increases the price of the retail level thus inhibiting CBD beverages to the price sensitive consumers. Furthermore, CBD is a sensitive ingredient which has the ability to degrade with time or react with other ingredients affecting the efficacy and uniformity of products. This presents logistics difficulties of storing, distributing and quality check.

Changing regulations – Among the most important drivers is the increasing social tolerance of cannabis-derived products, and particularly, hemp-derived CBD, which is currently viewed by many as an all-natural way to cope with stress, anxiety, and other issues related to wellness. This move is intimately related to the changes in regulation, especially in North America and some jurisdictions in Europe, where the legalization and decriminalization of cannabis-derived CBD allowed the businesses to work on the development and marketing of their products with more freedom. As the legal clarity increases, market entry barriers will also go down thus enhancing innovation and growth. The surge in the use of natural and plant alternatives to conventional medicine and traditional alcohol can also be viewed as another factor positively influencing the market’s growth. Millennials and Gen Z consumers are embracing more holistic lifestyles and are focusing on products that meet those needs, choosing offerings that are non-intoxicating and have a therapeutic value as beverages rich in CBD certainly do. Also, media, wellness blogs, and even influencer marketing have done a lot to normalize the idea of CBD-infused products in people making them seem comfortable and eager to know more about them. The enhancement of distribution is also imperative; nowadays, CBD beverages have become more accessible via retail networks, health food markets, and online retail markets enhancement greatly increases visibility and accessibility.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global CBD infused beverages market, with a 38% market revenue share in 2024.

North America, especially the United States, has been on the rampage after the legalization of hemp-derived CBD was authorized and established by the 2018 Farm Bill. This landmark policy eliminated the inclusion of hemp among the controlled substances, and since then, companies are allowed to legally manufacture and sell CBD-infused products, which preconditioned the swift expansion of the industry. Additionally, Canada has also adopted an advanced approach to cannabis as recreational marijuana and CBD products were legalized across the country, making the market idealistic in terms of product growth and innovations. North America has the highest level of consumer awareness and acceptance of CBD than any other region. Natural remedies with the goal of alleviating stress, tensions, and sleep disturbances are streamlined by a massive, health-conscious market, which makes CBD-infused drinks a no-go functional wellness beverage. In addition, there is a competitive and innovative market as large beverage companies, wellness startups and cannabis brands are present in North America. The wide availability of its products has been enabled through strategic partnerships, intensive advertising and fine-grained retailing, all of which create ample visibility driving the market’s growth.

North America Region CBD Infused Beverages Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into non-alcoholic beverages and alcoholic beverages. The non-alcoholic beverages segment dominated the market, with a market share of around 64% in 2024. A relatively uncomplicated regulatory environment in non-alcoholic beverages containing CBD is one of the parameters why non-alcoholic beverages are leading in the market. Depending on the area, it is legal in most regions to add hemp-derived CBD to wellness and functional drinks as long as the product contains less than 0.3 percent of THC. Nevertheless, the use of CBD alongside alcohol poses regulatory dilemma, thereby restricting the pace of CBD-enriched alcohol. In addition, the increasing consumer demand of healthier and functional beverages has greatly done wonders to the non-alcoholic CBD segment. A large number of consumers are in the market looking for alternatives to sugary soda drinks, caffeine stimulated, energy drinks as well as alcohol-best alternatives that do not have any negative consequences. Hemp-enriched sparkling water, teas, juices, and coffee products attract this health-conscious group due to a supposedly healthy advantage and include feelings of relaxation and an absence of anxiety, stress, and a preference to sleep at night. It is also more available in conventional retail outlets such as grocery stores, convenience stores, cafes, and wellness stores in non-alcoholic forms. They are able to reach a large market that covers working professionals, fitness enthusiasts among others as well as the older people. Moreover, non-alcoholic CBD is also gaining popularity because of new flavour combinations, enhanced water-soluble CBD technology, and cool-looking branding.

The distribution channel segment is divided into offline retail and online retail. The offline retail segment dominated the market, with a market share of around 58% in 2024. Supermarkets, hypermarkets, health food stores, cafes, and convenience outlets are significant since they allow people to see and feel the CBD beverage. Among the consumers, particularly those who are first-timers in the purchase of the CBD products, direct access to a product to study its label, review its quality, and thus make the purchase a worthwhile. In addition, offline retail stores also tend to have knowledgeable personnel who can explain to the customers their inquiries and address their concerns concerning the safety, efficiency, and legality of CBD. This face-to-face association serves to establish brand trust, which in this market is so important in overcoming stigma and doubt. Regulation rules is also a factor; in many countries it is easier to sell CBD products in brick-and-mortar stores compared to online shops where cross-border issues enforcement rules and regulations surrounding e-commerce may complicate one sells the product. Also, face-to-face stores have greater propensity to make impulse buys. Strategic placement of CBD beverages will allow attracting those casual buyers, who are unlikely to seek the product on the Internet. All of these promotions, sample booths, and store branding also increase awareness levels and trial level.

The source segment is divided into hemp-derived CBD and marijuana-derived CBD. The hemp-derived CBD segment dominated the market, with a market share of around 66% in 2024. The key reason why hemp-derived CBD has taken over the CBD-infused drinks market in the world is its positive legal stance, safety rating, and increased receptivity among consumers in general. This level of regulation has enticed the beverage industry producers to embrace the use of hemp in CBD since they would find it easy to comply and distribute it to mainstream retailers without the legal burden of marijuana-based products. As a consumer would see it, the hemp-derived CBD is more manageable to get and safer than other wellness products. It is of interest to those who want all the therapeutic effects of CBD, including stress alleviation, sleep, and relaxation without the intoxication effect of THC. This is what makes it non-intoxicating, which is vital to the marketing of CBD beverages as ordinary functional products of everyday life, instead of a niche, or recreational product. The hemp-derived CBD supply chain is also more advanced and more standardized resulting in heightened levels of consistency, traceability, and scalability. This facilitates integrity of products and facilitates production on a large scale to satisfy the increasing demand of consumers. CBD derived out of hemp, is also assimilated more easily into diverse forms of beverages, owing to the increase of technologies in water-soluble form and nano-emulsification processes.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 4.30 Billion |

| Market size value in 2034 | USD 20.66 Billion |

| CAGR (2025 to 2034) | 17% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Distribution Channel and Source |

As per The Brainy Insights, the size of the global CBD infused beverages market was valued at USD 4.30 billion in 2024 to USD 20.66 billion by 2034.

Global CBD infused beverages market is growing at a CAGR of 17% during the forecast period 2025-2034.

The market's growth will be influenced by product innovations and changing consumer preferences.

Inconsistent products with varying quality levels could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global CBD infused beverages market based on below mentioned segments:

Global CBD Infused Beverages Market by Product Type:

Global CBD Infused Beverages Market by Distribution Channel:

Global CBD Infused Beverages Market by Source:

Global CBD Infused Beverages Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date