- +1-315-215-1633

- sales@thebrainyinsights.com

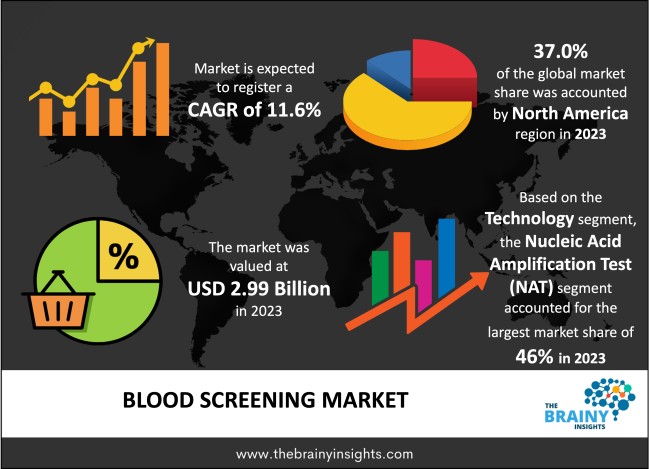

The global blood screening market was valued at USD 2.99 billion in 2023 and is anticipated to grow at a CAGR of 11.6% from 2024 to 2033. Ensuring blood supply safety is crucial, and this involves screening donated blood for potential infections or diseases. As a result, there has been growing attention to streamlined and thorough processes for blood screening due to heightened demand for transfusions. Furthermore, technological advances in medical treatments such as surgeries, organ transplants and trauma care have led to an increased need for safe, compatible blood products, which further fuels the necessity of comprehensive screenings. Also, with rising incidences of chronic health diseases requiring surgical interventions linked with transfusions, all these aspects contribute positively to market growth.

Blood screening plays a crucial role in the medical field as it assesses different elements within one's bloodstream - for diagnoses, preventative measures or research-related reasons. This procedure can detect anomalies, diseases and other constituents that may indicate potential health complications by conducting an all-encompassing analysis of collected blood samples. With a broad range of tests under its umbrella term, each serving unique purposes and providing insightful information regarding an individual's well-being are made known through such procedures.

The blood screening technique evaluates the body's general health and performance by analyzing various factors found in blood, such as hemoglobin and glucose levels. Other factors evaluated include electrolyte balance, the presence of enzymes, hormones or specific disease markers. By closely examining these elements, healthcare providers can acquire vital insights into a person's metabolic activity, functionality of their organs, and optimal immune response, enabling them to gain an overall picture regarding their well-being.

Get an overview of this study by requesting a free sample

Increasing Blood Donation Rates - The incidence of chronic illnesses, injuries from operations, and trauma patients has led to an increase in the need for blood products worldwide. This demand has been met by an upsurge in global blood donations owing to awareness initiatives on the significance of donations alongside improvements in collection technologies and infrastructure. As a result, there's now a requirement for rigorous screening protocols that authenticate the safety standards and quality of such donated commodities- all spurring growth across the market segment. The demand for blood transfusions in emerging economies is rising. This is due to urbanization, the growing need for healthcare infrastructure and rapid population growth. This growing need has sparked concerns over infectious diseases, maternal complications and trauma cases, which necessitate expanded screening capabilities to guarantee safe blood products. Market players are now targeting these regions by forming strategic collaborations and partnerships with distributors, offering localized products, and fueling market expansion.

Stringent Regulatory Scenario – Blood screening practices are subject to differing regulatory frameworks across regions, which frequently undergo updates and revisions. This aspect poses a noteworthy challenge for market players who must adhere to strict regulatory requirements set forth by agencies like the FDA, EMA, and WHO. Ensuring compliance requires significant investments in quality assurance measures, validation studies and documentation processes. The constantly changing nature of these regulations adds another layer of complexity that creates uncertainty around investment decisions and impacts overall market dynamics due to increased compliance burdens. The intricate challenges that healthcare providers, policymakers, and regulatory authorities face regarding blood donation, screening and utilization involve ethical and legal considerations. The intricacies of donor consent and confidentiality issues relating to genetic testing or discrimination raise critical concerns for ethics and the law. Established moral frameworks must be taken into consideration while carefully assessing these problems.

Growing Geriatric Population - The global trend of an ageing population has significant implications for healthcare systems and blood transfusion services. The elderly often necessitate blood transfusions owing to age-related ailments, surgeries, and chronic disorders that escalate the need for blood products. Moreover, due to their susceptibility to infections related to transfused blood or complications, strict screening policies are being highly prioritized, thereby boosting market growth trends. Investment in healthcare infrastructure and blood transfusion services has been boosted by economic growth, especially in developing countries. Governments and healthcare authorities are allocating significant budgets to enhance blood safety measures by adopting sophisticated screening technologies and expanding blood bank facilities. This correlation between rising prosperity, improved medical facilities, and initiatives for ensuring better health outcomes is driving the market growth significantly.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region emerged as the most prominent global blood screening market, with a 37.0% market revenue share in 2023. North America is a major player in the worldwide blood screening market, encompassing Canada and the United States. The area's emphasis on strict regulatory requirements, advanced technology capabilities, and well-developed healthcare infrastructure make it a force to be reckoned with within this industry. Additionally, respected entities like Health Canada and the U.S. Food & Drug Administration (FDA) enforce stringent practices surrounding blood safety protocols for quality assurance purposes. This collective of influential factors promotes the continued adoption of pioneering technologies towards progressive change across all aspects of sophisticated screening techniques used throughout society today. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

North America Region Blood Screening Market Share in 2022 - 37.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The feedstock segment includes Nucleic Acid Amplification Test (NAT), ELISA, Chemiluminescence Immunoassay (CLIA) and Enzyme Immunoassay (EIA), Next Generation Sequencing and Western Blotting. The Nucleic Acid Amplification Test (NAT) segment dominated, with a market share of around 46% in 2023. Blood screening for viral nucleic acids has been revolutionized using Nucleic Acid Amplification Testing (NAT). This method, primarily utilizing Polymerase Chain Reaction or Transcription-Mediated Amplification technologies, provides highly precise and sensitive detection capabilities in identifying viruses such as HIV, Hepatitis B/C Viruses (HBV/HCV), and Human T-cell lymphotropic Viruses (HTLV) within blood samples. The early identification of infections during their 'window period' is a significant advantage afforded by NAT. As a result of its adoption in detecting transfusion-transmitted infections (TTIs), there have been notable reductions to previously associated morbidity/mortality risks while enhancing overall safety measures concerning human blood usage.

The product segment includes reagent and instrument. The reagent segment dominated, with a market share of around 68% in 2023. Blood screening assays rely heavily on reagents, which help precisely identify and quantify infectious agents, biomarkers, and antibodies. These versatile biochemical components, such as enzymes, nucleic acid probes, antigens or antibodies, are customized to suit the particular assay formats used for detection. In blood screening tests like immunoassays or NATs (nucleic acid amplification tests), including molecular diagnostics that target different types of infections such as HIV/AIDS/HCV virus transmission caused by Hepatitis C Virus, syphilis, etc., these high-quality reagents offer exceptional sensitivity and specificity performance metrics critical towards achieving effective disease prevention strategies.

The end-user segment is bifurcated into hospitals and blood banks. The blood banks segment dominated, with a market share of around 58% in 2023. Blood banks are responsible for preserving blood safety while maintaining a sufficient supply for transfusion needs. To achieve this, these specialized establishments collect, test, process, and store donated blood products with strict adherence to quality control measures and regulatory compliance standards. Blood screening is an integral part of their function whereby diverse assay methods detect pathogenic organisms alongside antigens related to blood groups and antibody titers within donor samples.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 2.99 Billion |

| Market size value in 2033 | USD 8.96 Billion |

| CAGR (2024 to 2033) | 11.6% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Technology, End-user, Product |

As per The Brainy Insights, the size of the blood screening market was valued at 2.99 billion in 2023 to USD 8.96 billion by 2033.

The global blood screening market is growing at a CAGR of 11.6% during the forecast period 2024-2033.

North America region became the largest market for blood screening.

The rising incidences of chronic diseases across the globe is driving the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global blood screening market based on below-mentioned segments:

Global Blood Screening Market by Technology:

Global Blood Screening Market by Product:

Global Blood Screening Market by End-user:

Global Blood Screening Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date