- +1-315-215-1633

- sales@thebrainyinsights.com

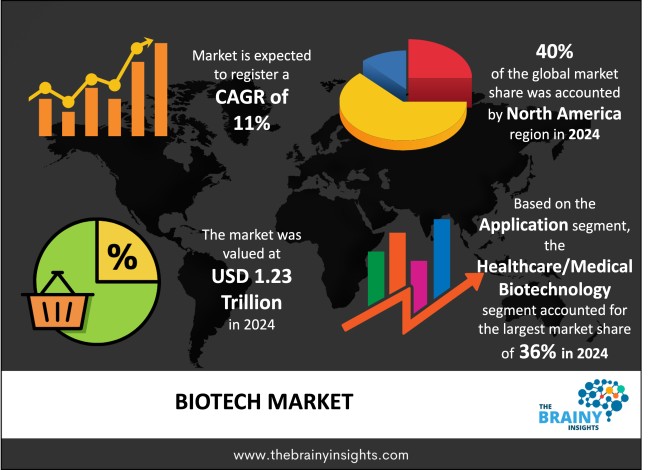

The global biotech market was valued at USD 1.23 trillion in 2024 and grew at a CAGR of 11% from 2025 to 2034. The market is expected to reach USD 3.49 trillion by 2034. The increasing healthcare expenditure will drive the growth of the global biotech market.

The area of biotechnology or biotech, makes use of biology, chemistry, genetics and engineering to create useful products and technologies for human and environmental welfare. Basically, biotechnology focuses on using living things or parts of their structure, for instance cells, enzymes and DNA, to develop beneficial things or find solutions in many sectors. It covers a wide area of application in various sectors, including healthcare, farming, protecting the environment and industry-related functions. In healthcare, biotechnology has made medicine better by helping to make new drugs, gene therapies and better diagnostic methods. technologies like recombinant DNA technology and monoclonal antibody production have made it possible to treat diseases like cancer, disorders related to genes and infectious diseases more effectively. Biotech is a major factor in the development of vaccines, especially for vaccines against COVID-19. As a result of biotech, plants now have stronger growth, better protection from pests and increased tolerance of environmental stresses from genetically modified organisms (GMOs). They ensure enough food and environmentally friendly farming by cutting down on chemical pesticides and increasing how healthy food is. Using microbes and plants in environmental biotechnology allows for cleaning the environment, handling waste and generating renewable energy from biofuels, supporting the well-being of the planet. With industrial biotechnology, chemical, material and bio-based manufacturing is done more efficiently and more environmentally friendly than with older methods. It means making biodegradable plastics, creating enzymes for use in detergents and creating bio-based solvents. To sum up, biotechnology is an area that is growing fast by linking science and technology to help solve major global problems. Because biology can create advances in many fields, it is at the heart of science today and helps solve problems in health, food production, industry and preserving the environment. Progress in research keeps biotechnology growing which contributes to the world’s economy and improves living standards for everyone.

Get an overview of this study by requesting a free sample

Rising investments and technological advancements – Quick developments in genomics, bioengineering and synthetic biology have helped create precise medicines, personalized care and new technologies in farming. Their discoveries help enhance the range of biotechnology and they also form new areas for business. Higher spending on research and development (R&D) helps drive innovation. Most biotech firms concentrate a large share of their budgets on R&D which leads to a steady stream of new products, among them gene therapies, biologics, diagnostics and bio-based chemicals. Keeping this cycle of new products improves the company’s competitiveness and attracts more customers which further increases investments in the future. Part of growth comes from expanding the company’s drug pipeline. Regular mergers, acquisitions and partnerships take place between biotech companies and firms from pharmaceutical, research or Agri-tech fields. Such cooperation allows biotech businesses to develop products faster, increase sales in other countries and launch their products sooner, all of which help them gain a higher position. In addition, personalized medicine is being practiced more often which requires greater use of biotech, as it stems from a wider healthcare trend to match treatments to patients’ needs.

Significant capital investments and longer time periods – Innovation characterizes biotechnology, but certain factors within the industry stop its market from growing properly. Research and development (R&D) work takes a long time and costs a lot which makes it a major constraint. It often takes over ten years and a significant amount of money, depending on the field, to create a biotech product in pharmaceuticals or therapeutics and there is no certainty of success. All this effort means smaller businesses often find it hard to survive throughout a product’s development. A further serious challenge comes from the complex nature and low chances of success in most biotech innovations. Problems with safety, how well a drug performs or production often cause products to fail in preclinical or clinical testing, costing the company significant funds and lowering the interest of investors. Regulations make it even harder for companies to run things internally. Because global regulations are strict and often change, biotech companies must comply with different sets of rules in various regions which can result in delays and extra cost. After approval, it can be hard for biotech products to deal with issues that arise in the manufacturing process. These products, biologics and cell therapies, are hard to produce in large amounts because of their complex structure and specialized handling requirements. Because of this, they struggle commercially and it can also impact how much is available and how much it costs. The law of intellectual property (IP) can also block advancements. There is a lot of competition in biotech and issues regarding patents or infringement can block progress and turn off people from innovating.

The growing burden of health and environmental challenges globally – A key factor is the growing difficulty of global health issues which include chronic illnesses, new infectious outbreaks and the development of drug resistance. Thus, the increase in these health problems has highlighted the demand for breakthrough therapies, vaccines and lab tests which biotechnology can provide. Moreover, the population of the world is rising and there is more worry about enough food, encouraging the rise of agricultural biotechnology. Genetic modification in crops and the use of bio-fertilizers help farmers get higher yields, use less chemicals and grow all kinds food in any climate. Favourable laws, public money, tax benefits and improving biotech infrastructure contributed to biotech growth through government aid. Biotech ecosystems are being developed and invested in by many countries in North America, Europe and Asia, mainly to improve healthcare and agriculture. A strong external influence comes from the worldwide focus on protecting the environment and reducing climate change. Biotechnology supports many green choices like using biofuels, biodegradable plastics and bio-cleaning methods that help cut down on pollution and use of resources. Demographic changes, especially the global aging trend, are leading to greater demand for new healthcare solutions which helps biotech innovation thrive. Similar factors will drive the market for biotech globally.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global biotech market, with a 40% market revenue share in 2024.

North America’s position as a leader comes from placing a strong focus on research and development (R&D), assisted by many renowned universities, research institutes and centres for biotechnology in the region. The cluster brings together academics, industry groups and government which furthers the biotech innovations and growth. Biotech innovation is promoted and new drugs are approved more quickly, thanks to large government funding from the NIH and flexible policies set by the FDA. Besides, North America is supported by a well-developed healthcare setting, quite a high budget for healthcare and nationwide use of advanced tech in medicine, all of which increase the demand for biopharmaceuticals and precision medicines. The large number of leading biopharmaceutical companies, new startups and contract research organizations (CROs) make the market lively and attract much venture capital funding. In addition, having good intellectual property protection laws in the area helps companies increase innovation by making their investments more secure. AI and bioinformatics are being widely used in drug discovery and personalized healthcare in North America which is why the region is leading in digital biotech adoption. Also, due to more chronic diseases, people living longer and knowing more about modern biotech approaches, the market keeps growing steadily.

North America Region Biotech Market Share in 2024 - 40%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The application segment is divided into healthcare/medical biotechnology, agricultural biotechnology, industrial biotechnology, environmental biotechnology, animal biotechnology and marine biotechnology. The healthcare/medical biotechnology segment dominated the market, with a market share of around 36% in 2024. Healthcare or medical biotechnology represents the biggest share in the global biotechnology market because of its key role in supporting human health and new advances in medicine. More people suffering from chronic problems like cancer, diabetes and heart conditions are a major reason why personalized and effective treatments are now more necessary. Biologics have become very important in oncology, autoimmune diseases and rare genetic disorders, so this sector is now a leading source of revenue for biotech companies. The COVID-19 pandemic emphasized the significance of healthcare biotechnology, as biotechnology firms quickly introduced mRNA vaccines and diagnostic kits, proving the field can quickly help when there are global health threats. People looking for treatments specific to their genetics have increased the demand for biotech ideas in diagnostics and therapeutic solutions. Greater funding, relaxed regulations and new AI and data analytics technology have allowed this segment to lead the biotech industry for a long time. Besides, as populations around the globe age, demand for regenerative medicine and chronic disease care has gone up, giving healthcare biotech more reasons to succeed.

The technology segment is divided into DNA sequencing and recombinant technology, cell and tissue culture, fermentation, PCR technology, chromatography, nanobiotechnology, CRISPR and gene editing and bioinformatics. The DNA sequencing and recombinant technology segment dominated the market, with a market share of around 33% in 2024. DNA sequencing and recombinant DNA technology lead the global biotechnology sector because they form the core of present-day biological studies, diagnostics and creating new drugs. DNA sequencing enables the understanding of precise arrangement of DNA letters which helps in the discovery of genes involved in diseases and offer personalized medical care. Now with NGS, sequencing is more accurate, time-efficient and cheaper, so it has been more widely adopted by healthcare, farming, police investigation and microbiology. Recombinant DNA technology generally means combining pieces of DNA from various sources to make something new. Making genetically engineered organisms, therapeutic proteins, insulin, growth hormones and monoclonal antibodies requires this type of technology. It helps to advance the progress of drugs and genetic engineering in health care and agriculture. Manipulating genes now makes it possible for scientists to design new vaccines, gene therapies and synthetic biology techniques that improve public health and farming. They also lead in their field because they are used widely in science, healthcare and business and keep advancing with new technology. Finding drugs, creating vaccines and providing diagnostics often depends on these technologies by major biotech and pharmaceutical companies.

The end-user segment is divided into biopharmaceutical companies, academic & research institutes, CROs (contract research organizations), biotechnology companies, hospitals & clinics and agriculture & food industry. The biopharmaceutical companies segment dominated the market, with a market share of around 38% in 2024. They concentrate on creating biologics which include monoclonal antibodies, recombinant proteins, gene therapies and vaccines. The rise in chronic diseases, rare genetic disorders and cancer has placed biopharmaceuticals at the forefront of more effective and targeted treatments. The powerful position of big pharma depends on their abundant investments in research and development (R&D), strategic partnerships with universities and new biotech firms and strong infrastructure for clinical trials and meeting regulations. Biopharma firms use their resources and infrastructure to bring difficult and long-term studies from research to commercialization. They are major users and supporters of advanced technologies such as CRISPR, cell and gene therapy and AI in medicine which adds to their overall leadership in the sector. COVID-19 showed that these companies were critical, as leaders in the field rapidly brought out vaccines and treatments with mRNA technology. On a global scale, their supply chains provided them with the ability to mass-manufacture and rapidly send products to people. In addition, these companies are protected by strong patents, regulations and high costs for newcomers to the industry which explains their stability and profitability.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Trillion) |

| Market size value in 2024 | USD 1.23 Trillion |

| Market size value in 2034 | USD 3.49 Trillion |

| CAGR (2025 to 2034) | 11% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Application, Technology and End-User |

As per The Brainy Insights, the size of the global biotech market was valued at USD 1.23 trillion in 2024 to USD 3.49 trillion by 2034.

Global biotech market is growing at a CAGR of 11% during the forecast period 2025-2034.

The market's growth will be influenced by rising investments and technological advancements.

Significant capital investments and longer time periods could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global biotech market based on below mentioned segments:

Global Biotech Market by Application:

Global Biotech Market by Technology:

Global Biotech Market by End-User:

Global Biotech Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date