- +1-315-215-1633

- sales@thebrainyinsights.com

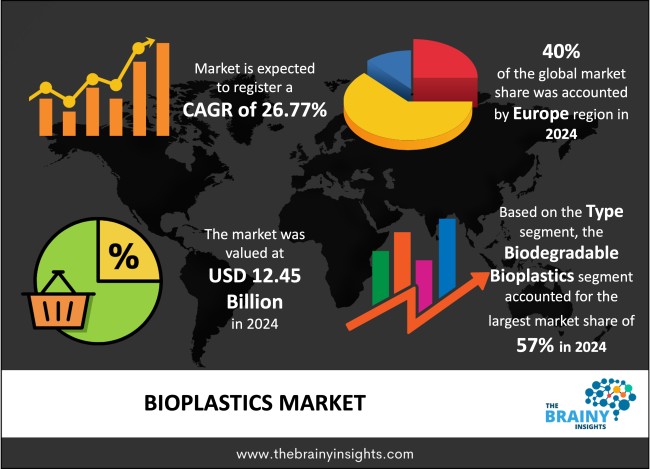

The global bioplastics market was valued at USD 12.45 billion in 2024 and grew at a CAGR of 26.77% from 2025 to 2034. The market is expected to reach USD 133.45 billion by 2034. The growing emphasis on sustainability will drive the growth of the global bioplastics market.

Bioplastics comprise plastics with renewable biological elements that break down eventually. These substances serve as environmentally friendlier alternatives to petroleum-based plastic products. Bioplastics derive their source material from renewable biological plant starches which include corn starch with additional options like sugarcane cassava and algae. The production of these types of plastics strives to eliminate fossil fuel dependence and lower environmental consequences. Bioplastics dissolve faster than traditional plastics which require hundreds of years to break down thus becoming a preferred solution for reducing plastic contamination. Bioplastics exist in two distinct subcategories: the first type combines renewable bio-mass such as biobased polyethylene into plastics; but these materials may or may not degrade over time. The second category comprises plastics that degrade through microbial action. The increasing application of these materials extends to packaging, agriculture and textiles together with medical applications and consumer goods industries. The manufacturing process of bioplastics creates emissions with smaller carbon releases in comparison to conventional plastic production steps. A product's environmental advantages specifically depend on three fundamental aspects including raw material origins together with manufacturing techniques and waste management procedures. The adoption of bioplastics continues to increase because technological improvements meet the rising awareness about environmental practices. Multiple governments together with industries throughout the world dedicate their funds toward developing bioplastics by making them perform better while improving their scalability and their ability to break down through composting. Bioplastics gain ground as the world intensifies its efforts to reduce plastic waste because they support the development of a sustainable circular materials economy.

Get an overview of this study by requesting a free sample

Stringent environmental legislation – Environmental regulations at a global level are being tightened because governments aim to control plastic pollution while reducing greenhouse gas emissions. Manufacturers must move beyond conventional plastics toward sustainable alternatives such as bioplastics given the ban on single-use plastics, mandatory compostable packaging requirements and extended producer responsibility (EPR) schemes. The existing regulatory frameworks make two key contributions to the industry: they establish legal mandates that promote bioplastics pursuit and direct market development by spurring innovation and investment activities. The increasing awareness about environmental issues among customers leads to escalated market demand for sustainable products. The public has gained better knowledge regarding petroleum-based plastics harmful ecological effects resulting from how these plastics stay permanently in dumps and marine settings. Consumer choice now strongly favours biodegradable items and recyclable products along with pieces built from renewable materials. The rise of environmental consciousness amongst consumers forces brands to both introduce sustainable solutions and enhance ecological aspects of their packaging combined with products. Corporate sustainability goals have boosted the market acceptance of bioplastics by different industrial sectors. Global consumer goods giants and all companies experience rising pressure to lower their environmental impact on the planet. Companies have developed stringent sustainability goals which include making their entire packaging reusable, and recyclable alongside becoming carbon zero emitters. Regulatory reforms and customer market demands have motivated businesses to adopt bioplastics as an environmentally beneficial solution that supports sustainability targets without compromising consumer demand.

High costs of production – The increasing attention to sustainably sourced materials has not led to widespread adoption of bioplastics because of their expensive production and inadequate disposal systems. Production barriers stem mainly from the high manufacturing expenses at present. The industry production of bioplastics remains minimal as they have not reached commercial adoption at the same scale as traditional plastics. Specialized raw materials like corn starch and sugarcane alongside algae need fermentation or polymerization methods that increase manufacturing expenses. Bioplastics manufacturers must elevate costs because they need to recoup their expenses which decreases product competitiveness when dealing with cost-sensitive industries that use packaging and consumer goods. A significant barrier exists due to insufficient facilities designed for correct disposal solutions when it comes to biodegradable and compostable bioplastics. Bioplastics function best with suitable industrial composting environments which demand specific humid and hot conditions to properly break down. These facilities remain scarce nationwide and particularly scarce throughout developing parts of the world. The improper disposal of bioplastics in landfills alongside regular recycling streams causes them to fail proper decomposition thus making their environmental benefits irrelevant. Performance limitations within specific bioplastics create barriers for their usage in critical applications and demanding industrial applications.

Increasing research and development expenditure – Bioplastics benefit from technological progress which has increased their performance and possible applications thus improving their competitiveness against conventional plastics. Research developments have strengthened the material properties of polylactic acid (PLA) and polyhydroxyalkanoates (PHA) which now allow these plastics to be used successfully in high-end applications. Enhancements in manufacturing technology resulted in cost efficiency thus improving the economic market potential of bioplastics. The bioplastics market strongly responds to the constant changes in crude oil prices which form a key element in its evolution. The production cost of traditional plastic materials based on petroleum increases whenever oil prices fluctuate because of supply chain disruptions or geopolitical tensions. The price instability of traditional plastics drives people toward bioplastics manufactured from renewable resources since these materials present long-term price stability. Public together with private organizations sustain investments and R&D efforts that are speeding up innovation in the field. Entrepreneurs along with government agencies and commercial organizations keep investing significant funds into bioplastics development and distribution that augment the market’s growth.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe emerged as the most significant global bioplastics market, with a 40% market revenue share in 2024.

Europe occupies a leading role in environmental policy through its establishment of detailed laws that minimize plastic waste together with circular economy requirements and sustainable materials usage guidelines. The EU Plastics Strategy and the Single-Use Plastics Directive produced a beneficial policy framework which brought increased opportunities for bioplastics expansion throughout the region. A well-developed waste management system operated by European countries enables them to properly dispose and compost bioplastics through their recycling infrastructure. Well-developed waste management and composting facilities together with efficient waste collection systems make bioplastics function effectively to increase their environmental benefits. Several prominent bioplastics industries and research centres located in Europe continue to invest in creating modern manufacturing processes along with developing sustainable production techniques. Strong collaboration between governments, industry players, and academia fosters technological advancement and commercialization of bioplastics across diverse applications.

Europe Region Bioplastics Market Share in 2024 - 40%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into biodegradable bioplastics and non-biodegradable/biobased bioplastics. The biodegradable bioplastics segment dominated the market, with a market share of around 57% in 2024. These material types consisting of PLA and PHA together with starch blends. The supply of biodegradable solutions rises directly because governments worldwide continue to implement bans and restrictions on single-use plastics. Restaurants and supermarkets together with takeaway services are shifting to PLA and starch blend products for food containers, plates and compostable cutlery and packages in their operations. Consumer demand for sustainable products with compostable features has become instrumental in the development of this market segment. Environmental activists seek out biodegradable bioplastics because these products help create items with minimal impact on the environment. Biodegradable bioplastics serve as central agents that promote sustainable change across worldwide material markets.

The material segment is divided into polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, bio-PET (Polyethylene Terephthalate), bio-PE (Polyethylene) and others. The bio-PET (Polyethylene Terephthalate) segment dominated the market, with a market share of around 42% in 2024. Traditional PET which originates entirely from fossil fuel sources receives its renewable content from sugarcane or corn derived materials with maximum biobased composition reaching up to 30%. Bio-PET achieves carbon reduction through petroleum raw material replacement without impacting physical characteristics and mechanical properties identical to standard PET. The broad acceptance of bio-PET stems from its complete chemical compatibility with traditional petroleum-based products. The total acceptance of bio-PET stems from its ability to function within traditional industrial recycling pathways and fabrication systems without requiring any changes. The industries that rely on PET bottles and containers and films should consider bio-PET because it presents them with an affordable alternative while requiring no changes to existing equipment. This makes industrial transitions very simple. The urge for sustainability and fossil fuel reduction by companies pushes them toward bio-PET as a practical solution which demonstrates scalability.

The application segment is divided into packaging, agriculture, textiles, automotive & transport, consumer goods, electronics and medical & healthcare. The packaging segment dominated the market, with a market share of around 41% in 2024. The market dominance stems from three essential factors: plastic pollution urgency has strengthened; customers favour sustainable goods and government single-use plastic restrictions. Takeaway and online food delivery services are adopting compostable packaging solutions which extend the market reach. The governmental restrictions on single-use plastic packaging together with bans drive manufacturers and retailers to move their operations toward bioplastic alternatives. Technological progress allows manufacturers to develop better bioplastics which maintain their properties so they can safely protect goods.

The end-use industry segment is divided into food & beverage, retail, agriculture, healthcare, cosmetics & personal care and automotive. The food & beverage segment dominated the market, with a share of around 38% in 2024. The food and beverage industry operates as the largest user of bioplastics worldwide because it consumes massive amounts of packaging materials and implements growing sustainable practices. Food and beverage manufacturers experience growing demands to decrease their environmental impact because of their single-use packaging plastic waste. Bioplastics represent a promising solution because they provide all necessary food contact properties together with durability and safety and surpass conventional plastics when it comes to eco-friendliness. The market for bioplastics utilizes a substantial amount for making flexible and rigid packages. The beverage industry extensively uses bio-PET for bottles because this material duplicates normal PET specifications and works within established recycling operations so major beverage companies select it as their packaging material of choice. The food and beverage industry takes the leading role in bioplastics adoption because of growing consumer demand for compostable and biodegradable packaging solutions particularly through the rise of online food delivery services. The food sector will continue to make sustainability its central business priority due to this ongoing trend.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 12.45 Billion |

| Market size value in 2034 | USD 133.45 Billion |

| CAGR (2025 to 2034) | 26.77% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Material, Application and End Use Industry |

As per The Brainy Insights, the size of the global bioplastics market was valued at USD 12.45 billion in 2024 to USD 133.45 billion by 2034.

Global bioplastics market is growing at a CAGR of 26.77% during the forecast period 2025-2034.

The market's growth will be influenced by stringent environmental legislation.

High costs of production could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global bioplastics market based on below mentioned segments:

Global Bioplastics Market by Type:

Global Bioplastics Market by Material:

Global Bioplastics Market by Application:

Global Bioplastics Market by End-Use Industry:

Global Bioplastics Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date