- +1-315-215-1633

- sales@thebrainyinsights.com

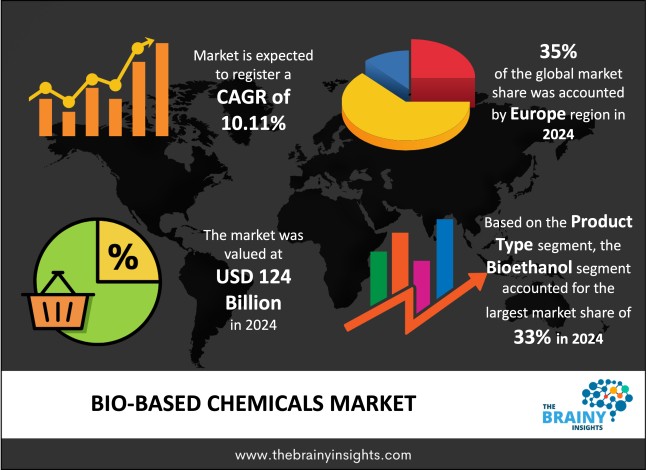

The global bio-based chemicals market was valued at USD 124 billion in 2024 and grew at a CAGR of 10.11% from 2025 to 2034. The market is expected to reach USD 324.85 billion by 2034. The growing emphasis on sustainability will drive the growth of the global bio-based chemicals market.

Bio-based chemicals include those chemicals produced based on the renewable biological materials like plants, agricultural wastes, forest waste residues, algae and even microorganisms. The bio-based chemicals are generated in biologic ways, meaning, by fermentation, enzymatic alteration, microbial synthesis, as opposed to making chemicals through fossil-derived fuels like petroleum, coal or natural gas, also known as tradition chemicals. The utilization of these chemicals has replaced their petroleum counterparts rendering them as sustainable and are commonly found in several industries such as agriculture, packaging, textile, automotive, pharmaceutical and personal care industries. Bio-based chemical development is one of the cornerstones of the transition to a circular economy and low-carbon economy worldwide. They will help to reduce the emission of greenhouse gases, boost energy reliability and lower the reliance on lessening non-renewable fossils. Typical examples are bioethanol, biobutanol, biosuccinic acid and lactic acid, polylactic acid (PLA) and bio-based polyethylene. Such chemicals may be applied as solvents, bioplastic monomers or intermediates in the other materials and products production. Major drivers that spur the market growth of bio-based chemicals are growing demand of sustainable products and tougher environmental regulation that promotes green alternatives. The use of new technologies (synthetics biology and metabolic engineering) has also allowed industrial-scale production of bio-based chemicals in a cost-effective and energy-efficient way.

Get an overview of this study by requesting a free sample

Technological advancements leading to progress in manufacturing processes – Among the greatest catalysts is the blistering advances in biotechnology and process engineering which include microbial fermentation, metabolic engineering and enzymatical catalysis. Such innovations have enhanced efficient, scalable and cost-effective production of bio-based chemicals. Feedstock diversification, which includes shifting over traditional food sources of feedstock, such as corn and sugarcane, to more sustainable solutions, such as lignocellulosic biomass, agricultural residues and algae, also acts as a key factor. This transformation will minimize the competition with food materials and will encourage the utilization of waste materials, thus the industry will be much greener and cost-effective. Innovation of products has also been very important. Numerous bio-based chemicals are performing as well as their fossil-based equivalents and in many cases better and as a result are more competitive in a variety of applications, in areas such as the packaging, textiles, coatings and personal care industry. Also, the increasing number of investments in research and development, as well as the strategic collaboration between chemical companies, biotechnology corporations and agribusiness organizations, help the commercialization of the new bio-based solutions. The vertical integration is also being pursued by companies that include constructing dedicated biorefineries and ensuring a steady feedstock supply that would increase production stability and reduce the overall costs of operation in the long run.

Technical, economical and infrastructural limitations – The production of bio-based chemicals is significantly expensive as opposed to conventional petrochemical products. Raw materials of bio-based chemicals are usually rather costly. This reduces their competitiveness in the market. Besides, most of the production technologies of the bio-based chemicals are at the development stage or in pilot status, with problems such as poor yields, inefficient use of energy, and inability to scale to industrial output. The other major weakness is the limited performance and applicability of some of the bio-based solutions. Most bio-based chemicals have competitive properties although others are not as durable or stable particularly in heavy industrial use or even as effective. They also have a narrower product range when compared to well-established petrochemicals, meaning they cannot be used as much or are not that versatile. Another very important bottleneck is infrastructure. Global chemical sector is highly geared towards fossil supply as it has fully integrated supply chains, refineries and distribution system. Comparatively, the bio-based chemicals infrastructure, including-specific biorefineries, biomass collection infrastructure, as well as special transportation, remains insufficient.

Stringent environmental regulations – The increasing pressure to cut carbon emission and shift towards environmentally sustainable practices is one of the most powerful drivers of this industry. Considering environmental regulations, carbon tax, and plastic waste reduction imperatives, governments all over the world are tightening regulations, which all are nudging industries to move away petrochemical-based input sources toward renewable, bio-based input sources. Also, favourable policy frameworks like reduction in taxes, support in the form of subsidies and grants to green chemistry projects and bio-economy projects are developing a good ecosystem on which the market can flourish. Critical roles are played by fluctuations in prices in crude oil and the long-term volatility of fossil fuel supply chains which also drives the market’s growth. Furthermore, the increasing consumer awareness and the drive to purchase ecologically neutral products move brands in various fields such as food packaging, cosmetics, and fashion towards the adoption of bio-based materials and demonstration of sustainability in their supply chain. The next crucial outside factor is the worldwide dedication climate change reduction, where a lot of countries and companies are committed to meet net-zero. This is speeding up the strategies to low-carbon technologies and solutions including bio-based chemicals.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe emerged as the most significant global bio-based chemicals market, with a 35% market revenue share in 2024.

The European leadership in the global market supply of bio-based chemicals can be explained by its effective regulatory framework, developed research base, and reliance on sustainable development. European Union has led in the development of a bio-based economy by using the extensive policies like EU Bioeconomy Strategy, European Green Deal and REACH regulations. Such plans are meant to minimize the use of chemicals based on fossils, minimize carbon emissions and shift into circular economy. This level of regulatory support has given the region an advantageous environment in which bio-based chemical technology can be invested in, developed and commercialised. The European nations such as Germany, Netherlands, France and Sweden are rivals in the Research and Development and have set up state-of-the-art biorefineries and pilot plants. The area also has a very enlightened and green-savvy consumer market that is developing a taste towards sustainable products. The consumer demand also gives an added reason to business to incorporate bio-based solutions in their value chains. Furthermore, the strategic investments of Europe in feedstock diversification, starting with agricultural residues and moving on to algae, improve the chain of supply and increase the environmental responsibility.

Europe Region Bio-Based Chemicals Market Share in 2024 - 35%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into bioethanol, bioplastics, biobased acids, biopolymers, bio-based solvents, bio-butanol and bio-based surfactants. The bioethanol segment dominated the market, with a market share of around 33% in 2024. Bioethanol plays a leading role in the bio-based chemicals market because it is widely used and has a well-developed production base and a major contribution to the transition to renewable energy. Bioethanol is mainly manufactured via fermentation processes of biomass like corn and sugarcane and they are used as a bio-derived chemical as a transport fuel and an additive to fuel. It is mostly mixed with gasoline to decrease greenhouse emissions and to increase engine performance, thus in achieving global clean energy, and emission cutting targets. Stable demand underpinnings have been present in the United States and Brazil, which has been integrating bioethanol into its fuel supply using governmental orders, bioethanol subsidies, and blending requirements. Besides as a fuel, bioethanol is also finding more application in the industrial sector as a solvent and a raw material in the manufacture of other plants-based chemicals such as ethylene and bioplastics. It has had an edge against other emerging bio-based alternatives because of its relatively mature technology of production and availability in large scale. Bioethanol dominance on the market is further enhanced by the developed supply chains, existing infrastructure, and the support of the policy. The versatile and scalable nature of bioethanol, combined with its lower costs makes the substance stay on top in the bio-based chemicals industry.

The feedstock segment is divided into sugarcane and corn, lignocellulosic biomass, algae and waste and residues. The sugarcane and corn segment dominated the market, with a market share of around 35% in 2024. The feedstocks most common in the international market of bio-based chemicals are sugarcane and corn because they have the most carbohydrate reserves, are available in sufficient amounts, and there is an existing cultivation system. They contain a lot of fermentable sugars and starch that makes them optimal choice to be used in production of major bio-based chemicals such as level, lactic acid and other organic acids in a quite efficient way. Additionally, corn farming on a large scale sustains one of the most developed bioethanol sectors worldwide. Superiority of the sugarcane and the corn is also based on the fact that it is cost-friendly and can be scaled up. They give a higher hectare yield and produce a more reliable output as compared to other available sources of bio-mass fuel, which is important in satisfying industrial demands.

The application segment is divided into transportation fuel, packaging, agriculture, industrial and institutional cleaning, food & beverage and cosmetics and personal care. The transportation fuel segment dominated the market, with a market share of around 36% in 2024. Bioethanol has been primarily made of corn and sugarcane and then combined with gasoline to form ethanol-gasoline blends (such as E10 and E85) that have been widely used worldwide. The blends aid in cutting down carbon emission, improving the efficiency of fuel, as well as aid in the national energy security intents by reducing the reliance on imported crude oil. In the same way, biodiesel, which consists of vegetable oil or animal fats, mixes with diesel and is applied in heavy-duty vehicles and in the public transportation system. The overwhelming presence of transportation fuel as an application is associated with the robust regulatory support, including renewable fuel standards, carbon credit scheme, government support of the driving industry decarbonization. As transport represents a large percentage of greenhouse gases released in the world, governments are requiring biofuel mixing and favour the use of bio-based products in order to achieve climate goals. In addition to environmental advantages biofuels are attractive applications of bio-based chemicals due to their economic feasibility, particularly in the areas with high agricultural feedstock availability. This high and increasing demand in the use of cleaner fuels will make sure that transportation will remain the largest and most powerful application sector in the bio-based chemicals market.

The end-use industry segment is divided into automotive, packaging, agriculture, textiles, pharmaceuticals and personal care. The automotive segment dominated the market, with a share of around 38% in 2024. The global automotive industry consumes biofuels, bioplastics, and bio-based composites in quite large proportions. The large-scale use of bioethanol and biodiesel as alternative transport fuels is one of the major aspects. As the automakers and fuel distributors are under increased regulatory pressure to minimize the number of emissions of vehicles, biofuels are used more and more frequently as a way of achieving the low-carbon goals. Additionally, polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-based polyethylene are current examples of bioplastics used in car interiors, dashboards, door panels, and upholstery since the materials are lightweight, have a lower carbon overall, and are close to conventional plastic in performance. These materials can be used to make the vehicle lighter to increase its fuel efficiency and it can be used in the quest to attain sustainability. Another way automotive firms are focusing on bio-based innovation is to achieve global decarbonization goals and the concept of circular economy. The development of bio-based material manufacturers in strategic collaboration is enhancing the commercialization rate of environmentally friendly car parts.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 124 Billion |

| Market size value in 2034 | USD 324.85 Billion |

| CAGR (2025 to 2034) | 10.11% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Feedstock, Application and End-Use Industry |

As per The Brainy Insights, the size of the global bio-based chemicals market was valued at USD 124 billion in 2024 to USD 324.85 billion by 2034.

Global bio-based chemicals market is growing at a CAGR of 10.11% during the forecast period 2025-2034.

The market's growth will be influenced by technological advancements leading to progress in manufacturing processes.

Technical, economical and infrastructural limitations could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global bio-based chemicals market based on below mentioned segments:

Global Bio-Based Chemicals Market by Product Type:

Global Bio-Based Chemicals Market by Feedstock:

Global Bio-Based Chemicals Market by Application:

Global Bio-Based Chemicals Market by End-Use Industry:

Global Bio-Based Chemicals Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date