- +1-315-215-1633

- sales@thebrainyinsights.com

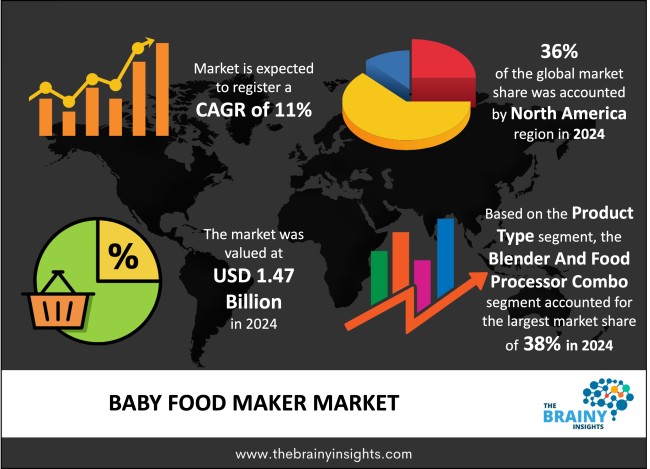

The global baby food maker market was valued at USD 1.47 billion in 2024 and grew at a CAGR of 11% from 2025 to 2034. The market is expected to reach USD 4.17 billion by 2034. The lifestyle changes leading to busier parents and double-income households will drive the growth of the global baby food maker market.

Baby food makers are used as appliances in kitchen and they are built for convenient homemade preparation of food for babies and young toddlers. These food processors have been designed to create healthy homemade purees, fresh soups and snacks for children which are a better substitute of commercial baby food products. The multiple functions of typical baby food makers merge into one device including steaming capability, blending and chopping. Additionally, these appliances have the ability to defrost and reheat which enables it to deliver multiple functionalities for parents. The main operation of most commercial baby food makers consists of steaming ingredients because this method preserves most nutrients while creating soft textures. The steamed food gets blended into a pureed consistency using the machine while users can select puree textures that match their child's age and nutritional requirements. Identical models permit user production of various serving portions simultaneously to streamline food storage because they can be served multiple times. The safety features along with easy functionality make these devices attractive to consumers because they offer simple controls and portions that can be cleaned in a dishwasher. The built-in safety features of several baby food makers feature one or more automatic shutdown capabilities that protect against both overheating and burn hazards. Baby food making appliances exist to serve parents who desire easy preparation methods for healthy meals allowing them control over ingredients and preservative-free options thereby promoting balanced nutrition. Health-conscious parents who prioritize homemade meals for their babies along with diversified taste profiles choose these devices during their weaning process.

Get an overview of this study by requesting a free sample

The multiple features and convenience offered by baby food makers – People choose these appliances mainly because they combine several functions like steaming, blending, reheating, and defrosting in a single device to deliver accelerated meal preparation. Many busy parents find these combined features highly attractive since they need to manage their professional duties and care for their children simultaneously. Baby food makers allow parents to take complete control of ingredients so their babies receive fresh nutritious meals that are composed of wholesome elements. The possibility to customize food represents a major advantage when consumers aim to eliminate preservatives and additives while discontinuing artificial ingredients from commercial baby foods. A vital feature of these devices is their straightforward operation and simple elements that ensure quick maintenance thus allowing users from beginner to experienced parent to handle the device easily. The key advantages of convenience together with nutritional control and user-friendly operation and multiple food preparation possibilities establish baby food makers as necessary appliances for current parents who want nutritious homemade infant meals despite their busy schedules.

Cost of baby food maker – The product price along with difficulties using and complexity of baby food makers stand as primary internal limitations for market demand. The considerable price tag of baby food makers serves as a major challenge since it exceeds the cost of alternative appliances such as blenders and steamers which perform similar tasks. Parents who must watch their finances are likely to refrain from buying the device because of the expensive initial payment. Baby food makers serve mainly the initial period of infancy since parents need them only when their children require purees and soft foods. The decreasing need for specialized appliances during the solid food transition of the baby results in diminished usage of the product. Parents who already possess kitchen appliances suitable for making baby food perceive these devices as redundant because the appliances already fulfil the same functions. The demand for baby food makers becomes limited because some manufacturers do not provide the upgraded features which modern parents anticipate from contemporary kitchen tools. Several built-in obstacles such as restricted functionality and both complicated designs and technical restrictions make parents reluctant to add a baby food maker to their kitchens.

Lifestyle changes, rising awareness and societal development – The external forces that drive baby food maker demand depend heavily on prevailing social developments coupled with economic conditions throughout the market. The health and wellness movement's rise represents a major reason behind the increasing demand for baby food makers because parents desire to create pure homemade meals without additives commonly present in purchased commercial foods. The consumer desire for home-made food preparation supports the increasing sales of appliances built for this purpose. Rising family incomes enable parents to make healthy investments for their children's nutrition through purchasing baby food makers and other products. Working parents whose schedules fill up their time are looking for modern solutions that enable them to give their children healthy meals. Baby food manufacturers address this parental requirement through products that assist quick and efficient meal assembly to serve working families' dual needs. Modern parents require convenient child products with safety features in addition to flexible functionality and these devices fit their needs.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global baby food maker market, with a 36% market revenue share in 2024.

Parents in North America prioritize high-quality nutritious baby food that increases the demand for baby food makers to create homemade meals. People in this region increasingly recognize the advantages of preparing baby food at home because they can select their ingredients while eliminating preservatives which boosts the market demand. The North American market benefits from an established distribution network because online and offline sales channels operate throughout the region. Parents in North America primarily buy baby food makers since they operate dual-income systems that need efficient solutions. Busy parents find baby food makers highly attractive because these devices provide quick access to nutritious meals efficiently. The expensive habits of consumers combined with high income levels in North America leads to extensive use of baby food makers which makes the region a leading market for this product category.

North America Region Baby Food Maker Market Share in 2024 - 36%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into blender and food processor combo, steamer and blender combo, standalone blenders and standalone steamers. The blender and food processor combo segment dominated the market, with a market share of around 38% in 2024. The blender-food processor combination appliance enables parents to produce different types of baby foods through multiple processing functions within a single device. The combination of multiple functions within this device attracts modern parents because it makes cooking easier by eliminating the need for multiple and separate kitchen tools. It also speeds up the process of meal preparation. Consumers prioritize this appliance because it performs blending, chopping, pureeing and steaming functions in single unit thus offering superior convenience and efficiency for kitchen work. Another benefit of this product is its versatility because it produces both baby food and smoothies and soups and other meals for the entire family. The clever functionality of this device enables parents to obtain better value because it functions as a dual-purpose tool that provides benefits for baby food production and more. The wide acceptance of this segment stems from its user-friendly operation and simple cleanup which enables parents who lack culinary skill to easily use it.

The distribution channel segment is divided into online retail and offline retail. The online retail segment dominated the market, with a market share of around 62% in 2024. Online retail offers parents’ convenience of shopping from anywhere and at any time. It offers comprehensive product information and user-generated reviews and ratings which helps them make informed decisions. The simple online shopping process enables parents to gather effective shopping information from their residence without setting foot in physical establishments. Parents can boost their purchase of baby food makers through online shopping by examining different platforms for optimal price comparisons which results in superior offers and discounts. People accelerated their transition from brick-and-mortar stores to online shopping because the pandemic made consumers choose digital purchases for safety reasons. Online retail platforms attract business due to their availability for serving customers worldwide. Through their online presence sellers access customers across different regions which broadens their current client base. The dominance of online retail as a distribution channel by baby food manufacturers rests on three key factors: convenience, competitive pricing and the rising e-commerce trends which match modern parents' expectations for ease of use.

The end-user segment is divided into individual parents and commercial/institutional buyers. The individual parents segment dominated the market, with a market share of around 58% in 2024. The rising parent awareness about early childhood nutrition leads them to look for ways to provide their babies with preservative-free homemade food that does not contain store-bought additives. Parents who focus on delivering healthy nutrition for their children need these appliances to avoid long daily kitchen routines. Modern parents who exist in dual-income households struggle to find enough time in their day. The ability to create baby food meals rapidly with minimal effort stands out as a major attractive feature for parents. Baby food makers simplify meal preparation for parents through their complete functionality which also results in fewer necessary kitchen tools. The ease of use that baby food machines provide to parents represents one of the main factors in individual parent consumption choices.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 1.47 Billion |

| Market size value in 2034 | USD 4.17 Billion |

| CAGR (2025 to 2034) | 11% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Distribution Channel and End-User |

As per The Brainy Insights, the size of the global baby food maker market was valued at USD 1.47 billion in 2024 to USD 4.17 billion by 2034.

Global baby food maker market is growing at a CAGR of 11% during the forecast period 2025-2034.

The market's growth will be influenced by the multiple features and convenience offered by baby food makers.

Cost of baby food maker could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global baby food maker market based on below mentioned segments:

Global Baby Food Maker Market by Product Type:

Global Baby Food Maker Market by Distribution Channel:

Global Baby Food Maker Market by End-User:

Global Baby Food Maker Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date