- +1-315-215-1633

- sales@thebrainyinsights.com

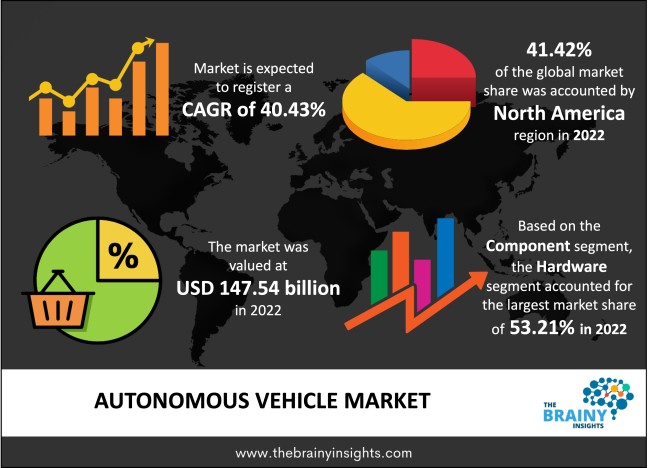

The global Autonomous Vehicle market was valued at USD 147.54 Billion in 2022 and growing at a CAGR of 40.43% from 2023 to 2032. The market is expected to reach USD 4,372.74 Billion by 2032. This market growth is attributed to several factors, such as the development of interconnected infrastructure with the advancement in technology, reduction in traffic congestion, and enhancement of safety measures. The recent trend suggests increased investment and collaboration among organizations working in the autonomous vehicle domain. Hence, the government's growing focus on the enhancement of vehicles along with safety and pedestrians, advancement in technology, ADAS & safety features, and advanced safety features offered by OEMs are some of the factors driving the growth of the autonomous vehicle market.

Self-driving car is a feasible project. In the coming 5 to 15 years, self-driving vehicles will become common as automotive manufacturers and technology organizations start mass-producing autonomous vehicles, which depend on the combination of AI, cloud, advanced sensors, and analytics to operate. These factors are propelling the growth of the autonomous vehicle market. Based on one of the studies, there was a prediction that around 200,000 fully autonomous ride-hailing automobiles would be operating in around 15 major cities by 2030; each vehicle would generate a yearly profit of USD 13,000. Similarly, based on the studies by the National Highway Traffic Safety Administration in 2017, the increase in the number of autonomous vehicles has the possibility to impact industries like insurance, healthcare, internet, and infrastructure. The adoption of autonomous vehicles helps in improving safety. More than 90% of the traffic accidents are due to human error. There were around 40,000 traffic fatalities in the US and around 1.2 million globally yearly. Hence, the removal of humans from driving substantially decreases accidents, which helps both vehicle-related injury and mortality. It also decreases healthcare spending and provides the revenue opportunity for property and casual insurance. The main difference between level 3 and level 4 automation is that the level 4 vehicles could interfere if there is some system failure or something goes wrong. Level 4 autonomous cars generally do not require human interaction in most circumstances. Such vehicles could operate fine in self-driving mode but are restricted to a limited area, like the urban area, where the top average speed could be around 30mph. The restriction will be there till the legislation and the infrastructure evolves. This restriction is known as geofencing, and most level 4 vehicles available focus on ridesharing. For instance, NAVYA, a French company, manufactures and sells level 4 shuttles and cabs in the US; they are electric cars with a speed of 55mph. All these factors drive autonomous cars in the market.

Get an overview of this study by requesting a free sample

Increase in investment by the companies for the autonomous car– Many technology giants, automaker organizations, and start-up specialist companies have invested around USD 50 Billion in the last five years in developing autonomous vehicles and their technology. Based on one of the studies, around 70 per cent of the investment is from the non-automotive sector. Public authorities are observing its huge potential and the economic and social benefits it could offer. Many companies are launching their R&D project to develop autonomous vehicle technology; for instance, Chinese electric vehicle maker Nio has relaunched its homegrown Level 4 self-driving technology R&D project. Based on one of the studies, it was estimated that the automaker expected around 1 million robotaxis in 2020. In the next two years, Tesla plans to make a car without steering wheels, pedals, etc. All these factors are driving the Autonomous Vehicle market.

Safety restraints for AI Autonomous Cars– Carmakers plan to invest in autonomous cars. Many companies involved in the making of autonomous cars are planning to remove the gas pedal, brake pedal and steering wheel as these are used for human drivers, and in driverless cars, there would be no need for drivers. These factors are against the safety regulations at present, so these factors would act as a restraint for the market. Also, it is considered that digital security features are not completely secure, which could lead to a malicious attack on software and technology. All these factors would hamper the market.

Collaboration and advancement in technology – Volvo and Baidu have also announced a strategic partnership for developing Level 4 electric vehicles together. It is planned to serve the robotaxi market in China. Similarly, Magna, a Canadian automotive supplier, has developed a technology called MAX4 to provide level 4 capabilities to urban and highway environments. The organization works with Lyft to supply high-tech kits that turn vehicles into self-driving cars. WeRide was fully open to the public in November 2019. It is very crucial to improve the vehicle’s motion perception competence in the future. High-precision positioning could be achieved by integrating high-precision positioning modules composed of IMU, 5G modules, and High-definition maps. May Mobility, a single-car intelligence or strong field terminal solution, is the way for the L4 autonomous driving. Still, in the long run, companies focus on a collaborative vehicle infrastructure system (CVIS) as the mainstream technology for L4 autonomous driving. All these factors would propel the market in the forecasting period.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the largest market for the global Autonomous Vehicle market, with a 41.42% share of the market revenue in 2022. This lion's share is attributed to many amendments which are taking place in the traffic regulations for incorporating autonomous vehicles on public roads in the US. These regulations are slowly being adopted in every state of the US, which would help make transportation completely autonomous. All these factors are driving the Autonomous Vehicle market in the region.

North America Region Autonomous Vehicle Market Share in 2022 - 41.42%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into hardware and software and services. The hardware segment dominated the market, with a market share of around 53.21% in 2022. This market share is attributed to several automotive manufacturers investing in developing advanced hardware systems for autonomous cars. The leading organizations invest substantial amounts in hardware, piloting, and testing the vehicles.

The application segment is divided into transportation and defense. The transportation segment dominated the market, with a market share of around 92.25% in 2022. This market share is attributed to the growing adoption of autonomous vehicles in transportation. For instance, Alphabet’s Waymo has shown the level 4 self-driving taxi service in Arizona. The company has tested driverless cars without any safety drivers. It has been tested for around 10 million miles. These factors contribute to the share of the segment.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2022 | USD 147.54 Billion |

| Market size value in 2032 | USD 4,372.74 Billion |

| CAGR (2023 to 2032) | 40.43% |

| Historical data | 2019-2021 |

| Base Year | 2022 |

| Forecast | 2023-2032 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component and Application |

North America region emerged as the largest market for the Autonomous Vehicle.

The market's growth will be influenced by increase in investment by the companies for the autonomous car.

Safety restraints for AI autonomous cars could hamper the market growth.

Collaboration and advancement in technology will provide huge opportunities to the market.

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. The Brainy Insights has segmented the global Autonomous Vehicle market based on below mentioned segments:

Global Autonomous Vehicle Market by Component:

Global Autonomous Vehicle Market by Application:

Global Autonomous Vehicle by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date