- +1-315-215-1633

- sales@thebrainyinsights.com

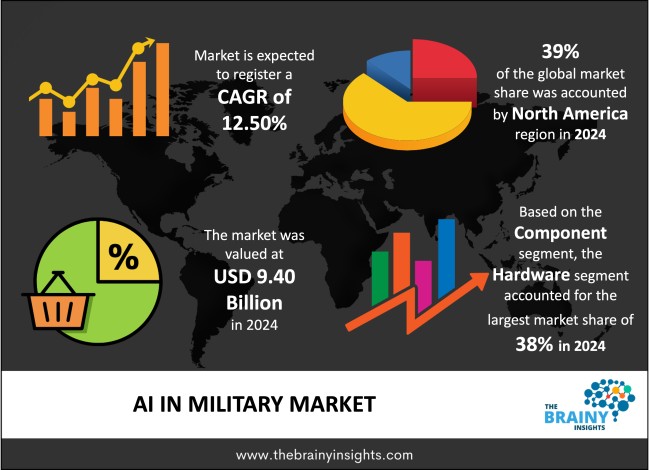

The global AI in military market was valued at USD 9.40 billion in 2024 and grew at a CAGR of 12.50% from 2025 to 2034. The market is expected to reach USD 30.52 billion by 2034. The increasing investment in defence sector worldwide will drive the growth of the global AI in military market.

The concept of Artificial Intelligence (AI) in the military is based on the implementation of intelligent algorithms, machine learning models and autonomous systems into defence processes to facilitate better decision making, improvement of efficiency and better combat readiness. It has a great number of possible applications which include surveillance and reconnaissance, logistics, cyber operations, and autonomous weapons systems. Another primary value of using AI is in the data processing and analysis model; through its ability to analyse large amounts of data on the battlefield, such as satellite images and intelligence packets, as well as data about military battles and patterns, AI can help military strategists determine threats, patterns, and active opportunities much faster than reaction time human-only. Within the context of cybersecurity, AI can enable the protection of key military networks by means of real-time detection of vulnerabilities and responsive actions to the threat. Simulation-based training is also possible with AI, thus providing a realistic combat scenario and decision-making tasks to soldiers. Moreover, AI can be applied in predictive maintenance of military equipment, which will result in ensuring that repair is done in good time, reducing downtime.

Get an overview of this study by requesting a free sample

The modernization of defence infrastructure – AI tools can facilitate efficient logistics functions, allow predictive maintenance of military vehicles and equipment, and balance resources, which maximizes the uptime and minimizes the life cycle costs. Furthermore, the digital transformation and modernization of most military forces globally involve adopting AIs in the command-and-control structure, surveillance systems, and communication infrastructures on the battlefield. This modernization will enable better and quicker decision-making involving the use of real-time data and superior analytics. Additionally, the simulators in AI technologies provide a very real battle situation so that the soldiers can train to hone their skills in strategy and tactics with minimal physical tools. These virtual simulated training spaces also allow a customizable learning and performance tracking process, and increase preparedness. Moreover, AI promotes force multiplication, in this case, fewer people are needed to carry out complex and large-scale tasks facilitated by automation and smart systems. Due to the fact that military organizations want to achieve more with less resources, AI provides scalable solutions to sustain combat readiness. All these dynamics are contributing to the increased desire by defence establishments to embrace AI technologies to drive performance, increase readiness and stay ahead technologically in more complex military environments.

Financial and technical limitations – The major limitation is the fact that the development, implementation as well as the maintenance of AI systems are quite expensive. Military grade AI also necessitates significant investment in software, hardware and the infrastructure to maintain such technologies, and this investment adds an extra burden to the defence budget and may conflict with other areas of interest. Also, the experienced team in the military organizations with the experience of operating, managing, and innovating with AI systems is usually lacking. This skills shortage prevents successful integration of AI in the current workflow. Another major challenge is integration, as the bulk of the armed forces operate under legacy platforms and infrastructure, which is not compatible with the new AI technologies. Upgrading or retrofitting these systems provide obstacles since this is complex and also costly. Lastly, resistance to change within the organization and hierarchical command chain may be slowing the rate of adaptation to AI.

Increasingly volatile geopolitical landscape – the increasingly active geopolitical landscape and the advent of the AI arms race between the great powers such as the United States, China, and Russia drives the market of AI in military. These countries are also highly invested in AI to have a tactical advantage in terms of military capabilities over other countries. The other critical aspect is that AI and the associated technologies, including robotics, sensors and big data analytics are quickly advancing and are opening new opportunities to be used in military applications. These technological developments are forcing the defence organizations to consider the use of AI-powered systems in order to boost Pentagon efficiency and situation understanding. The use of AI-powered systems is necessary to defend sensitive military information and infrastructure via the real-time identification of threats, and automated responses to cyberattacks. Moreover, a new form of warfare, characterized by asymmetric threats, hybrid warfare, and terrorism, creates a need to respond quicker, smarter, and more agile on defence, and AI can adequately address this. AI is also being adopted faster in the defence-related scenarios, with the governments and technology companies and startups collaborating to co-develop the latest technologies. The tendency is boosted by more and more countries having raised defence budgets due to increased security concerns.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global AI in military market, with a 39% market revenue share in 2024.

North America, specifically the United States is dominating the AI military market across the globe because of high technological capabilities, high military spending and government willingness to embrace innovations. U.S. Department of Defence (DoD) is among the biggest AI research and development investors, hence, paving way to the development of various AI-based military applications like autonomous vehicles, surveillance systems, cyber security, and command and control platforms. This leadership is backed by a well-established ecosystem of defence contractors, tech giants and startups that work extensively with the military to come up with the advanced AI solutions that suit the defence requirements. The fact that North America possesses a well-developed system to test and implement AI and has access to huge amounts of quality data, high-end computing capabilities and a talented workforce only contributes to its dominance. Besides, the geopolitical agenda of North American nations focuses on technological leadership over their potential aggressors, which leads to continuous funding in the modernization of defence on the AI-based system.

North America Region AI in Military Market Share in 2024 - 39%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into hardware, software and services. The hardware segment dominated the market, with a market share of around 38% in 2024. The hardware gets the largest market share in the global AI military industry as it forms the backbone of AI application and systems to be useful in military activities. Contrary to software allowing hardware to be interchangeable and with sufficient capabilities, the AI hardware consists of those more specific elements including special processors, sensors, cameras, autonomous drones, and unmanned vehicles that practically carry out those tasks with AI in the battlefield. Moreover, the development of autonomous platforms such as flying drones, self-driving cars, and ground robots is more dependent on advanced hardware to navigate, monitor, and attack targets without any human inputs. The defence sector also concentrates on hardware related to increasing cyber security, like: hard processors, and tamper proof parts to provide protection of sensitive data.

The application segment is divided surveillance and reconnaissance, autonomous weapon systems, cybersecurity, command and control systems and training and simulation. The surveillance and reconnaissance segment dominated the market, with a market share of around 32% in 2024. Militaries have been able to use AI-based functions to collect, analyse, and interpret large quantities of information transmitted by a variety of sources like satellites, drones, radar, and ground sensors to provide real-time knowledge of the situation and intelligence. The growth in complexity of current conflicts such as asymmetric warfare and cyber threats further boosts the need of sophisticated surveillance systems that will be able to work persistently and in many different spheres. The world governments are rampantly turning to investing in AI powered reconnaissance tools as this keeps them ahead of the game and enhances their preparedness in defence. Moreover, there is a tendency to use surveillance apps as force multipliers that can better coordinate the activities of various divisions of the army and allied organizations.

The platform segment is divided into aerial systems, ground systems, naval systems and space systems. The aerial systems segment dominated the market, with a market share of around 34% in 2024. Aerial systems dominate the global AI military sector, since they offer strategic benefits in terms of surveillance, reconnaissance, combat and logistics. A key player in the recent past in warfare is the Unmanned Aerial Vehicles (UAVs) popularly referred to as drones which have become a prominent feature in the warfare arena through its capacity to move freely without a human operator, covering mass areas and undertaking various missions with negligible exposure to human life. The integration of AI improves these aerial platforms by making them autonomous, better at target recognition, and with the ability to make real-time decisions which can make a vast difference in terms of efficiency and accuracy of missions. Also, the AI-enhanced airborne systems facilitate the precision strike because the targets are accurately detected and attacked minimizing the collateral damage and raising the chances of successful missions. The flexibility of the aerial systems also applies to the field of logistics where the AI-powered drones are capable of delivering provisions to distant or hazardous locations in a rapid and secure manner. The absolute superiority of airborne systems is also supported with the constantly developed innovations of lightweight sensors, high resolution cameras, and communicative systems which improve the capacities of the aerial systems.

The end-user segment is divided defence forces, intelligence agencies and homeland security. The defence forces settings segment dominated the market, with a share of around 46% in 2024. Defence forces are the leading category of end users in the AI military market worldwide, given that they were the main stakeholders of implementing and using AI capabilities in an extensive set of military operations. The army, navy, and air forces are incorporating AI to a larger extent as a way of increasing combat readiness, efficiency in operating and strategic capability. Defence forces are motivated to modernize armed forces due to the emergence and advancement of threats and diversity of geopolitical conditions. AI allows such forces to enable the processing of large volumes of battlefield data, enhance decision-making velocity and automate vital processes, including surveillance, target tracking, and logistics operations. The defence forces are also enjoying the advantages of AI-enabled simulation and training that equip soldiers to tackle various combat scenarios with greater proficiency and with more realism. Moreover, the funding and strategic plans of governments give most of the investment to defence institutions, so they become the main consumers and creators of AI-based systems as per military demands.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 9.40 Billion |

| Market size value in 2034 | USD 30.52 Billion |

| CAGR (2025 to 2034) | 12.50% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Application, Platform and End User |

As per The Brainy Insights, the size of the global AI in military market was valued at USD 9.40 billion in 2024 to USD 30.52 billion by 2034.

Global AI in military market is growing at a CAGR of 12.50% during the forecast period 2025-2034.

The market's growth will be influenced by the modernization of defence infrastructure.

Financial and technical limitations could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global AI in military market based on below mentioned segments:

Global AI in Military Market by Component:

Global AI in Military Market by Application:

Global AI in Military Market by Route of Platform:

Global AI in Military Market by End-User:

Global AI in Military Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date