- +1-315-215-1633

- sales@thebrainyinsights.com

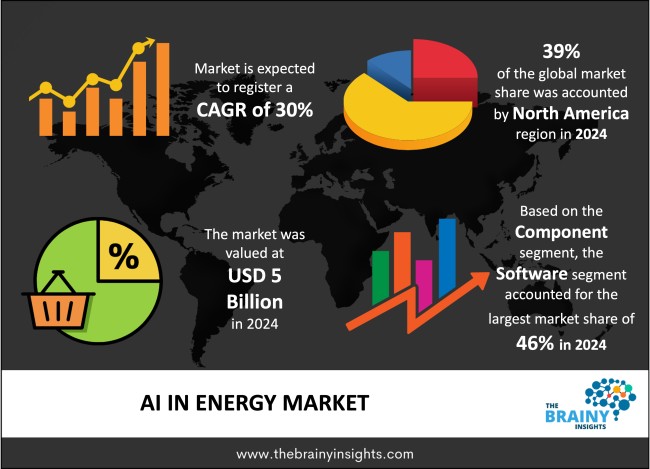

The global AI in energy market was valued at USD 5 billion in 2024 and grew at a CAGR of 30% from 2025 to 2034. The market is expected to reach USD 68.92 billion by 2034. The rapid automation of the oil and gas industry will drive the growth of the global AI in energy market.

The application of advanced computational techniques including machine learning, deep learning and data analytics is known as Artificial Intelligence in energy systems. It is used for generating, monitoring, distributing, storing and consuming energy. AI resolves power sector issues through its applications in sophisticated energy operator capabilities, automated maintenance routines and load prediction systems together with autonomous operational decisions. Through artificial intelligence the power grid attains enhanced capabilities for management by forecasting sudden demand peaks and detecting real-time faults while performing automated rebalancing operations which reduces service interruptions and ensures higher reliability. AI technology aids smart meter operations and home energy management systems which enable consumers to enhance their resource use for cost-savings. AI models that predict market trends help suppliers enhance their energy trading operations and increase their business profitability. The technology plays an essential function in enhancing energy storage by designing the most effective operations between charging and discharging cycles for maximizing battery lifespan and performance. Business operations leverage AI capabilities to conduct simulations of different environmental and economic conditions that aid green energy system transition planning. The decarbonization efforts of industries receive support from AI systems that detect operational inadequacies and present sustainable options.

Get an overview of this study by requesting a free sample

The pressing need to upgrade energy grids – The energy industry demands AI technology mainly because it needs to update operations while seeking maximum efficiency and operational economy. The essential driver behind this demand originates from the necessity to upgrade power grids. Many of the current energy grids need new smarter and more durable systems to manage the growing challenges from distributed energy resources. AI technology permits constant grid surveillance and predictive system maintenance. It also enables automatic fault analysis to maintain strong grid operations while decreasing system outages. The rising global energy demands together with tightened energy efficiency standards encourage energy companies to find smarter means for operation. AI solutions combine high-quality prediction models with optimal resource consumption systems to boost energy efficiency throughout its processes thus lowering operational expenses and waste creation. Better management systems are necessary because of the increasing dependence on energy storage solutions that use batteries. Therefore, the need to upgrade energy grids and adopt cost saving and efficient processes in the energy sector will drive the market’s growth.

Financial, technical and operational difficulties – Budget constraints substantially affect small enterprises because implementing and deploying AI solutions requires major financial investments into new technological infrastructure along with talent acquisition and data management systems. Organizations face a severe problem because they lack specialists who have the necessary expertise. The integration of new systems with existing legacy platforms creates the most significant barrier. Organizations become reluctant to implement AI solutions because doing so would force them to make major operational modifications. The internal resistance increases because the return on investment (ROI) remains uncertain to employees. Numerous businesses remain uncertain about returning high initial expenses when evaluating AI opportunity because AI technology consistently transforms at a fast pace. The lack of clarity about AI benefits causes organizations to postpone essential decision-making and to resist expanding their AI solution implementation.

Rising sustainability concerns – The worldwide transition toward solar power together with wind energy represents a major force that drives energy demands for artificial intelligence systems. Traditional energy generation methods differ from renewables due to their weather-dependent variability so AI becomes necessary to predict renewable energy levels and manage smooth power-grid processes. Additionally, energy companies face extensive pressure from governments together with industries and investors to use AI and other efficiency technologies that lower carbon emissions from energies systems toward net-zero targets. Tariffs introduced by governments along with regulatory support drive industries to select smart grids and develop renewable integration and advanced energy management solutions. Energy companies face increased incentives to adopt AI-powered systems because various national governments now provide policies combined with financial support.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global AI in energy market, with a 39% market revenue share in 2024.

The United States maintains leading positions among technology enterprises that develop AI and cloud computing systems with machine learning capabilities to offer energy sector optimization. The new energy capabilities allow firms serving the energy sector to enhance their grid performances and predictive maintenance abilities as well as energy efficiency and resource utilization. Both private investors and government funding programs support this region substantially. The application of artificial intelligence receives extensive financial backing from both private venture capital firms using it for energy purposes and public government agencies that support its adoption through funding programs targeting carbon reduction and energy security. The North American regulatory system enables innovation because it establishes guidelines which stimulate the adoption of modern sustainable energy operations together with digital energy transformation within the sector. The extensive collection of energy facilities that extend from traditional oil gas operations to renewable systems lets AI technologies spread throughout the area.

North America Region AI in Energy Market Share in 2024 - 39%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into software, hardware and services. The software segment dominated the market, with a market share of around 46% in 2024. Software dominates the AI in energy market because it creates the essential core functionality by processing real-time data through complex algorithms and machine learning models and data analytic applications. AI software offers better flexibility because it does not require the same capital expenses found in hardware systems that need special infrastructure. Software also allows energy companies to adjust their usage according to business demands. The adoption of cloud-based systems drives software domination because it enables ongoing software modifications. AI software provides flexible applications throughout the energy industry ranging from power generation to oil and gas sectors. AI software demands continue to grow more rapidly than other components in data-driven energy markets thus pioneering the transformation of the sector into smarter sustainable systems.

The deployment mode segment is divided into cloud-based and on-premises. The cloud-based segment dominated the market, with a market share of around 56% in 2024. AI deployment through the cloud has become the leading choice for energy sector applications because it provides scalability in addition to reduced costs along with effective management of energy systems. Cloud-based infrastructure gives energy firms the ability to expand their AI capabilities by demand without needing to invest in capital-intensive on-site computer systems thus reducing entry barriers. Energy managers and analysts empowered with cloud-systems can retrieve and respond to data from any location which benefits organizations that manage extensive geographic operations. The implementation of cloud services enables energy companies to access updated software continuously. Cloud computing enables different business teams inside energy establishments to share information through a smooth collaborative environment. Cloud-based AI solutions perform real-time data processing and sharing to produce fast decision outcomes and quick organizational responses to changing energy industry conditions.

The application segment is divided into energy management, demand forecasting, predictive maintenance, power distribution and optimization, safety and security and others. The energy management segment dominated the market, with a market share of around 37% in 2024. The dominant application of AI within the energy sector exists in energy management since it helps optimize energy consumption, improve efficiency and decrease costs for all industries. Companies need to effectively handle energy resources because the global energy demand are growing on one hand while sustainability concerns are rising on the other. Organizations achieve maximum energy generation efficiency and consumption optimization through their implementation of AI. Machine learning algorithms within AI-powered energy management systems process large quantities of data that originates from smart meters and sensors together with other sources. The energy management systems implement predictions about future demand together with automated distribution control mechanisms which perform real-time adjustments for optimized energy efficiency. Through industrial process optimization AI technology decreases financial expenses enabling better industrial profitability. The effort to integrate renewable energy systems places extra pressure on the need for artificial intelligence in energy control systems. Energy management has become the principal AI application because this technology directly addresses economic and environmental issues with applicable scalable solutions for modern energy systems.

The end-user segment is divided into oil & gas, power generation, renewable energy, utilities and others. The oil & gas segment dominated the market, with a share of around 36% in 2024. Many business operations within the oil and gas sector accumulate extensive datasets from its distinct processes of exploration. AI technologies analyse large data sets to boost operational performance and decrease equipment breakdown periods while guaranteeing operational security in businesses. Predictive maintenance presents itself as a major AI application which monitors equipment states to detect potential equipment failures ahead of time thus preventing unplanned shutdowns and optimizing asset operational periods. The comprehensive usage of AI spans from maintaining operations to drilling along with geological search operations in the oil and gas sector. Mainframe computers implement seismic data analysis and locate ideal drilling sites to enhance operational efficiency throughout the drilling procedure. AI assists businesses in faster decision-making by processing sensor and geophysical survey datasets thereby it minimizes exploration costs while improving operational efficiency. AI strengthens its position in this industry because it assists companies with supply chain direction and regulatory demands alongside environmental sustainability initiatives.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 5 Billion |

| Market size value in 2034 | USD 68.92 Billion |

| CAGR (2025 to 2034) | 30% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Deployment Mode, Application and End-User |

As per The Brainy Insights, the size of the global AI in energy market was valued at USD 5 billion in 2024 to USD 68.92 billion by 2034.

Global AI in energy market is growing at a CAGR of 30% during the forecast period 2025-2034.

The market's growth will be influenced by the pressing need to upgrade energy grids.

Financial, technical and operational difficulties could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global AI in energy market based on below mentioned segments:

Global AI in Energy Market by Component:

Global AI in Energy Market by Deployment Mode:

Global AI in Energy Market by Application:

Global AI in Energy Market by End-User:

Global AI in Energy Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date