- +1-315-215-1633

- sales@thebrainyinsights.com

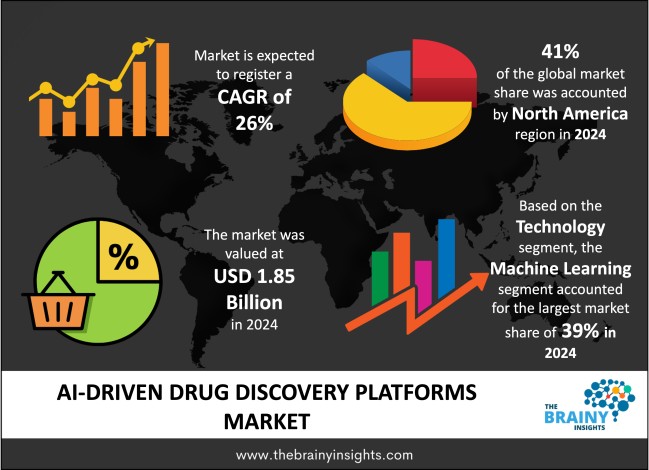

The global AI-driven drug discovery platforms market was valued at USD 1.85 billion in 2024 and grew at a CAGR of 26% from 2025 to 2034. The market is expected to reach USD 18.65 billion by 2034. The rapid technological advancements will drive the growth of the global AI-driven drug discovery platforms market.

Many important elements within the healthcare industry are encouraging drug developers to adopt AI systems to shorten, simplify and control the costs of developing new drugs. A major reason for all this is how companies are now expected to speed up and lower the costs of drug production. Bringing a drug to market by traditional methods can take more than ten years and a vast budget. With AI, the periods used for target identification, molecule screening and lead development are cut, allowing companies to save effort and expenditure. AI approaches are essential because diseases like cancer, disorders affecting the brain and infectious diseases are becoming more complex. With AI, scientists can look at large biological datasets and bring to light brand-new drug targets which makes the technology key in handling these issues. The rising use of big data and improved technology now make it ideal for AI to be adopted. The processing of massive biological, chemical and clinical data is possible today with AI. This means insights can now be discovered that could not be accessed in the past. As a result, there is a growing emphasis on using individual genetic and molecular makeups to choose treatments. AI-driven solutions take patient-specific information into account to make therapies more suitable and effective for each patient. In addition, researchers, academic institutions, pharmaceutical companies and biotech companies are cooperating closely and rapidly advancing and innovating to increase the adoption of AI. Regulatory groups are also starting to accept and endorse AI-driven ways of working, motivating players in the industry to spend more on these technologies.

Get an overview of this study by requesting a free sample

The rapidly rising need for developing drugs, medications, therapies and other treatments globally – The need for AI-driven platforms in drug discovery mainly arises because pharmaceutical and biotech companies rely on better efficiency and new innovations for their R&D. The desire to decrease both the length and expense of developing new drugs is a major motivation. Adding AI to the process means companies can more quickly spot targets, check compounds and make better leads which reduces research costs and shortens the product timeline. Additionally, AI’s ability to predict allows scientists to spot out good drug prospects early in the process which means there are fewer issues in clinical trials and the final programs are more likely to succeed. Many life science organizations aim to come up with new ideas to tackle difficult problems like cancer and various disorders affecting the brain and genes. For these important health fields, it takes powerful technology to analyse big biological data and AI tools fulfil that requirement. At the same time, companies are devoting more attention to personalized medicine which calls for tailored therapy choices based on a patient’s unique gene and molecular analysis. AI helps organizations gather and process patient-specific information which allows them to develop therapies that are more likely to succeed. Working with other organizations forms a major part of the company’s activities. There is an increasing trend for pharmaceutical companies to unite with AI vendors, universities and biotech businesses to tap into the best AI technology and share what they have.

Capital intensive nature of AI-drive drug discovery platforms – An important challenge is the high cost needed to develop or acquire, deploy and maintain AI technology systems. Platforms of this kind require lots of money, special skills and strong infrastructure, making them tough for small or mid-sized businesses to manage. Also, since bringing AI systems into current research setups and past databases involves much technical work and more time which also hinders its adoption. Resistances toward change, sticking with convention is common for some researchers and decision-makers and they are not always convinced about what AI can provide which also hampers the market’s growth. the lack of qualified professionals also limits the market’s growth. Reliable results from AI models come from having a large amount of well-prepared and standard data. There are often difficulties for companies in getting, ordering and keeping these kinds of data. Imperfect data can affect the accuracy of AI and break people’s trust in their predictions. When there is little clarity about the performance of AI, many companies might be reluctant to depend entirely on these platforms.

Technological advancements, rising investments and regulatory support – rapid progress in big data systems and computer chips is one of the biggest drivers of the market. New AI techniques can handle enormous collections of biological, chemical and clinical data because there are now powerful computers and plenty of data. With these advancements, AI is more likely to be used in finding and developing new drugs. Since complex and chronic diseases such as cancer, diseases of the nervous system and infections are becoming more widespread worldwide, finding new treatments is increasingly necessary. These problems encourage the industry to look at AI-based approaches to discover new solutions faster and meet medical challenges that remain unaddressed. Many regulators are now adjusting their rules to help AI be used in pharmaceutical development. With more helpful guidelines from relevant regulatory authorities like the FDA, companies can rely on clearer paths to getting AI approved for use. Also, more partnerships and groups in the industry contribute knowledge and data to AI, supporting fresh solutions and decreasing any roadblocks to adoption.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global AI-driven drug discovery platforms market, with a 41% market revenue share in 2024.

This market is largely dominated by North America because it has well-developed healthcare sector, advanced technology and substantial capital and effort that is invested into research and development. The area gains from several top pharmaceutical and biotech companies as well as from AI startups working on advanced drug discovery methods. The generous financial support from the public and private players significantly augments the market’s growth. There are strong and evolving safety rules in the region, headed by the FDA, to help AI technology gain clearance and approval. Because of this regulation, companies no longer worry so much and are more willing to use AI-based systems. Highly skilled experts in AI, machine learning and biomedical fields are available in North America which helps in developing AI tools for drug discovery a much easier and speedier process. Besides, AI’s impressive data-handling and prediction skills are useful for the North American market’s shift towards personalized treatments. Because of these advantages—strong innovation, financial support, friendly rules, good talent and healthcare focus—North America is at the forefront of the AI-driven drug discovery market worldwide.

North America Region AI-Driven Drug Discovery Platforms Market Share in 2024 - 41%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into software, hardware and services. The software segment dominated the market, with a market share of around 40% in 2024. The main reason behind software’s dominance in the market is its support in many stages in drug discovery. AI applications in the drug development area rely on software solutions to supply the main algorithms, tools for data processing and computational models for fast and precise selection of potential drugs. Software platforms give pharmacies scalable, repeatable and customizable tools they can build right into their research routines making them highly sought after components in the market. A major reason for software’s success is that it can process and study large and complicated biological data far more productively than traditional methods which saves both money and time. All in all, the AI-driven drug discovery market relies heavily on software because it scales well, is efficient, can handle large data and drives both innovation and productivity in modern drug development.

The application segment is divided into target identification, drug design & optimization, preclinical testing and clinical trials support. The target identification segment dominated the market, with a market share of around 35% in 2024. Recognizing and confirming which proteins, genes or pathways play a role in disease is necessary for creating good drugs. With AI, it becomes possible to quickly and accurately scan much more information about biological, chemical and clinical data than standard methods can handle. AI is applied in platforms for target identification to find important information hidden in big datasets, including genomics, proteomics and transcriptomics. Researchers can detect targets and biomarkers connected to particular diseases which helps design medicines with improved results and lower risks. Companies in the pharmaceutical sector emphasize this step, since it supports every following drug development activity and is why they make up most of the market. The main reason for this is that target identification plays a crucial part in drug development, is greatly influenced by AI and is key to the development of precision medicine initiatives.

The technology segment is divided into machine learning, deep learning and natural language processing (NLP)). The machine learning segment dominated the market, with a market share of around 39% in 2024. The reason ML is most popular in the drug discovery platforms market is its flexibility, strong performance and versatile use throughout the drug development process. Much like other AI technologies, ML algorithms are great at handling huge amounts of data, making patterns that are hard to notice with normal statistics easier to find. Another advantage is that machine learning models need less processing power enabling them to be used in many places regardless of limited resources. As a result, small and mid-sized companies are picking up AI at a faster pace to save money. In addition, ML is able to process genomic, proteomic, chemical and health data from patients, giving a complete picture of both drug action and patient responses. By collecting detailed knowledge, it is possible to make better choices at every step in drug development. Overall, machine learning’s effectiveness is based on being flexible, efficient, scalable and reliable in generating usable insights which is why it is chosen to drive drug discovery and speed up pharmaceutical innovation.

The therapeutic area segment is divided into oncology, neurology, infectious diseases, cardiovascular diseases and others. The oncology segment dominated the market, with a share of around 37% in 2024. Among all therapeutic areas, oncology leads in the AI-driven drug discovery platforms market because of the various challenges, how common cancer is and how urgent the care requirements are. Cancer involves many kinds of genetic changes, different tumour surroundings and various patient responses making it extremely challenging to find effective drugs for cancer. AI used in oncology can look through many different types of data, from genetic records to clinical information, to discover new drug targets, estimate treatment results and customize care. The increase in oncology is largely due to a greater effort and more money devoted to developing cancer drugs. Many companies and research institutions are prioritizing oncology because of a large group of cancer patients, high cancer-related deaths and the big benefits of successful cancer treatments on the market. AI helps quickly detect important connections in how tumours act and in patients’ information which allows experts to develop better targeted therapies with fewer side effects. In addition, precision medicine which tests DNA and RNA to design treatments for specific patients, is developing rapidly in oncology. Through use of AI, this process becomes much easier. In addition, government entities now favour new oncology therapies which also augment’s the segment’s growth. The field of oncology commands the AI-driven drug discovery market mostly because cancer is complex to treat, there are big gaps in care, there is rapid rise in cancer patients and plenty of funding is provided for cancer research.

The end-user segment is divided into pharmaceutical & biotechnology companies, contract research organizations (CROs) and academic & research institutes. The pharmaceutical & biotechnology companies segment dominated the market, with a share of around 44% in 2024. Most of the AI-driven drug discovery platforms are used by pharmaceutical and biotechnology companies, who depend on them to stay ahead in the market with new drugs, medication, therapies and treatments. They can make use of AI technologies in drug discovery because they have enough resources, rich private data and competent staff. Since bringing a new drug to the market is both difficult and expensive, AI-based tools are being used by these companies to make the process more efficient, faster and successful. In addition, the need to innovate due to rising competition and the interest in providing specific treatments motivates these companies. Overall, the main companies in this market are pharmaceutical and biotechnology firms that lead with their major role in drug development, strong investments, focus on new ideas and direct advantages from applying AI to discovering drugs.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 1.85 Billion |

| Market size value in 2034 | USD 18.65 Billion |

| CAGR (2025 to 2034) | 26% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Application, Technology, Therapeutic Area and End-User |

As per The Brainy Insights, the size of the global AI-driven drug discovery platforms market was valued at USD 1.85 billion in 2024 to USD 18.65 billion by 2034.

Global AI-driven drug discovery platforms market is growing at a CAGR of 26% during the forecast period 2025-2034.

The market's growth will be influenced by the rapidly rising need for developing drugs, medications, therapies and other treatments globally.

Capital intensive nature of AI-drive drug discovery platforms could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global AI-driven drug discovery platforms market based on below mentioned segments:

Global AI-Driven Drug Discovery Platforms Market by Component:

Global AI-Driven Drug Discovery Platforms Market by Application:

Global AI-Driven Drug Discovery Platforms Market by Technology:

Global AI-Driven Drug Discovery Platforms Market by Therapeutic Area:

Global AI-Driven Drug Discovery Platforms Market by End-User:

Global AI-Driven Drug Discovery Platforms Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date