- +1-315-215-1633

- sales@thebrainyinsights.com

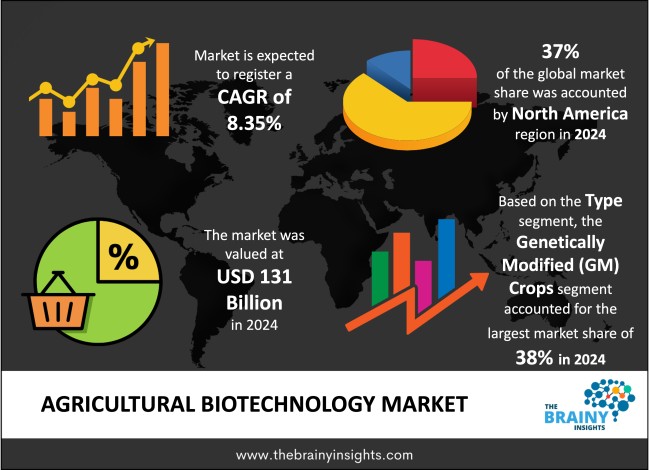

The global agricultural biotechnology market was valued at USD 131 billion in 2024 and grew at a CAGR of 8.35% from 2025 to 2034. The market is expected to reach USD 292.11 billion by 2034. The increasing global population and need to ensure global food security will drive the growth of the global agricultural biotechnology market.

Agricultural biotechnology is an area of science that uses technological applications and biological procedures to increase agricultural productivity, sustainability and food quality is agricultural sector. It encompasses various practices encompassing genetic engineering, molecular markers, tissue culture and molecular diagnostics in a bid to increase crop yields, build resistance to pests and diseases. It also helps in making crops more resistant to the extreme weather events. Among the most well-known examples is the production of genetically modified (GM) crops, including the so-called Bt-cotton or herbicide-resistant soybeans that have been altered with the genes of other organisms to get the required features. These developments make farming effective and eco-friendly by minimizing the reliance on chemical pesticides and fertilizer. In agricultural biotechnology, biology and technology are also applied in livestock where it aids disease resistance, reproductive performance, conversion ratio in terms of better feed performance by selective breeding aided with genetic tools. Moreover, microbial biotechnology is used in developing biofertilizers and biopesticides as a substitute or alternative to synthetic chemicals. Rise in global population, climate change and straining natural resources suggest that agricultural biotechnology is viewed as a primary innovation to guarantee food security, mitigate environmental impacts and promote sustainable agriculture.

Get an overview of this study by requesting a free sample

Technological advancements and the increasing demand for sustainable agricultural practices – The driving force behind the global agricultural biotechnology market is mostly concentrated in the area of innovation, technological development and industry dynamics. The fast pace of research and development (R&D), especially in the genetic engineering methods including CRISPR-Cas9, RNA interference (RNAi) and marker-assisted selection, are driving the market’s growth. These devices allow the creation of crops that have better characteristics such as resistance to pests, drought resistance, and greater nutritional content that are in greater demand in the modern market. The introduction of the commercialization of genetically modified (GM) crops has played a key role in enhancing the popularity of agricultural biotechnology in particular countries where the farming activities have been industrialized and are conducted on large scales. Biotech seeds that perform well do not only enhance the quantity of the product, but they also cut down chemical use, a measure that has both economic and environmental benefits. The other important market driver is the increasing number of strategic alliances, partnerships and mergers between biotechnology companies, Agri-tech companies, and research organizations. Such joint ventures are useful in resource pooling, rapid innovation and market extension. Another prominent role is also played by technological integration; bio technologies used in farm life are already being integrated with digital tools like artificial intelligence (AI), prescriptive farming technologies and remote sensing. The combination promotes improved and focused, agricultural activities, a feature that improves their effectiveness and sustainability.

High costs of development – A high cost of research and development (R&D) is one of the biggest obstacles. Genetic engineering of a crop is a complex process that requires years and millions of dollars to develop a single genetically modified crop because of complicated genetic engineering, field-testing procedures, and biosafety evaluation. Such expenses usually restrict the presence of small and mid-sized firms, thereby limiting innovation. They also have a very long development and regulatory approval process of products that usually take 8 to 12 years to commercialize which further slows down the market dynamism by discouraging quicker innovation. The second restraining force is the absence of technical knowledge and biotechnology facility in most developing nations. Such a disparity in local development and adoption of agricultural biotechnology solutions limits agricultural production solutions in areas where yield increasing, climate-resilient technologies could have the greatest benefits. Additionally, biotech seeds are distributed at higher prices than the conventional ones thus becoming unaffordable to smallholder farmers who form the majority in most regions. Such a problem in pricing not only restricts the adoption, but also it causes a certain dependency on the subsidies and external support.

Growing emphasis on environmental sustainability – rising levels of droughts, flooding, and the deterioration of soil are compelling both the governments and farmers to embrace the resilient crop variety produced by biotechnology. In addition, the fact that there is a dire need to take care of food security, particularly in populations exhibiting very high growth in Asia and Africa makes agricultural biotechnology of utmost importance as a means through which sustainable food production can be achieved.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global agricultural biotechnology market, with a 37% market revenue share in 2024.

North America is the leading market leader in agricultural biotechnology on the international platform owing to its high levels of agricultural infrastructure, regulation control processes, and use of genetically modified (GM) crop cultivation. The US especially is the global leader in the production, marketing and commercialization of biotech crops such as soybean, corn and cotton. The biotechnology industry faces a favourable research and development environment in terms of how much the industry invests in research and development, the level of cooperation between the different state and biotechnology companies and the government policies in favour of the industry. The availability of big investors in the industry like Monsanto, Corteva Agriscience or Syngenta also enhances the leadership of the region. Furthermore, farmers in North America have quickly turned to GM crops due to their pest resistance, herbicide tolerance and increased yield. Moreover, the regulatory agencies such as the U.S. Department of Agriculture (USDA), the Environmental Protection Agency (EPA), and the Food and Drug Administration (FDA) offer the relatively straight-forward and science-based approval mechanism of biotech products allowing their quick commercialization in comparison to more regulated localities.

North America Region Agricultural Biotechnology Market Share in 2024 - 37%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into genetically modified (GM) crops, molecular diagnostics, genetic engineering services and molecular markers. The genetically modified (GM) crops segment dominated the market, with a market share of around 38% in 2024. Genetic modification (GM) of crops leads the field of agricultural biotechnology since it has tested the capability of solving serious problems of the agricultural sector that includes pest infestation, weeds control, climatic pressure, and agricultural security. There is an increasing trend of GM crop adoption especially in the last two decades in those countries with large scale commercial agriculture like in United States, Brazil, Argentina, Canada, and India. GM products such as soybean, corn, cotton and canola have become ideal alternatives amongst farmers due to their capacity to increase yield as well as minimize the need of chemical products such as pesticides and herbicides. For example, crops such as herbicide-tolerant crops make the process of controlling weeds simpler and reduces the efforts needed in controlling them and hence less manpower is required to accomplish this making it economically sustainable as well as improving environmental sustainability. In addition, GM crops are very appealing to farmers because of their scalability and cost-effectiveness, and farmers whose activities are located in areas that are vulnerable to prevailing climatic changes. The market penetration of GM crops in those jurisdictions where regulatory conditions are conducive and the level of the technological infrastructure is good is exceptional.

The trait segment is divided into herbicide tolerance, insect resistance, disease resistance, drought tolerance and nutritional enhancement. The herbicide tolerance segment dominated the market, with a market share of around 37% in 2024. Fast becoming integrated into large-scale commercial agriculture in countries such as the United States, Brazil, Argentina and Canada are herbicide-tolerant crops. Glyphosate-resistant crops is the most common herbicide tolerance system methodology that allows working with a post-emergency type of control of weeds by using only one, most efficient herbicide. This saves more on the number and intensity of herbicide application besides the adoption of no-till farming which enhances the soil structure and helps in the minimization of greenhouse gases. Farmers grow herbicide-tolerant crops because of the operational comfort and economic decision that it attains as it saves them a lot of costs, especially in areas where large-scale monoculture has been adopted. In addition, the fact that herbicide-tolerant crops boost the economic conditions of the farmers means that millions of hectares of farmland across the world are being switched to it fast and ensure that the crops remain dominant in the market.

The application segment is divided into crop production, animal agriculture, aquaculture, biofuels and environmental protection. The crop production segment dominated the market, with a market share of around 42% in 2024. The most booming application industry in the global agricultural biotechnology market comprises crop production that constitutes the highest share because it is at the centre of food security provision, farm productivity and dietary demands of the increasing world population. Biotechnology in agriculture has drastically changed the agricultural crop production since it has made it possible to develop genetically modified (GM) crops that have better characteristics like resistance to pests, resistant to herbicides, resistant to drought, and better nutritional value. The innovations enable farmers to realize improved production yields with low cost of inputs and crop production is more efficient, predictable and sustainable. The prevalence of planted biotech crop such as soybean, corn, cotton, and canola in major agricultural economies particularly in United States, Brazil, Argentina, and India has strengthened the control of crop production along with the biotechnology market. It is highly economically important because these crops are known to be widely used in food, feed, fibre, as well as biofuel. Moreover, the increasing rate of climate-related issues (droughts, soil salinity, temperature, etc.) has led to the increase in demand of biotech solutions increasing crop resilience. As long as technology drives innovative techniques and there is a growing demand in sustainable and environmentally friendly ways of doing agriculture, crop production has been the most influential and commercially powerful field of application in agricultural biotechnology.

The crop type segment is divided into soybean, corn, cotton, canola and fruits & vegetables. The soybean segment dominated the market, with a share of around 40% in 2024. It has gained significance as one of the major oilseed and source of proteins in the world with a variety of uses that include human foods, animal foodstuff and biodiesel. This property of GM soybean has made it very appealing particularly in the economies that practice mass scale production of soybean such as the United States, Brazil and Argentina collectively, of which the soybean account most of the production in the world. The use of GM soybean has also led to increase in the level of yield, lower input costs and increased farm profitability. Furthermore, soy beans with enhanced quality and oil and resistance to disease are on the increase due to the use of biotechnology with all these benefiting its market potential more. The fact that the crop is adapted to various climate conditions and soils requirements has contributed to its cultivation in wide areas of agricultural lands which has made it a backbone of commercialized agriculture both in developed countries and developing ones. Moreover, the international demand of plant-based proteins and vegetable oil has increased tremendously, which has boosted the applicability of soybean in the market. Due to this diversity and biotech-enabled performance benefits it has become the preferred crop type in the biotechnology agricultural sector.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 131 Billion |

| Market size value in 2034 | USD 292.11 Billion |

| CAGR (2025 to 2034) | 8.35% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Trait, Application and Crop Type |

As per The Brainy Insights, the size of the global agricultural biotechnology market was valued at USD 131 billion in 2024 to USD 292.11 billion by 2034.

Global agricultural biotechnology market is growing at a CAGR of 8.35% during the forecast period 2025-2034.

Global agricultural biotechnology market is growing at a CAGR of 8.35% during the forecast period 2025-2034.

The market's growth will be influenced by technological advancements and the increasing demand for sustainable agricultural practices.

High costs of development could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global agricultural biotechnology market based on below mentioned segments:

Global Agricultural Biotechnology Market by Type:

Global Agricultural Biotechnology Market by Trait:

Global Agricultural Biotechnology Market by Application:

Global Agricultural Biotechnology Market by Crop Type:

Global Agricultural Biotechnology Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date