- +1-315-215-1633

- sales@thebrainyinsights.com

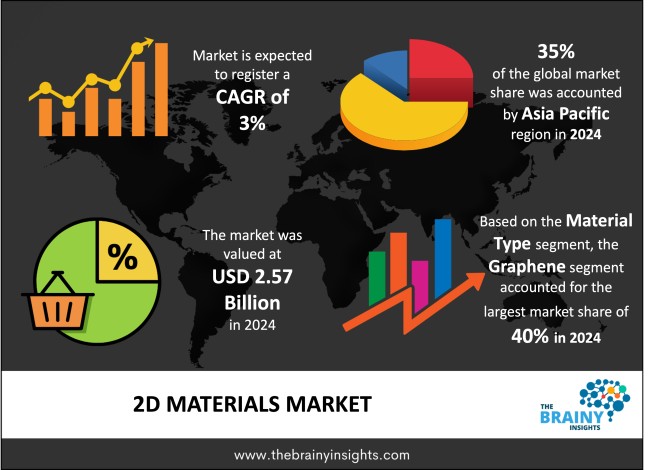

The global 2D materials market was valued at USD 2.57 billion in 2024 and grew at a CAGR of 3% from 2025 to 2034. The market is expected to reach USD 3.45 billion by 2034. The rapidly expanding semiconductor industry will drive the growth of the global 2D materials market.

Two dimensional materials are crystalline materials with a thickness of a few atomic layers, in effect, one plane of atoms. These materials have received such interest in the fields of science and technology because of the extraordinary physical, chemical, electrical, optical, and mechanical characteristics of these materials. Its best known and best studied example is that of graphene which is a one-atom-thick sheet of carbon atoms in which the bonds form a honeycomb structure, particularly strong, flexible, and conductive. With the isolation and discovery of a graphene sheet in 2004, several other 2D materials have since been identified, such as transition metal dichalcogenides (TMDs) such as molybdenum disulphide, hexagonal boron nitride (h-BN), phosphorene, silicene and MXenes. The distinctive set-up of 2D materials allows them to enjoy the quantum confinement effect, large surface-to-volume ratio, and controllable band gap behaviour, which largely makes them prospective material candidates to be used in a broad variety of applications. They present potentials in electronics of fabricating transistors, sensors, and memory devices in nanoscale dimensions owing to ultra-thin dimension and high carrier mobility. In energy storage and conversion 2D materials are sought in batteries, supercapacitors and catalytic processes, including water splitting and carbon dioxide reduction. They are also appropriate for flexible displays, wearable electronics and optoelectronic devices such as solar cells, and photodetectors they are of high transparency and flexible. Besides, 2D materials are explored in biomedicine, such as use as drug carriers, biosensors, and tissue scaffolds, as they approach the biocompatibility and highly functional surface area requirements.

Get an overview of this study by requesting a free sample

The increasing number of applications of 2D materials across sectors – the excellent electrical conductivity, mechanical strength, thermal stability, and optical transparency of 2D materials enable their advance application in a vast number of sectors such as electronics, energy storage, optoelectronics, and nanotechnology. They are of the atomic-scale thickness and they can be used to create the ultra-thin devices that will respond to the growing trend of miniaturization of devices, as well as with the dynamic world of flexible electronics. That is especially useful to create next-generation semiconductors, bendable displays, and wearable technologies. The ability to modify 2D materials, particularly by adding in heterostructures, with different 2D layers stacked together to produce material with desired properties, is another important factor driving the market’s growth. In addition, 2D materials have great surface-to-volume ratios which increase their contact with the light, chemicals, and other materials- this is particularly useful in sensor and catalysis technologies. They are also more energy efficient; they have excellent electron mobility and low power requirements that make them more attractive to energy-sensitive devices meant by batteries, supercapacitors, and low-power electronics. Also, the possibility of synthesis of 2D materials at a commercial level has increased with the development of the methods like chemical vapor deposition (CVD) and exfoliation. Broadly, the in-house technological advantages of 2D materials, including those of enhanced performance, transduction, customization, etc. are central to this emerging trend of their uptake in various industries and applications.

Technical and production limitations – among the greatest challenges is the inability to synthesize 2D materials, high-quality and free of defects, in scale. To make these materials industrially, current production processes usually involve cumbersome, costly apparatus and specific conditions. This drawback limits their accessibility and increases costs thus making them less competitive with traditional materials. Furthermore, a significant number of 2D materials lack stability and durability properties. There exists another obstacle i.e. the challenge of seamless adaptation of the 2D materials to the current fabrication processes and technologies, specifically silicon-based electronics. Moreover, there is an issue connected with the absence of standard and control. Differences in thickness, purity and defect density arising as a result of different synthesis techniques lead to uncontrolled material properties making it hard to design the products and customer confidence gets lost. Last, the prohibitive cost of production and handling also inhibits accessibility as the cost of 2D material production and processing is still by far more expensive than the traditional materials.

The rapidly growing semiconductor industry – the growing semiconductor and electronic sectors whose demand in materials is expected to continue growing since they require a material that has the capability of providing higher performance, reducing its size and energy efficiency. With silicon-based technology nearing its physical confines, there are significant prospects to be had with 2D materials as the next step towards the next-generation chips, sensors and flexible electronics that is required in the wake of the digital age. The growing introduction of 5G networks, Internet of Things (IoT), and wearable devices also has an accelerative force because these technologies will need very thin, flexible and highly conductive material that will be able to support connectivity and performance in miniaturized, mobile size factors. In addition, the worldwide focus on sustainability and green technology is one more reason why 2D material seems to be of interest because it could be used in energy-saving technologies like high-efficiency solar cells, lightweight batteries, and zero-pollution catalysts in pollution control and water treatment. The other important factor is that the government and academic investments in research and development are rising and the investments render breakthroughs in the sphere of synthesis, scalability, and application development. Investments and favourable policies make ideal conditions of commercializing and industrializing 2D materials.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global 2D materials market, with a 35% market revenue share in 2024.

Countries such as China, South Korea, Japan, and India already have developed electronics and semiconductors industries which drives the demand for 2D materials. The rich supply of qualified scientific, engineering and technical talent in the region enhances the pace of developing and commercializing 2D materials in many industries including consumer electronics, energy storage and transportation. Among the most significant factors that contributed to the supremacy of Asia Pacific is the enormous amount of interest that governments and other private industries have invested in research and development infrastructure regarding nanotechnology and other advanced materials. This is a proactive system that creates a healthy environment where startups and established firms will innovate and amplify production effectively. In addition, Asia Pacific has the advantage of being able to produce and arrange their product supply chains cheaply, which means that they are able to price their goods at a competitive rate and get them to the market significantly faster as compared to other regions. Major existence of electronics producers and OEMs also increases the demand in the region in a symbiotic connection with material producers and end-users.

Asia Pacific Region 2D Materials Market Share in 2024 - 35%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The material type segment is divided into graphene, transition metal dichalcogenides (TMDs), hexagonal boron nitride (h-BN) and others. The graphene segment dominated the market, with a market share of around 40% in 2024. Graphene has a remarkable electrical, mechanical, thermal, and flexibility conductivity due to its single layer of carbon atoms organized in the form of a hexagonal lattice, which qualifies the material to have many applications. This has contributed to graphene being the dominant material when it comes to its application in next-generation electronics, sensors and photonics. The dominance of graphene can also be explained by the fact that the research and development of this material is relatively advanced in comparison with other 2D materials. Its swift commercialization has been posed by the simplicity of the synthesis techniques such as chemical vapor deposition (CVD) and the mechanically exfoliated techniques to mass production. Further, the fact that graphene is compatible with the rest of silicon-based technology can make it easier to integrate into the already existing manufacturing processes, which is another major advantage that the material has over other relatively unknown 2D materials. The second reason as to why graphene takes market lead is due to the wide scope of application in various sectors.

The application segment is divided into electronics & semiconductors, energy storage & conversion, sensors & actuators, composites & coatings, biomedical & healthcare and others. The electronics and semiconductors segment dominated the market, with a market share of around 36% in 2024. The current semiconductor technologies based on silicon are reaching physical and performance limitations and it is necessary to seek alternative materials that could support the rate of breakthrough. 2D materials, in particular graphene and transition metal dichalcogenides (TMDs), have outstanding electrical, thermal and mechanical properties that are extremely suited to the next generation semiconductor devices. The surge in the deployment of technologies as 5G, Internet of Things (IoT), and artificial intelligence is adding more pressure on the generation of advanced semiconductors able to resist challenging conditions, thus contributing to the demand of 2D materials in this sphere. Moreover, the electronics industry is highly supported in terms of investments and research, so the commercialization of 2D materials proceeds at a fast pace.

The end-use industry segment is divided into consumer electronics, automotive & transportation, healthcare & pharmaceuticals, aerospace & defence, energy & power and others. The consumer electronics segment dominated the market, with a market share of around 38% in 2024. Consumer electronics market segment has a supremacy in the 2D materials market because of the incessant need of the segment in terms of new, small and high-performance components. The new trend of modern consumer applications such as smart phones, tablets, laptops, wearable, and smart home systems demands the material that can achieve even more capabilities in limited size and weight. Graphene is ultra-thin and bendable, thereby enabling creation of flexible display, touch screens, and wearable sensors that are changing the way consumers can interact with electronic devices. Also, a consumer electronics market is dominated by speed in the innovation cycle and high competition, which makes it a good idea to start using advanced materials to sustain the competitive advantage of the manufacturer. The research and development of advanced materials in electronic is one of the major investments in cyber nations and privately as well leading to the use of 2D materials even faster. The growth of smart devices powered by IoT and 5G connectivity has increased the demand of micro-miniaturized, energy-efficient components and consumer electronics remains the biggest end-user segment in the 2D materials market. The growing demand by consumers to have electronics that are more powerful, light weight and multi-purpose may lead to increase in integration of 2D materials, which will support the dominance of the segment in the market over the years to come.

The production method segment is divided into chemical vapor deposition (CVD), mechanical exfoliation, liquid phase exfoliation and others. The chemical vapor deposition segment dominated the market, with a share of around 39% in 2024. The current trend in the global 2D materials market is towards Chemical vapor deposition (CVD) which possesses the capacity to yield high quality, large area thin uniform films demanded in commercial and industrial usage. In contrast to other synthesis methods of creating 2D materials that tend to produce tiny pieces of flakes or suggest discontinuous layers, CVD allows us to definitively grow 2D materials on substrates as sheets, which is why it fits well in manufacturing scale processes. The flexibility of CVD is one of the major strengths of it. This degree of control is essential to engineering of the material properties to make them useful in particular applications like electronics, sensors and energy storage devices. Moreover, CVD grown material tends to have less impurities and a higher degree of crystallinity; a fact leading to better electrical mechanical and optical properties when compared to other material growing techniques. The dominance of CVD is further reinforced by the continuous developments that are geared towards streamlining the processes, reducing the cost of production, and compatibility with the existing semiconductor manufacturing techniques.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 2.57 Billion |

| Market size value in 2034 | USD 3.45 Billion |

| CAGR (2025 to 2034) | 3% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Material Type, Application, End-Use Industry and Production Method |

As per The Brainy Insights, the size of the global 2D materials market was valued at USD 2.57 billion in 2024 to USD 3.45 billion by 2034.

Global 2D materials market is growing at a CAGR of 3% during the forecast period 2025-2034.

The market's growth will be influenced by the increasing number of applications of 2D materials across sectors.

Technical and production limitations could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global 2D materials market based on below mentioned segments:

Global 2D Materials Market by Material Type:

Global 2D Materials Market by Application:

Global 2D Materials Market by End-Use Industry:

Global 2D Materials Market by Production Method:

Global 2D Materials Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date